For 2024-25 Phil Murphy, with assistance from the New Jersey legislature, a growing economy and slightly shrinking enrollment, has done what no other governor has: the full funding of New Jersey's state aid law.

The Big Picture

Overall, NJ's $11.4 billion in formula aid for 1,314,974 students is $8,811 per pupil, however, state aid is concentrated in a small number of districts, with only 18 districts (with 22% of the students) getting half the formula aid. The median district only gets $2,752 per student.

The highest aided districts are Bridgeton, $24,577 per pupil, Plainfield at $23,351 pp, and Camden at $23,343, which, combined with federal aid, their own tax levies, and indirect state aid like TPAF, construction aid, and teachers Social Security brings their spending to about $30,000 per student. Those amounts are important to keep in mind in the context of arguments that will occur in the next few years that SFRA does not send enough state aid to high-FRL districts.

At the other extreme, the lowest aided operating districts get about $1,200+ per student, with Beach Haven, at the bottom with $1,158 per student. Overall, 250 districts get less than $2,000 per student.

The increase in K-12 operating aid is part of an overall billion spending increase for PreK-12 education, from $20.6 billion to $21.6 billion, out of a $55.9 billion Total Operating Budget. Education spending ~38% of the total state budget, is high compared to the 1990s-2000s, but lower than the 40% when Phil Murphy came into office. Education spending actually is more than 100% of $19.34 billion NJ expects to bring in from income taxes, due to how education is also funded by a half-cent of the sales tax and lottery transfers (See page 66)

There are No Underaided Districts:

For 2024-25, there is nothing for me to write about underaided districts. All districts are at a minimum of 100%. The S2 timeline for full funding has been met.

The number of districts losing state aid is smaller than the ~200 districts per year of recent past because many districts in 2023-24 were only slightly overaided and large increase in Equalization Aid (plus $599 million) slightly lowers the Local Fair Share. Therefore a few dozen districts tipped from being overaided to underaided status and gained state aid. The $105 million of aid cuts is also smaller than years past, it was a $165 million loss for 2023-24 (before re-appropriation) and $186 million loss for 2022-23.

|

| Source |

As an aside, Asbury Park's aid loss has also been so large because it's enrollment has continued to plummet. Its 2024-25 enrollment is only 1,846, compared to 2,350 back in 2015-16.

Six other districts would be overaided if I included Military Impact Aid.

Military Impact Aid is only $9.4 million and goes to six districts, but it's a substantial amount per student. For instance Cape May City gets $1.2 million in Military Impact aid for only 123 students, which is $9,756 per student. However, I do not consider this "excess aid" because Military Impact Aid is governed by a different law (P.L.2021, c.283,) and has a different purpose.

Over 100 districts would be overaided if I included Choice Aid in my calculations. At an extreme, Deal gets $2.3 million in Choice Aid for 159 resident students, a surplus of $14,821 per student. Hoboken would also be substantially overaided if I included its $2.9 million in Choice Aid. However, I've also elected not to include Choice Aid since Interdistrict Choice is governed by a separate state aid law ( P.L.2010, c.65) and districts receiving it are doing something to merit that aid.

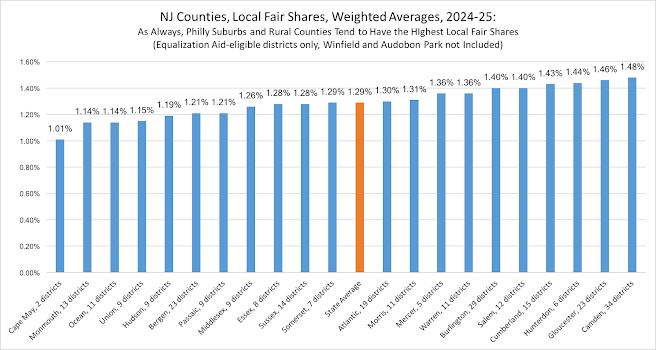

Local Fair Share and Equalization Aid-eligibility

For 2024-25 New Jersey's Local Fair Share formula is

(Aggregate Income x 0.050601493 + Equalized Valuation x 0.012707978) / 2

Which is a slight decrease for each multiplier from 2023-24's Local Fair Share formula, which was:

Injustice for Runnemede, and How it Illustrates the Lunacy of Using Aggregate Income to Calculation Local Fair Share

Runnemede, a K-8 district in Camden County with 741 students, is one of the largest aid loses for 2024-25, whose $4,150,077 aid loss is $5,600 per student.

How Runnemede got to this loss exposes the lunacy of using Aggregate Income to calculate Local Fair Share.

Please notice that Runnemede's Equalized Valuation grew by 12%, but the Aggregate Income grew by huge increase in Runnemede's Aggregate Income grew by 147%!!

Palmyra's situation is similar:

Either there is a mistake in the Department of Treasury's Aggregate Income data for Runnemede, or a random high-income outlier in Runnemede had a windfall year or moved in, but whatever the cause, Runnemede's 2.5% Local Fair Share tax rate is now the highest in NJ (not counting Winfield) and it lost $4.15 million.

Although the magnitude of Runnemede's loss shocks me, I knew that this could happen as the result of the arrival of a high-income outlier or a rich person having a windfall year.

Conclusion:

2024-25 will be a landmark year in the history of NJ state aid. It exceeds my expectation back in 2017, when I thought that Phil Murphy would only allow $200-$300 million in redistribution. Phil Murphy cannot receive all the credit though. Steve Sweeney was the primary champion of S2, and all the legislators who voted for it deserve credit. Even Chris Christie should get some credit for signing Chapter 78 which freed up billions for operating aid, although that bill also has had downsides.

Unfortunately there have been losers in the redistribution. Some Adjustment Aid districts were high-spending and their cuts are things we need to accept lest they have an unfair spending advantage over other districts, but other Adjustment Aid districts, like Brick and Toms River, had to make cuts from a position of low spending. Although it was a mistake of S2's authors not to provide tax cap relief to non-Abbotts, it was also a mistake of Brick and Toms River not to vocally ask them to.

The FY2025 budget also continues the neglect of municipal aid in NJ, which will be but by $134 million (see page 10), so education's gain has come at the expense of other vital services.

The FY2025 budget is good for state aid, but let's look forward to FY2026 as a year when almost all districts can gain state aid and when municipal aid can also see a long-overdue boost.

-----

- 2023-24 NJ State Aid

- New Jersey's 2022-23 State Aid

- 2021-22 Brings $1.7 Billion to Education, More State Aid Equity

- 2020-21 State Aid Closer to Equality

- 2019-20 State Aid Gets Fairer, but the Deficit Grows

- 2018-19 Disparities Narrow, but Remain Stark

- Updated State Aid Disparities for 2017-18