New Jersey, by any analysis, has one of the ten highest costs of housing in the United States.

Conservatives and liberals disagree on what the solutions to New Jersey's housing crisis should be, but all credible economists agree that the fundamental cause of high housing costs is insufficient supply relative to demand.

Conservatives and liberals disagree on what the solutions to New Jersey's housing crisis should be, but all credible economists agree that the fundamental cause of high housing costs is insufficient supply relative to demand.

Background to the Housing Crunch

Despite our slow-growing economy and population, NJ's housing crisis remains acute because we are running out of buildable land, so construction of single-family detached homes has fallen.

Whereas in the 1990s and early 2000s New Jersey would build 20,000-25,000 single-family homes a year. Now, despite continuing acute demand, we only build 10,000-11,000.

Whereas in the 1990s and early 2000s New Jersey would build 20,000-25,000 single-family homes a year. Now, despite continuing acute demand, we only build 10,000-11,000.

|

| Source: http://www.northjersey.com/counties/single-family-homes-stay-in-the-game-1.1677967 |

How bad has NJ's housing shortage gotten? As was reported in October 2016:

On a year-to-date basis (January-September) home purchase demand in New Jersey increased by 14%. This increase has however been largely concentrated in lower priced homes as first-time ‘Millennial’ buyers begin to transition from rentership to homeownership. By comparison, the number of luxury home sales priced at $2,500,000 and above declined by 4% this year. Reasons for this trend include a greater number of younger-age first home buyers, trade-down purchases by older-age empty-nesters, and relaxed mortgage lending standards which have reduced minimum down-payment amounts.

Shifting to the supply side of the equation, the supply of homes being offered for sale remains constricted, which is limiting choices for home buyers. The number of homes being offered for sale today in New Jersey has declined by nearly 6,000 (-11%) compared to one year ago. This is also about 25,000 (-34%) fewer homes on the market compared to the cyclical high in 2011. Today’s unsold inventory equates to 5.4 months of sales (non-seasonally adjusted), which is lower than one year ago when it was 6.7 months.

Currently, the majority (81%) of New Jersey’s 21 counties have less than 8.0 months of supply, which is a balance point for home prices. Hudson County is presently experiencing the strongest market conditions in the state with just 3.2 months of supply, followed by Union, Essex, Morris, Middlesex and Somerset Counties, which all have fewer than 4.5 months of supply.

The only effective solution to this housing and land shortage is to accept greater density and allow more apartments to be built, but this is illegal due to municipal zoning regimes and other forms of discouragement.

Yes, New Jersey is seeing a surge in apartment construction, but almost none of the new units are designed for families. The minuscule number of three-bedrooms that are built are almost always as part of COAH (COAH = Supreme Court-required affordable housing) requirements, so there are vanishingly few three-bedrooms available for middle-class and even affluent families.

-----

A Spectre is Haunting New Jersey, the Spectre of NIMSSism

-----

There is a sub-form of NIMBYist anti-development activism that I am going to call NIMSSism - "Not In My School System"ism.

Unlike NIMBYism, which has come to mean opposition to any housing within a given area, NIMSSism is selective in what it opposes. NIMSSies accept the construction of apartment buildings as long as the apartment buildings are going to have zero or very few public school children.

| NIMSSies are ok with their towns allowing apartments for Empty Nesters. |

Millburn, South Orange-Maplewood, and Kearny have seen considerable student population growth in the last few years and have school systems that are above capacity. Millburn's student population has increased from 4,573 in 2005-06 to 4,903; South Orange-Maplewood's student population has increased from 6,209 to 6,872. Kearny's has grown from 5,469 to 5,910.

Millburn is in the process of buying a new elementary school and South Orange-Maplewood is gearing up to build another fifty classrooms. Kearny has already put on another 20 classrooms at its high school.

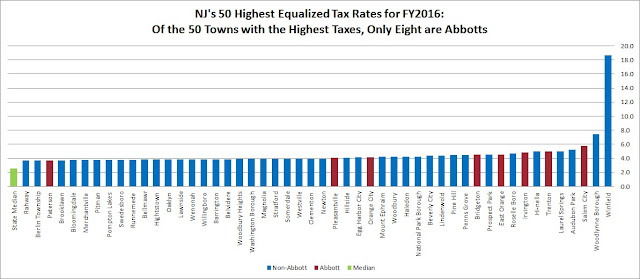

Since New Jersey's aid law - the School Funding Reform Act - is designed to give as little money as possible to suburbs - and New Jersey's aid distribution has been frozen anyway for years, Millburn, South Orange-Maplewood rely almost entirely on local taxpayers to fund their schools and even Kearny is mostly locally funded.

| But NIMSSies Oppose Family-Sized Apartments, SO Families Must Buy Houses |

Millburn's budget is 95% from local money. South Orange-Maplewood, a more middle-class town than Millburn, has a budget that is 94% from local money. Kearny is more working class, but it still pays for 61% of its costs with local money.

Millburn's per pupil spending is $16,136, which is high, but not extraordinary. South Orange-Maplewood's spending, on the other hand, is only $14,667 per student, which is slightly below average. Kearny's is only $12,590 per student, which is quite inadequate.

With the schools being crowded in all three districts is it any wonder that residents of the towns oppose new construction that might bring in more children?

Here are Millburn residents protesting the construction of 200 units on what was a parking lot near the Short Hills Mall.

...residents maintained the apartment complex could bring an additional 200-plus students to the school district and repeatedly challenged [the Planning Board attorney's] assertion that he and municipal Business Administrator Timothy Gordon had alerted then-school superintendent James Crisfield and Jeffrey Waters, school board president at the time, that the application for the hotel/apartment complex was on the way.

On a Change.org there is a Millburn anti-housing petition that has gotten over 1300 signatures, the Millburn residents warned the development might have 300-400 students.

The 300-400 student estimate is delusional. The whole complex will have only six three-bedrooms. However, Millburn's delusion is a symptom of anger about genuine crowding problems and thus shows the strength of anti-public school children incentives.

You might attribute the NIMSSism to Millburn being so rich, but the same tendency exists in working class towns too.

Here are officials in Kearny also assuring their residents that there are almost no public school children living in some controversial apartment buildings there too. (the Kearny complex under discussion, Vermella Crossing - has zero three bedrooms)

You might attribute the NIMSSism to Millburn being so rich, but the same tendency exists in working class towns too.

Here are officials in Kearny also assuring their residents that there are almost no public school children living in some controversial apartment buildings there too. (the Kearny complex under discussion, Vermella Crossing - has zero three bedrooms)

While the residential portion of Vermella Crossing's first phase was under construction, Kearny residents raised concerns that the development would bring too many new students into the local public school system.

Those fears appear to be unfounded, according to rental statistics recently released by Russo Development, the Carlstadt-based firm building the complex.

With a little less than half of the complex's 150 units leased, just four children have moved in, Lisa Kaplan, vice president for leasing/marketing, reported in a written statement.

Demographics so far skew toward young adults occupying the new units. The average age of renters is 29, with nearly 88 percent of occupants between ages 18 and 35. More than 60 percent of the residents are single.

That's good news to local officials, who view Vermella Crossing as a litmus test for two additional developments Russo is planning in Kearny -- a 458-unit complex along the Passaic River in Kearny and a mixed-use development on Bergen Avenue across the street from Vermella Crossing.

"This is very consistent with the numbers that Mr. Russo advised the (Town) Council and planning board of," Mayor Al Santos said. "We were concerned it would create a burden on the school system, but it has turned out not to be the case.

For South Orange-Maplewood please read this article where the mayors of South Orange and Maplewood argue that new apartment buildings in the two towns have almost no children living in them. (this is by design since South Orange-Maplewood prohibits family-sized apartments.)

“Developments such as Gateway, Avenue, Mews, Gaslight, Ridgewood Commons are bringing in kids at a 1 per 30 unit to 40 unit ratio,” said [South Orange Village President Sheena] Collum in an email to Village Green. She added that this was “de minimis from a numbers standpoint.”

Collum further explained that “a 100-unit development may bring 3 kids or less… That’s just our consistent statistics. In fact, our vision plan noted 1 per 38 units.” She added, “And many of those kids were once already in the district and, through separations (etc.) and existing parents, went into a rental.”....Maplewood's Mayor said:

Based on the record of [other] occupied buildings, the ratio is less than 1/10 of a student per unit.”Would the mayors of South Orange and Maplewood make this argument if fears of public school children living in apartments were not pervasive?

The mayors are correct that very few public school children from the new apartments since the new apartment buildings are 99% studios, one-bedrooms, and two-bedrooms, with the few three-bedrooms also required as part of judicial affordable housing obligations.

Apartment buildings are technically called "multifamily housing," but that's a misnomer, since very few "families" live in them.

Due to the lack of family-sized apartments, parents who have two or more children in Millburn, South Orange-Maplewood, Kearny, and many other towns would either have to squeeze into a two-bedroom unit or buy a conventional, single-family detached house.

There are middle-class families out there who would like to live in a suburb, but still live in an apartment to avoid the hassles of maintaining a large house and yard, but the construction of three-bedroom apartments is unlawful and since public school children are so expensive for a town to educate, there is no prospect of zoning being liberalized without state aid reform since towns have a strong incentive against allowing family-sized apartments.

If New Jersey gave more school aid to suburbs and state aid were not frozen, the municipal incentive to oppose family-size apartments would decrease.

NIMSSism is just a word I invented, but even the concept is rarely discussed. But it's is a major driver of zoning laws that hinder the creation of enough housing for New Jersey's growing population or PILOT deals that discourage 3-4 bedrooms.

However, the state is going to have to address the incentives that create NIMSSism since we are running out of buildable land.

While multifamily [sic] construction has rebounded from the worst housing crash since the Depression, annual construction of single-family homes has lingered in the 10,000 to 11,000 range, down from more than 20,000 a year through most of the 1990s. Single-family construction has been led by activity in Monmouth and Ocean counties.

Through August of this year, builders have started about 6,500 single-family homes in the state, about 36 percent of the total number of housing units started.

The main reason for this shift away from single-family: There’s just not enough space, especially in North Jersey. The state is already largely developed, and regulations bar further development in environmentally sensitive areas, such as the Highlands. As a result, land in the state has just become too scarce and too expensive to support a mass of single-family homes — particularly homes affordable to middle-income families....

"You just will never see again the type of single-family building we had in the past, because there just simply is not the land for it," said Billy Procida of Procida Funding & Advisors in Englewood Cliffs, which lends money for real estate development. "If you can find a deal with five lots, you’re lucky. You tell me where in New Jersey you’re going to find space to build 100 houses."

| Lakewood is the Exception That Proves the Rule: Lakewood always greenlights new development because new housing in Lakewood is occupied by children who do not attend public schools. |

were factored out of the calculation, the number of housing units under construction would be substantially lower.

In the future, towns are going to have to allow family-sized apartments because there is no way we can accommodate our growing population otherwise.

The days when every middle-class family could have a detached house and a yard are over.

And if NJ wants towns to allow enough housing to stabilize (or even reduce) prices, it is going to have to change how public schools are financed and/or change the law so that towns are forced to accept family-sized apartment buildings.

---

See Also these studies on how few children live in apartment buildings:

UPDATE: "School Aged Children in Rental Units in New Jersey"

http://bloustein.rutgers.edu/wp-content/uploads/2015/03/NJDM.pdf

http://www.nj.gov/state/planning/publications/177-who-lives-quick-guide.pdf