http://njeducationaid.blogspot.com/2018/07/2018-19-state-aid-disparities-narrow.html

THE FOLLOWING POST REFERS TO MURPHY'S ORIGINAL PROPOSAL BEFORE LEGISLATIVE MODIFICATION.

This post compares the proposed state aid levels of all New Jersey districts for 2018-19 with their Uncapped Aid levels. By comparing actual Aid to Uncapped Aid we can see how stark New Jersey's state aid disparities are.

While I am very disappointed and angry at the proposed distribution for 2018-19, at least the Murphy administration is attempting to follow some rational distribution of aid. From 2013 to 2018 the Christie administration more or less flat-funded all districts, with the exception of those who participated in Interdistrict Choice. For 2017-18, the Christie administration did not even initially calculate Uncapped Aid .

Although the Murphy administration describes itself as a 180 turn from the Christie administration in education policy, and that's the reality in a lot of ways, one thing the Murphy administration and Christie administration have in common is that they have no choice but to prioritize the state's debt payments. As large as Murphy's $283 million increase in K-12 aid is, it is significantly smaller than the increase for teacher pensions, ie the Teachers Pension And Annuity Fund.

|

| (Note, this does not include money from the lottery that is going to education) |

See below for a definition of "Uncapped Aid."

The Scope of the Disparities:

The Big Picture:

There are 212 overaided districts with a total surplus of $708.7 million. This is almost $70 million more than 2017-18, when the surplus was $643 million. (I am excluding Interdistrict Choice aid)

The Murphy administration's proposed increase for the 171 of the 212 overaided districts is $28,604,340.

There are 380 underaided districts with a total deficit of $1.913 billion. This is $52 million less than 2017-18, when the deficit was $1.965 billion. (again, I am excluding Choice Aid, plus I am also excluding Atlantic City's Commercial Valuation Stabilization Aid, which is $32 million.)

If New Jersey could redistribute Adjustment Aid, the net deficit is only $1.205 billion.

Notes on New Jersey's State Aid Have-Nots

There are 75 districts getting 50% or less of their Uncapped Aid.

If the state wanted to prioritize this sub-50% districts, it would only cost $106 million to bring them all up to at least 50% funding, or less than one-seventh of the total excess aid that the overaided districts receive.

Chesterfield is, yet again, in in last place, getting only 21% of the state aid SFRA recommends for it. River Edge is the next lowest aided, getting 24%, then Hasbrouck Heights at 24.5%, Elmwood Park at 26%, and Robbinsville at 27%.

There are 43 districts whose deficit is larger than $4,000 per student. To bring all of these districts up to a deficit of $4000 per student (which is still terrible) would require $155.7 million, which is about one-fifth of the state's excess aid.

(The $155.7 million number does include Atlantic City's Commercial Valuation Stabilization Aid)

If the state wanted to prioritize this sub-50% districts, it would only cost $106 million to bring them all up to at least 50% funding, or less than one-seventh of the total excess aid that the overaided districts receive.

Chesterfield is, yet again, in in last place, getting only 21% of the state aid SFRA recommends for it. River Edge is the next lowest aided, getting 24%, then Hasbrouck Heights at 24.5%, Elmwood Park at 26%, and Robbinsville at 27%.

There are 43 districts whose deficit is larger than $4,000 per student. To bring all of these districts up to a deficit of $4000 per student (which is still terrible) would require $155.7 million, which is about one-fifth of the state's excess aid.

(The $155.7 million number does include Atlantic City's Commercial Valuation Stabilization Aid)

|

Atlantic City's Taxes are 287% of Local Fair Share.

(+$52 million over LFS)

Phil Murphy's proposed budget will give Atlantic City $1.2

million in tax relief.

|

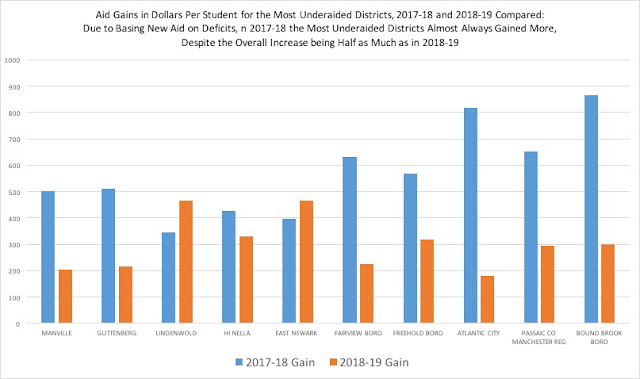

Bound Brook is the worst-off in deficit in dollars per student, at -$8,999 per student. Then Atlantic City (even with the $32 million CVSA), Manchester Regional, Fairview, and Freehold Boro.

Several vo-techs, like Atlantic County Vo-Tech, Cumberland Vocational, and Passaic County Vocational are also extremely underaided.

Atlantic City, has, by far, the worst taxes, with a tax levy at 287% of Local Fair Share. ($81,888,890 out of $29,396,657)

Manchester Regional, up until his year, had the worst taxes, but its tax levy was in the low-200% rage of Local Fair Share. Manchester Regional's 2017-18 taxes are still at 219% of Local Fair Share, which is the second worst in New Jersey.

Newark's deficit is the largest in total dollars, $130,042,863.

Notes on New Jerseys' State Aid Haves

Newark's deficit is the largest in total dollars, $130,042,863.

Notes on New Jerseys' State Aid Haves

There are 68 districts getting 200% or more of what SFRA's real recommendation for them is is. 23 lucky districts get over 300%. Washington Township in Burlington County tops off the overaided districts, getting 563% of its aid target.

If the districts receiving 200% or more of their state aid got their aid reduced to "only" 200%, it would free up $76.8 million.

Tavistock is a non-operating district that claims three students living there. It is getting $2299 on an aid target of $299, so it technically gets 1003% of its recommended aid.

|

| Jersey City's Taxes are only 29% of Local Fair Share. Jersey City is Gaining $1.8 Million in State Aid. |

Jersey City's excess aid is the ninth highest in dollars per student too, $5,716 per student. That's more than the total aid of its impoverished neighbors Guttenberg and Fairview get total!

Jersey City's Local Fair Share is $398 million. This is growth of $30 million in Jersey City's Local Fair Share in one year. This means that if Jersey City lost $30 million in state aid per year and made up for that loss with local taxes that its tax rate would not increase.

Also, Jersey City's Local Fair Share is growing at a rate where it will no longer qualify for Equalization Aid in 6-7 years. Right now the Local Fair Share is $398 million, but once it reaches Jersey City's $590 million Adequacy Budget (for Equalization Aid) the only state aid Jersey City will qualify for will be the three categorical aids.

This means that even if Jersey City's Adjustment Aid is redistributed the state should still be able to use money currently going to Jersey City for needier school districts.

Hoboken's Local Fair Share is $217 million, which surpasses Edison to be the second largest in NJ after JC.

| Hoboken's Local Fair Share is $217 million, the second largest in NJ. Hoboken's LFS is $79,000 per student and yet it gets $10.5 million. Hoboken's LFS per student is more than 2x Millburn's. |

Pemberton's surplus state aid is $25,680,554, the second most in New Jersey.

Asbury Park is overaided by the most per student, with a surplus of $11,827 per student. That excess aid alone is more than what low-wealth non-Abbotts like Freehold Boro, Dover, Guttenberg etc get total for their students.

Loch Arbour is at 100%

Loch Arbor is the only district in New Jersey to get 100% of its Uncapped Aid: getting $3,944 for its 5 students, which is exactly SFRA's recommendation. (Since Loch Arbour's Local Fair Share is $1,301,988, it could give up all of its aid and not notice a thing.)Abbott Specific Notes

The Abbotts are disparate. They range from Asbury Park and its mammoth $11,827 per student surplus to Plainfield, with its -$4,594 per student deficit (itself the 32nd largest in New Jersey).

For 2018-19 eleven Abbotts will be overaided, which is two fewer than the thirteen overaided Abbotts of 2017-18. The two Abbotts who slipped from overaided to underaided are Salem City and Burlington City. Their slippage, despite additional state aid, underscores how dynamic state aid is and that the deficit against Uncapped Aid constantly grows.

Only three of the Abbotts pay above their Local Fair Share (Burlington City, Salem City, and Phillipsburg)

The median Abbott only pays 56% of Local Fair Share. Hoboken's taxes are only 20% of Local Fair Share, despite having a levy that is extremely high in dollars-per-student.

Lakewood

Lakewood actually has a rapidly growing tax base and its Local Fair Share increased from $92,974,112 for 2016-17 to $102,034,106 for 2017-18 to to $111,534,172 for 2018-19. During that time there has also been a decrease in the student population.

Thus, Lakewood's state aid deficit, which was $19 million for 2016-17, has increased to a small surplus of $1,566,821.

Although SFRA does not work for Lakewood and the district does require additional state aid, the district also has the ability to increase the tax levy in excess of 2% (which it has been doing).

Debt Takes Most of the Money

In a continuation of what happened under Christie, the state is putting much more money into various debt categories than it is putting into

Lakewood is now overaided!

Lakewood actually has a rapidly growing tax base and its Local Fair Share increased from $92,974,112 for 2016-17 to $102,034,106 for 2017-18 to to $111,534,172 for 2018-19. During that time there has also been a decrease in the student population.

Thus, Lakewood's state aid deficit, which was $19 million for 2016-17, has increased to a small surplus of $1,566,821.

Although SFRA does not work for Lakewood and the district does require additional state aid, the district also has the ability to increase the tax levy in excess of 2% (which it has been doing).

Debt Takes Most of the Money

In a continuation of what happened under Christie, the state is putting much more money into various debt categories than it is putting into

See Also:

- "Despite Aid Increases, Inequalities Worsen: Phil Murphy's FY2019 Aid Proposal"

- "Tentative Reaction to Murphy FY2019 Budget Proposal"

-----

Uncapped Aid = the real full funding for every school district. The term "Uncapped Aid" derives from the fact that SFRA contains legal "caps" on how much a district can gain in a single year, which are usually a 10% or 20% increase on what the district received the year before. Due to these caps, a school district's statutory "full funding" may differ greatly from what SFRA's formulas say it actually needs.

Uncapped Aid also refers to the amount of state aid that overaided districts would get if it were not for the mechanism of Adjustment Aid delivering over 100% of their state aid to them. In the case of Adjustment Aid districts, "Capped Aid" might more accurately be called the "pre-Adjustment Aid state aid target," but that is too wordy, so I just call it "Uncapped Aid" even though the aid caps do not apply to districts who are already getting over 100% of their recommended state aid.