New Jersey has hundreds of districts in budgetary stress, scores in budgetary crisis, but perhaps only one in true budgetary disaster.

Lakewood.

Next year Lakewood is facing a $12 million deficit on an operating school budget that is only $120.8 million. To resolve the huge deficit, Lakewood is laying off 68 teachers, pushing average class size up to FORTY.

I don't use the word "disaster" lightly, but I'll use it for Lakewood because there is no other word.

Of the many growing NJ districts who are nevertheless forced to cut teachers, Lakewood stands out as perhaps still the worst-off situation because Lakewood's total spending and classroom spending are already among the lowest in New Jersey. Lakewood's classroom spending is currently 12th from the bottom,

Since Lakewood's students are classified as 87% FRL eligible and 28% Limited English, a budget that would be inadequate for a middle-class district is even more inadequate for a district like Lakewood.

New Jersey has many underaided districts and Lakewood is certainly underaided (officially by $19.3 million, or $3,049 per student for opex aid and another $2 million for Extraordinary Aid), but the complexity of Lakewood is that SFRA does not work for Lakewood in the first place and even if Lakewood (by some miracle), got its full uncapped aid, it would still be in severe budgetary stress.

Lakewood's Underaiding

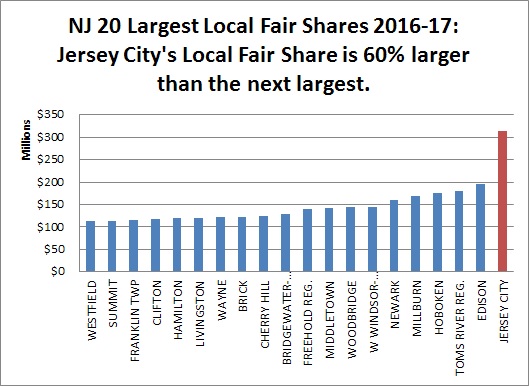

The factormost commonly always blamed for Lakewood's budget crisis is Lakewood's Orthodox majority and their representatives on the Lakewood BOE. While I don't claim that everything Lakewood's BOE does is right, to exclusively blame the BOE or the Orthodox majority is ignorant of multiple other factors, primarily that Lakewood's tax levy is above its Local Fair Share and that its official state aid deficit is $19.3 million.

Lakewood should be getting $6,955 per student in state aid, but in reality it only gets $3,906 per student. The $3,049 per student aid deficit places Lakewood in the state's bottom 15% for underaiding.

The $6,955 aid target is actually low for a district with Lakewood's demographics. For instance, Freehold Boro's aid target is $13,342 per student and Dover's is $13,655.

Lakewood's aid target is low because Lakewood's student population is very small proportionally and Lakewood thus has an above-average per student tax base. Lakewood's tax base is not spectacular, but it is approximately equal to Metuchen's and Haddonfield's, though spread out among a much larger, poorer population.

Not all demographically poor districts should get a lot of state aid if their tax bases are large (eg, many districts at the Jersey Shore, Hoboken), but Lakewood is different from other other poor-student/high-tax base districts because its tax base is only deceptively high due to so many homes being occupied by private-school families who contribute towards Local Fair Share but actually do make some demands on the school system.

I will talk more about how SFRA doesn't work for Lakewood later, but what is rarely said about Lakewood is that its public school population (and not just the private school population) is increasing rapidly and this is also a major factor in Lakewood's budgetary disaster. Since 2009-10, Lakewood has gained 1,200 students, or 24% (using the 2016-17 estimate of a 6,300 student population for Lakewood), in contrast to the state seeing a 1% loss of student population.

Soaring Out of District Tuition is the Proximate Cause

The Proximate Cause of Lakewood's budget disaster is increasing costs for Out of District Special Education.

Lakewood's Out of District spending has risen from $15.3 million in 2008-09 to $28.1 million in 2015-16, or $12.8 million. Since Extraordinary Aid only increased by $4 million, from $524,000 in 2008-09 to an estimated $4.5 million in 2015-16 (and this is $2 million below what Lakewood should get), an extra $9 million has to effectively come out of the Lakewood schools' operating budget.

During this time, Lakewood has increased its Local Tax Levy by $21 million, from $69 million to $90 million, but when Lakewood's public school population increase has been among the largest in New Jersey and there has been inflation, there is still much less available to public school students.

The huge OOD cost increases are due to the surge in Lakewood's overall population, as Lakewood grows by 4,000- 5,000 people a year and is by far New Jersey's most rapidly growing town. The new families of Lakewood have special-needs children in roughly the same proportion as every other town in New Jersey and Lakewood's public schools must pay to educate those education in a "free and appropriate" setting.

Many other rapidly growing districts are not getting proportionate aid increases, but at least as their student populations increase, their (theoretical) uncapped aid would increase and there would be some hope in SFRA, but Lakewood's population surge is among Orthodox Jews, whose children do not use the public schools except when they have special needs children and for transportation.

The Asbury Park Press and of NJLeftBehind have written many times about Lakewood having a large number of Jewish special needs children at a school called the "School for Children with Hidden Intelligence." The SCHI was founded by a rabbi and even the Jewish Press has said that the SCHI has a "decidedly Jewish" atmosphere. Although there may be something afoot to the controversy around the School for Children with Hidden Intelligence, the school is in the middle of Lakewood and in terms of transportation it is a sensible place for the Lakewood BOE to send special needs children.

Lakewood's former special education coordinator, Helen Tobia, had tenure charges filed against her for alleged illegal and unethical practices in special education placements, but even if there are inappropriate or illegal practices in Lakewood Out of District placements, it doesn't seem like it would negate the tendency of Lakewood to have a Out of District population disproportionate to its public school enrollment no matter what.

This is how Equalization Aid (the most important aid stream) is supposed to be calculated

Equalization Aid = Adequacy Budget - Local Fair Share.

Where Adequacy Budget is the demographic determination of a district's needs based on its public schoolers only. It depends on enrollment and has extra weights for "at-risk" students.

Equalization Aid is not tied to any particular budget item. Districts can spend it on teachers, basketballs, transportation, textbooks, and tuition for children with special needs.

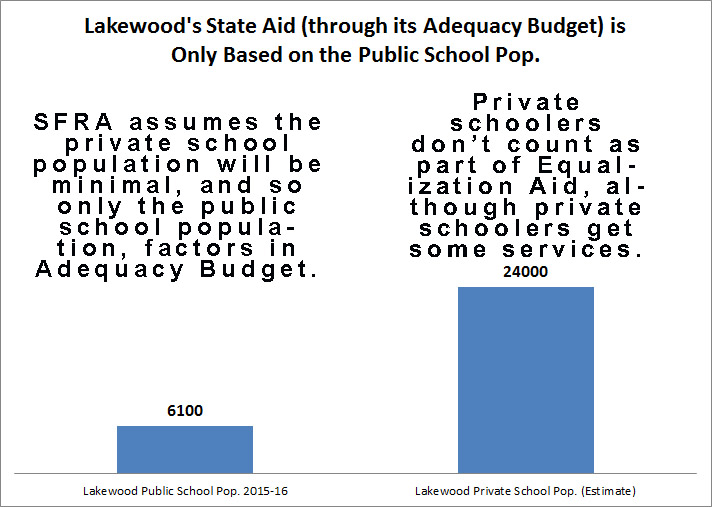

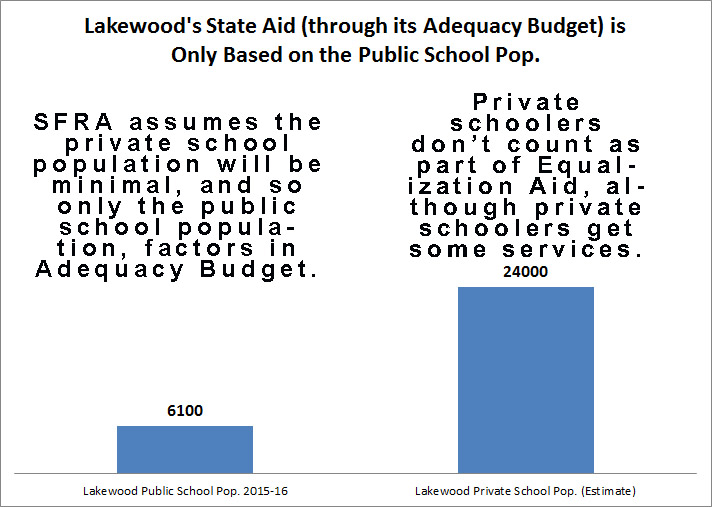

And herein is where Lakewood's problem lies: the enormous non-public school population doesn't figure into the calculation of Lakewood's Adequacy Budget and thus state aid, but receives transportation services and contributes to Out of District special needs population.

Lakewood's state aid problem is specifically in how the state expects districts to pay for tuition for special needs kids and transportation.

Extraordinary Aid is the aid stream for extremely high Out of District tuition, but (to simplify) Extraordinary Aid only kicks in at tuition bills at about $55,000 per student and even above that point, it only pays for 75% of tuition. (and Extraordinary Aid is underfunded)

The state expects school districts to be able to pay for the first $55,000 of tuition with their operationg funds (from local taxes and/or Equalization Aid) and the 25% cost share above $55,000 with their operating funds too.

Lakewood already is NJ's largest recipient of Extraordinary Aid, but Lakewood's problem is that it doesn't have enough operating money to pay for its end of tuition bills because 1) it is underaided 2) the aid target is too low anyway.

If you were to compare the 339 children in Lakewood who are in Out of District placement for 2015-16 to Lakewood's 6,100 student public school population, Lakewood is wildly out of proportion to any other district in New Jersey; however, if you compare the number of Lakewood children to its overall young person population of about 28,000-30,000, Lakewood would be in rough proportion to New Jersey's other largest towns.

Transportation

Lakewood's Underaiding

The factor

Lakewood should be getting $6,955 per student in state aid, but in reality it only gets $3,906 per student. The $3,049 per student aid deficit places Lakewood in the state's bottom 15% for underaiding.

The $6,955 aid target is actually low for a district with Lakewood's demographics. For instance, Freehold Boro's aid target is $13,342 per student and Dover's is $13,655.

Lakewood's aid target is low because Lakewood's student population is very small proportionally and Lakewood thus has an above-average per student tax base. Lakewood's tax base is not spectacular, but it is approximately equal to Metuchen's and Haddonfield's, though spread out among a much larger, poorer population.

Not all demographically poor districts should get a lot of state aid if their tax bases are large (eg, many districts at the Jersey Shore, Hoboken), but Lakewood is different from other other poor-student/high-tax base districts because its tax base is only deceptively high due to so many homes being occupied by private-school families who contribute towards Local Fair Share but actually do make some demands on the school system.

I will talk more about how SFRA doesn't work for Lakewood later, but what is rarely said about Lakewood is that its public school population (and not just the private school population) is increasing rapidly and this is also a major factor in Lakewood's budgetary disaster. Since 2009-10, Lakewood has gained 1,200 students, or 24% (using the 2016-17 estimate of a 6,300 student population for Lakewood), in contrast to the state seeing a 1% loss of student population.

Soaring Out of District Tuition is the Proximate Cause

The Proximate Cause of Lakewood's budget disaster is increasing costs for Out of District Special Education.

Lakewood's Out of District spending has risen from $15.3 million in 2008-09 to $28.1 million in 2015-16, or $12.8 million. Since Extraordinary Aid only increased by $4 million, from $524,000 in 2008-09 to an estimated $4.5 million in 2015-16 (and this is $2 million below what Lakewood should get), an extra $9 million has to effectively come out of the Lakewood schools' operating budget.

During this time, Lakewood has increased its Local Tax Levy by $21 million, from $69 million to $90 million, but when Lakewood's public school population increase has been among the largest in New Jersey and there has been inflation, there is still much less available to public school students.

The huge OOD cost increases are due to the surge in Lakewood's overall population, as Lakewood grows by 4,000- 5,000 people a year and is by far New Jersey's most rapidly growing town. The new families of Lakewood have special-needs children in roughly the same proportion as every other town in New Jersey and Lakewood's public schools must pay to educate those education in a "free and appropriate" setting.

Many other rapidly growing districts are not getting proportionate aid increases, but at least as their student populations increase, their (theoretical) uncapped aid would increase and there would be some hope in SFRA, but Lakewood's population surge is among Orthodox Jews, whose children do not use the public schools except when they have special needs children and for transportation.

The Asbury Park Press and of NJLeftBehind have written many times about Lakewood having a large number of Jewish special needs children at a school called the "School for Children with Hidden Intelligence." The SCHI was founded by a rabbi and even the Jewish Press has said that the SCHI has a "decidedly Jewish" atmosphere. Although there may be something afoot to the controversy around the School for Children with Hidden Intelligence, the school is in the middle of Lakewood and in terms of transportation it is a sensible place for the Lakewood BOE to send special needs children.

Lakewood's former special education coordinator, Helen Tobia, had tenure charges filed against her for alleged illegal and unethical practices in special education placements, but even if there are inappropriate or illegal practices in Lakewood Out of District placements, it doesn't seem like it would negate the tendency of Lakewood to have a Out of District population disproportionate to its public school enrollment no matter what.

Why SFRA's Aid Target Isn't Enough for Lakewood

Equalization Aid = Adequacy Budget - Local Fair Share.

Where Adequacy Budget is the demographic determination of a district's needs based on its public schoolers only. It depends on enrollment and has extra weights for "at-risk" students.

Equalization Aid is not tied to any particular budget item. Districts can spend it on teachers, basketballs, transportation, textbooks, and tuition for children with special needs.

And herein is where Lakewood's problem lies: the enormous non-public school population doesn't figure into the calculation of Lakewood's Adequacy Budget and thus state aid, but receives transportation services and contributes to Out of District special needs population.

Lakewood's state aid problem is specifically in how the state expects districts to pay for tuition for special needs kids and transportation.

Extraordinary Aid is the aid stream for extremely high Out of District tuition, but (to simplify) Extraordinary Aid only kicks in at tuition bills at about $55,000 per student and even above that point, it only pays for 75% of tuition. (and Extraordinary Aid is underfunded)

The state expects school districts to be able to pay for the first $55,000 of tuition with their operationg funds (from local taxes and/or Equalization Aid) and the 25% cost share above $55,000 with their operating funds too.

Lakewood already is NJ's largest recipient of Extraordinary Aid, but Lakewood's problem is that it doesn't have enough operating money to pay for its end of tuition bills because 1) it is underaided 2) the aid target is too low anyway.

If you were to compare the 339 children in Lakewood who are in Out of District placement for 2015-16 to Lakewood's 6,100 student public school population, Lakewood is wildly out of proportion to any other district in New Jersey; however, if you compare the number of Lakewood children to its overall young person population of about 28,000-30,000, Lakewood would be in rough proportion to New Jersey's other largest towns.

|

| Click to Enlarge |

If you are unfamiliar with NJ's law on private school transportation, all private school children living in bussing districts (like Lakewood) get a bus or an $884 check if they are in K-8 and live more than 2.0 miles from their school or more than 2.5 miles if they are in 9-12.

Lakewood's transportation spending is so high because it must provide bussing to over 11,000 private schoolers and has chosen to provide "courtesy" bussing to a few thousand more for whom there is no mandate to provide transportation. (most Lakewood private school children get to school without any public expenditure at all.) Although the state has focused on courtesy bussing for private schoolers, there were 2,700 public school children who got it too.

High transportation spending is a foundational budget problem for Lakewood, but it is not a proximate cause of the disaster like Out of District tuition is since Lakewood's Transportation Budget has been falling recently and will fall even more after courtesy bussing is is discontinued for 2016-17 (saving $6.2 million).

Again, the problem is that Lakewood has to provide transportation to private schoolers and this does not factor into Lakewood's Adequacy Budget. Non-public transportation is a component of the formula for Transportation Aid, but like with Out of District tuition, the school district is expected to pick up the rest of the cost with local tax dollars and/or Equalization Aid and since Lakewood's private school population is out of proportion to its public school population, Lakewood doesn't get enough Equalization Aid. (and is underaided compared to what it is supposed to get.)

Also, despite all the transportation spending, the percentage of its budget that Lakewood spends in the classroom (according to the Taxpayer Guide to Education Spending) is nearly the state's average.

Lakewood's Orthodox-dominated BOE resisted cancelling Courtesy Bussing for many years. Some critics see this as an inappropriate use of Orthodox power (or you could see it as democratic power since the Orthodox are a majority, after all), but the BOE had some legitimate reasons for supporting courtesy bussing, like wanting to prevent traffic chaos.

I don't think Lakewood BOE chairman Barry Iann was wrong either when he defended courtesy bussing with a a safety justification:

Also, despite the fact that courtesy bussing was the only thing some Lakewood private school families get for their local and state education taxes, an overwhelming majority of them opposed paying higher taxes to continue it in a January 2016 referendum on a special tax on courtesy bussing that was defeated 99% to 1%.

"This problem is about the children of Lakewood who will be forced to walk to school on the most hazardous and congested roadways in the State of New Jersey — most of which do not even have sidewalks."

“I pray that it will not take the death of a child (G-d forbid) before the gravity of this problem is finally addressed"

The Prospects

Lakewood's budget prospects are extremely bad due to the trend of continuing public school population growth and the growth of the town overall, which increases the Out of District placement population.

Since the state is not going to be able to fully fund SFRA and even a total redistribution of Adjustment Aid would only give a few million more to Lakewood, Lakewood's chances at getting a state rescue or are very small and are non-existent of Lakewood is unaware of the depths of its own underaiding and the township is divided.

People can legitimately blame Lakewood's municipal government for its laissez-faire posture on housing development and people can legitimately criticize NJ's private school transportation law, but it's unfair to attack Lakewood's BOE and Orthodox community without talking about how SFRA doesn't work for Lakewood and Lakewood doesn't even get what it is supposed to get.

Lakewood is often compared to East Ramapo, a district in Rockland County, New York that also has an Orthodox majority. The parallels with East Ramapo are there, no doubt, but Lakewood is also very similar to districts like Red Bank Boro, Freehold Boro, and Dover that have growing Latino populations and whose state aid has not kept up.

Lakewood is a topic that merits media coverage and conversation because of its demographic uniqueness, because of its incredible population growth, and because of the educational budget disaster unfolding there, but certain pieces of context have to be in this conversation: such as that Lakewood's taxes exceed its Local Fair Share, that Lakewood is badly underaided by SFRA, and that SFRA's calculation of Adequacy Budget does not produce a sufficient amount for Lakewood anyway.

---

Please, if you want to help Lakewood and other underaided districts, please sign this state aid petition from Our Fair Share!

----

See an earlier, less sophisticated piece by me on Lakewood being an underaided district.