One myth about the Abbott cases in New Jersey is that prior to the NJ Supreme Court's heroic takeover of school finance in 1990, the state singularly failed to live up to its constitutional obligation to provide a "thorough and efficient education" to children in poor urban districts. According to David Sciarra of the Education Law Center, NJ had "

two separate school systems, one for poor, one for rich."

Like most myths there's some truth to the notion of pre-Abbott II urban deprivation. New Jersey's urban poor districts (later known as theAbbotts) did indeed spend less than the rich suburban districts. Yes, the spending disparities translated into stark programmatic disparities between the rich and poor. Due to the "nested inequalities" where urban kids were "doubly disadvantaged" in being poorer than kids in rich suburbs, the urban schools couldn't give urban kids what they needed.

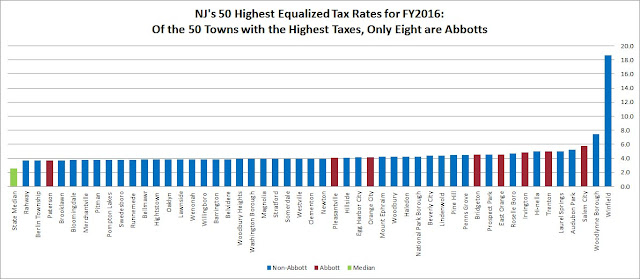

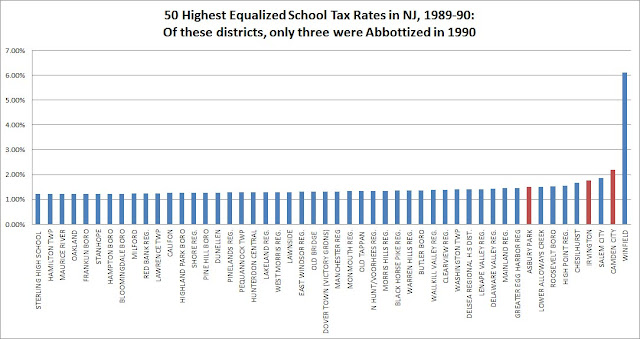

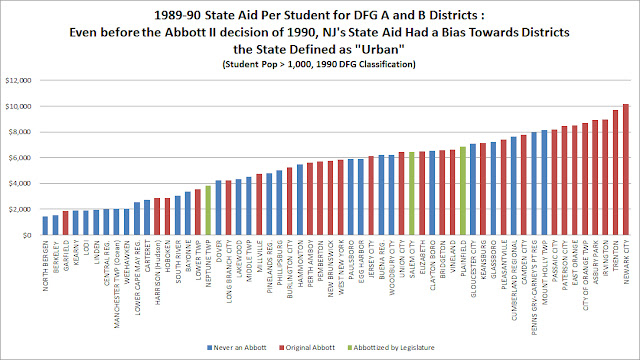

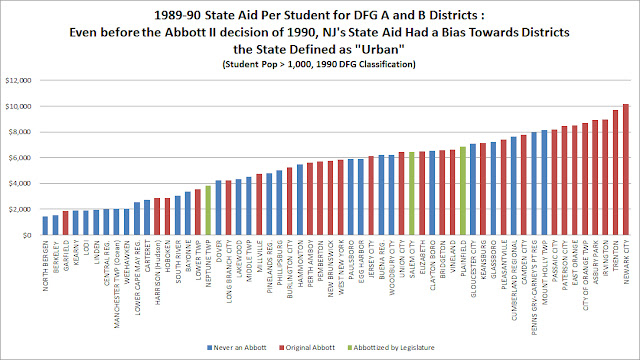

But what's never, ever discussed in the history of Abbott New Jersey school finance is that NJ had a smooth spectrum of spending, not "two separate school systems," and the Abbott districts in 1989-90 weren't New Jersey's budgetarily poorest. Not even close. Prior to the Abbott II decision New Jersey's most underbudgeted districts were, with very few exceptions, rural districts, mostly in South Jersey, not urban districts at all.

The fact that New Jersey had a progressive aid distribution even in the 1980s has been forgotten. The fact that Gov. Kean already had a special urban aid program in place that gave more money to urban poor districts than non-urban poor districts has been forgotten. The fact that Newark alone got more state aid than Bergen County and the rest of Essex County combined hasn't been forgotten per se because it has never publicized at all.

What people do not know anymore about the Abbott cases is that prior to the Abbott II decision of 1990, the future Abbott were disparate, but, as a class, only spent about 5% less than the state median.

What I have never seen in journalism since the 1980s is that in 1989-90, eight of the Abbotts actually exceeded the state's average spending and three Abbotts - Hoboken, Asbury Park, and New Brunswick - actually outspent Millburn.

Of New Jersey's fifty lowest spending districts, only four (4) were Abbotts.

(I got the data from the DOE via an OPRA request. This

Historical Budget Data spreadsheet contains the spending data, plus historical state aid and tax levy data.)

What I'm trying to do here is bust the Abbottist myth that New Jersey's governors and legislature singularly failed urban poor districts. If you reason that "average spending for demographically poor districts" = "constitutional violation," then the constitutional violation in New Jersey wasn't at its most severe in the Abbotts, since they were nearly average spending and had many districts below them. If low spending alone creates a constitutional violation, then the biggest violation was for rural, South Jersey districts.

The only way the state failed the urban districts would be if you compared them to the richest suburban districts in New Jersey, which is precisely what the Education Law Center did in order to make the Abbott districts appear to be more deprived than they were.

Abbott II was Based on Extremes in Spending

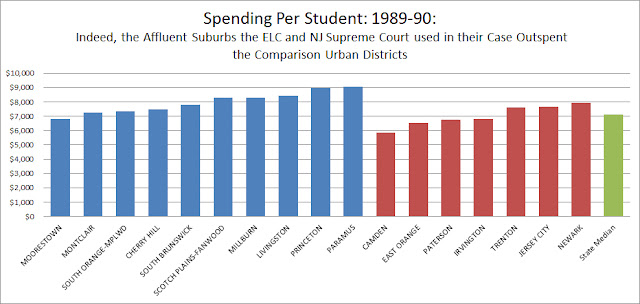

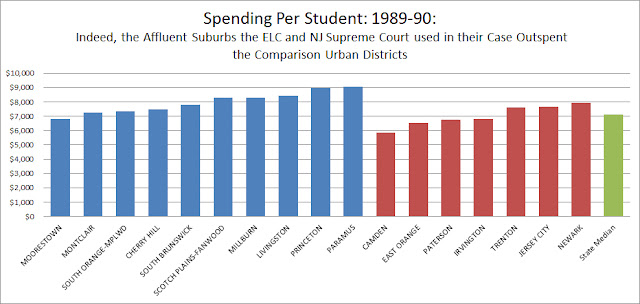

What must be made clear about the Education Law Center's argument Abbott II case is that it focused on comparisons of seven of the poorest Abbotts - Camden, East Orange, Jersey City and Irvington, Newark, Paterson, and Trenton - against ten of the most affluent and tax-supportive suburbs in New Jersey - Paramus, Princeton, Millburn, Scotch Plains-Fanwood, Livingston, South Brunswick, Cherry Hill, Moorestown, Montclair, and South Orange-Maplewood.

Kean's Justice and Education departments objected to the validity of this comparison, saying there was a continuum of financial resources, but Chief Justice Robert

Wilentz rejected this counterargument:

The State further claims that the most intensive study conducted by plaintiffs, including the study of funding disparities, is limited to comparisons between plaintiffs' districts (Camden, East Orange, Jersey City and Irvington) and three others-Newark, Paterson, and Trenton, all contrasted with certain richer suburban districts (Paramus, Princeton, Millburn, Scotch Plains-Fanwood, Livingston, South Brunswick, Cherry Hill, Moorestown, Montclair, and South Orange-Maplewood). We agree that plaintiffs' most complete study of the characteristics of districts, including substantive education, was made in the form just mentioned. But when it came to funding disparities and their relationships, plaintiffs' comparisons were across the board.

Obviously, when comparison is between affluent and high-tax suburbs to the poorest cities there are going to be spending disparities and these disparities would be exacerbated for the urban students on account of their having greater needs.

Indeed, what you have heard about unacceptable spending disparities between wealthy suburbs and the Abbotts is correct. Wilentz documented many of the disparities in his Abbott II decision. That Raymond Abbott himself had a learning disability and received no services for his disability is heartbreaking.

But what is missing from the suburban-Abbott comparison is sensitivity to the rest of the state and an analysis of where the Abbotts were to the rest of the state.

In 1989-90, the median district in NJ spent $7,094 per student, with the weighted mean being somewhat higher, at $7,267 per student. (vo-techs and some districts for which I did not have complete data are excluded.)

As you can see, the majority of the future Abbott districts were close to the median or exceeded it!

Since the Abbott districts had more disadvantaged students than New Jersey's average district, one could still argue that the urban poor districts needed more than the average amount of money, but what this ignores is that the Abbotts weren't synonymous with New Jersey's lowest-budgeted districts.

|

| Click to Enlarge |

As you can see, this list is dominated by South Jersey rural districts.

There are only four "urban districts" among NJ's fifty lowest-spending districts and three of them (Bridgeton, Pemberton, and Millville) are rural anyway.

Most of these lowest-spending districts include districts who are demographically poor too. Using the 1990 DFG classification (since it would be more contemporaneous than the 1980 classification). Fourteen districts in the bottom 50, Chesilhurst, Clementon, Fairfield, Elk, Westfield, Haledon, Prospect Park, Deerfield, Ocean Gate, North Bergen, Clayton, National Park, Lower Township, and Mullica were in DFG A or B. Another seven, New Hanover, Franklin, Winslow, Monroe, Freehold Boro, Pittsgrove, and Florence were in DFG CD.

*When I ran these calculations I could not believe that New Hanover and Chesilhurst only spent $1,000 per student, but I have double-checked the numbers I got from the Department of Education and cross-checked school spending with each district's local tax levy and state aid, and the $1,000 per student figures seem to be accurate. Even if it turns out that there is some mistake and New Hanover and Chesilhurst spent more than $1000 per student, the basic point that the most underbudgeted districts in New Jersey were mostly non-urban still holds.

Abbott: Judicial Activism at its Worst

A reasonable person could believe that urban social problems were deeper than rural social problems and that therefore extra state aid for urban districts was justified. A reasonable person could believe that Abbott districts suffered from "municipal overburden" and therefore more state aid was justified. Clearly the cost of living is higher in North Jersey than South Jersey, so some spending disparities are justified. Furthermore, some of the poorest non-Abbotts are not K-12 districts, so their spending also should logically be lower.

A reasonable person can say that urban problems were "more pressing," but the second part of Tractenberg's assertion, that the urban districts "had less resources to deal with them" is untrue of the Abbotts as a class. A handful of Abbott districts were indeed badly underresourced and those were the districts the Education Law Center used to argue its case, but the deep problems of Camden, East Orange, Jersey City and Irvington, Newark, Paterson, and Trenton did not exist to the same degree in all of the Abbott districts and the problems that existed in the poorest Abbotts existed in greater or equal depth in districts that were not legally considered "urban."

Chief Justice Robert Wilentz said that "society was failing" in the Abbott districts, hence the massive aid he ordered, but other poor districts still needed to keep their buildings warm in winter, still needed to bus kids, still needed to pay teachers, still needed to insure themselves, and still needed to buy equipment. Why should heating oil cost more in Newark than in East Newark? Why should a basketball court more for Bridgeton than for Fairfield Township? Why should health insurance for a teacher cost more for Pemberton than for Eastampton? Why need teacher salaries be higher for Harrison than North Bergen? Why should a computer cost more for New Brunswick than Sayreville?

These are the Savage Inequalities that Abbott forgot.

Against the State's argument that New Jersey had a continuum of need and that the Millburn/Newark comparison was unrepresentative of the state, Robert Wilentz and the Supreme Court stood athwart justice and said that

only the problems of urban districts, even if they were not the most severe, mattered. And against common sense, the Supreme Court asserted that you could draw rigid demarcation between "urban" and "suburban."

Jim Florio had originally only wanted to bring the urban districts up to the 60th percentile, but he and Christie Whitman complied with the NJ Supreme Court "Parity Spending" and later "Parity Plus" orders anyway.

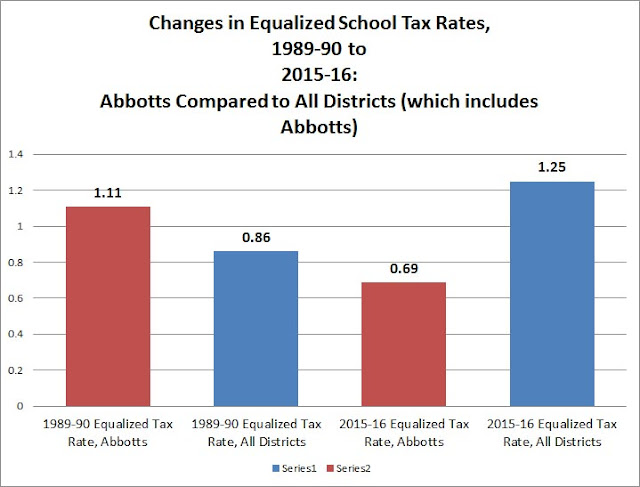

Over the next several years Abbott state aid would double, from $1,024,840,106 in 1989-90 to $2,291,696,951 in 1997-1998, when the Abbotts

reached parity with DFG I and J districts. From 1997-1998 to today, Abbott aid would double again, to $5.1 billion.

Even the Abbotts who were already the best aided saw large gains:

- Hoboken's state aid rose from $6.9 million to $10.2 million from 1989-90 to 1993-94.

- Asbury Park's state aid rose from $12.3 million to $21.6 million.

- New Brunswick's state aid rose from $12.2 million to $21.2 million.

DFG A and B districts, from 1989-90 to today, only had their aid double over this twenty-six year timeframe.

For anyone seeking an example of the dangers of judicial activism, look at Abbott.

---

More Abbott History Pieces:

---

Note on the data: I got the data from the Department of Education via an OPRA request. I got the enrollment data via scans of original 1990 documents. I had to enter the enrollment data into an Excel spreadsheet by hand. If there was a typo in the documents I saw or I created a typo, please excuse me.

I can forward to anyone the enrollment data sheets. Email me at stateaidguy@gmail.com if you want them.

I did not have enrollment data for every district I had budgetary data for. I have omitted those districts from my calculations.

I did not factor in vo-techs into my state spending averages and median calculations.