and expensive agenda for New Jersey.

Phil Murphy bases his campaign, in part, on how his work for Goldman Sachs gives him fiscal acumen, but he has not bothered to tabulate how much his spending and tax credit plans would actually cost, let alone how he would pay for his plans.

Nonetheless, there are a few items in the Murphy agenda where an outsider can make an estimate of what the cost would be, since there is a formula that Murphy is trying to fund or a precise target that Murphy is trying to reach.

- Pensions: fully fund the pensions, estimated cost based on 2017 deficit relative to the Actuarially Recommended Contribution, $3 billion per year.

- K-12 Education: "implement that formula," ie, fully fund K-12 state aid. estimated cost based on 2017 deficit, $2 billion per year (without redistribution.)

- Pre-K: Usually Murphy makes a vague promise to provide "more" Pre-K, but he once criticized Christie for denying Pre-K to 45,000 additional students, in which case I can estimate a cost based on 2016 per student costs, so $608 million per year.

- Increasing the Earned Income Tax Credit from 35% of the federal level to 40% of the federal level, $60 million per year.

However, there are many other items that Phil Murphy has promised to increase spending on, but with very vague or nonexistent targets for what the increase will be to, such as "increase college spending."

It's also difficult to estimate costs because it's not clear to what degree Phil Murphy's own "New Start New Jersey" organization speaks for Murphy and thus we do not know exactly what Murphy wants to do.

It's also difficult to estimate costs because it's not clear to what degree Phil Murphy's own "New Start New Jersey" organization speaks for Murphy and thus we do not know exactly what Murphy wants to do.

- Increase state assistance for higher education, including offer in-state tuition and financial aid to undocumented immigrants. Murphy's New Start New Jersey website favorably discusses "free" community college.

- Create a tax incentive for businesses to offer college loan forgiveness. Create loan forgiveness to STEM majors.

- Increase the Senior Property tax rebate. The legislative Democrats proposed a $45 million increase last year.

- Create a Child Care Tax Credit.

- Increase affordable housing.

- Create an "Advanced Industries Accelerator Grant Program."

Murphy's Cuts and Higher Tax Ideas

Since the Tom Moran interview, Phil Murphy has said he would save or raise money by cutting hedge fund investments made by the pensions, cutting corporate tax incentives, raising taxes on millionaires, "closing loopholes for corporations," and legalizing (and taxing) marijuana. In his 2005 Pension Benefits Task Force recommendations, Murphy also proposed selling off state assets, which would presumably be the NJ Turnpike and other highways, however we don't know if Murphy still favors this.

There's some merit to all of Murphy's ideas, but the sum of the savings would not even be close enough to pay for even the pension payment, let alone the rest of Murphy's agenda.

1. Cutting hedge fund investments. Maximum Savings = $728.4 million

Based on 2015 Costs, $728.4 million = $400 million in management fees plus $328.4 in performance bonuses. Not all of that money goes to hedge funds per se. Some of that money goes into real estate investments and private equity that New Jersey may not want to give up.

2. Cutting Corporate Tax Incentives. Maximum Savings = Very Low.

- This isn't politically possible.

- If implemented, some businesses will leave NJ or decide not to expand here.

Phil Murphy claims that tax incentives have very little to do with corporate expansion and relocation decisions, but I think many legislative Democrats would disagree and not go along with a plan that eliminates NJ's tax incentives program since every other state in the US has its own tax incentive program too.

Even if Murphy got a reduction or elimination of tax incentives through the legislature, the net savings would be very low.

The problem with estimating savings here is that the tax incentives are often offered to retain or attract businesses to New Jersey and nobody, other than the CEO and his closest confidants, knows what a company would do if it were not offered tax incentives by New Jersey. Although some companies are bluffing when they threaten to leave, it's implausible to assert that they all are.

If NJ refuses to grant a tax incentive to a business and it stays and pays taxes, the Treasury gains; if NJ refuses to grant a tax incentive and it leaves, the Treasury loses and then there are significant downstream negatives from the loss of spending power.

If NJ refuses to grant a tax incentive to a business and it stays and pays taxes, the Treasury gains; if NJ refuses to grant a tax incentive and it leaves, the Treasury loses and then there are significant downstream negatives from the loss of spending power.

Murphy claims that NJ has cumulatively "spent" $7 billion in tax incentives during the Christie administration, but this is a misconception. $7 billion in incentives have been "approved," but the payout takes place much later. So far New Jersey has not nearly paid out $7 billion.

3. "A Millionaire's Tax." $615 million, assuming the 8.97% tax rate were increased to 10.75% for earnings above $1 million.

With a 10.75% tax bracket, NJ would have the country's second highest top income-tax top rate, after California.

With a 10.75% tax bracket, NJ would have the country's second highest top income-tax top rate, after California.

It's not clear how literal Murphy is being regarding a "millionaire's tax." Someone making $800,000 a year is a millionaire too, although someone whose income is below the milestone $1,000,000 mark would not be subject to a tax levied only on million-dollar+ incomes.

4. "Closing Loopholes for Corporations"

Phil Murphy said he would "close loopholes for corporations" in his September 2016 economic policy speech, by which I assume he means implement Combined Reporting.

Many Democrats want to establish Combined Reporting in New Jersey and use a $200 million a year estimate for how much revenue it would bring in, but Andrew Sidamon-Eristoff, a bona fide tax and budget expert, warns that the new revenue would be nowhere near $200 million since New Jersey already has an "addback" provision that "requires corporate taxpayers to disregard or 'addback' specific kinds of transactions (such as rent, interest, or royalty payments) between related entities in computing their taxable income"

5. Legalizing Marijuana. Maybe $300 million per year.

|

| Washington State, Marijuana Sales & Revenue: There's real money to be made by a state becoming a drug dealer. |

The Terrible Budget Forecast for NJ

For the last few years, NJ's revenue has grown by about $1 billion per year, but the three "P.H.D." expenses - Pensions, Health care, and Debt - consume all of the new revenue.

Over the next few years the trend of big increases will continue for Pensions and Health Care.

Annual pension contributions are slated to increase by $500-$700 million per year until reaching $6 billion in 2023.

And health care is projected to increase by about $300 million per year:

However, a fiscal relief that the next governor of NJ will have is that NJ's non-pension debt servicing costs will fall by $780 million through 2021 as old debt is retired. The drop in debt service for FY019 (the next governor's first budget) is over $400 million.

Yet, the increasing costs for Pensions and Health Care exceed the relief from lower debt payments.

The TTF Tax Cut Pothole

The justification for raising NJ's gas tax is that we had a lot of potholes to fill, but by pairing the gas tax increase with big tax cuts, we created a huge pothole in the State's budget.

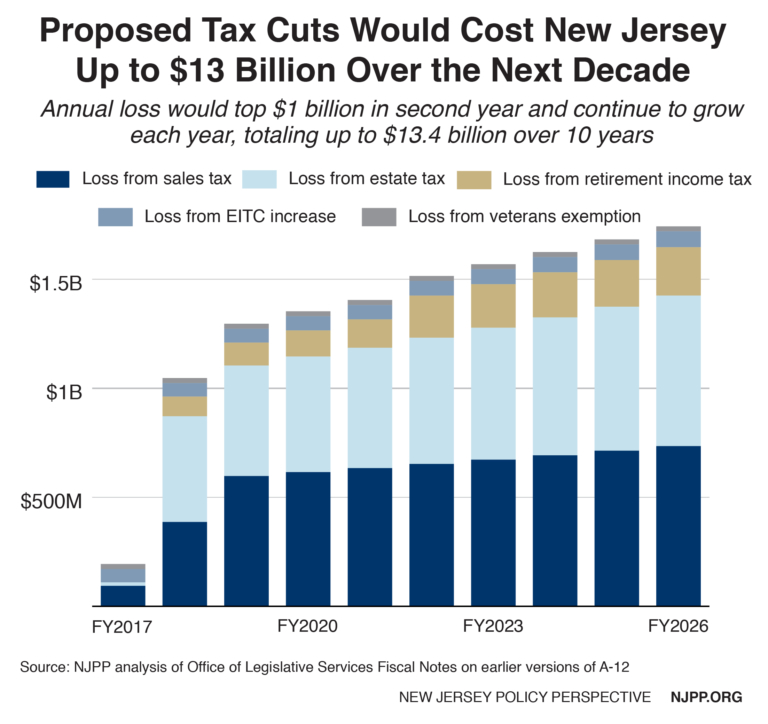

As part of the deal to increase NJ's gas tax by 23 cents a gallon, the Democratic leadership agreed to $1.3 billion in tax cuts. The tax cuts included the elimination the estate tax, tax cuts on retiree income, a $3,000 tax credit for veterans, a cut the sales tax by 3/8th of a percent, and an increase in the EITC from 30% of the federal level to 35%. (Murphy wants a bigger increase of the EITC.)

The costs of the sales tax cut alone are about $600 million per year. The estate tax elimination will cost $485 million per year when fully phased in.

Phil Murphy has said that the only tax cut he would have supported was the increase in the EITC, but does that mean that he will undo any of the tax cuts the legislature did pass? I think that cutting the new veterans and retiree benefits tax cuts would be impossible politically and restoring the estate tax to its pre-TTF level would be very difficult too.

In any case, New Jersey is going to to have to find the revenue somehow to make up for the losses from the TTF deal.

For the last few years, NJ's revenue has grown by about $1 billion per year, but the three "P.H.D." expenses - Pensions, Health care, and Debt - consume all of the new revenue.

Over the next few years the trend of big increases will continue for Pensions and Health Care.

Annual pension contributions are slated to increase by $500-$700 million per year until reaching $6 billion in 2023.

And health care is projected to increase by about $300 million per year:

|

| Source: http://www.nj.gov/treasury/omb/publications/17bib/BIB.pdf |

However, a fiscal relief that the next governor of NJ will have is that NJ's non-pension debt servicing costs will fall by $780 million through 2021 as old debt is retired. The drop in debt service for FY019 (the next governor's first budget) is over $400 million.

|

| Source: http://www.nj.gov/treasury/public_finance/pdf/DebtReportFY2015.pdf |

The TTF Tax Cut Pothole

The justification for raising NJ's gas tax is that we had a lot of potholes to fill, but by pairing the gas tax increase with big tax cuts, we created a huge pothole in the State's budget.

As part of the deal to increase NJ's gas tax by 23 cents a gallon, the Democratic leadership agreed to $1.3 billion in tax cuts. The tax cuts included the elimination the estate tax, tax cuts on retiree income, a $3,000 tax credit for veterans, a cut the sales tax by 3/8th of a percent, and an increase in the EITC from 30% of the federal level to 35%. (Murphy wants a bigger increase of the EITC.)

The costs of the sales tax cut alone are about $600 million per year. The estate tax elimination will cost $485 million per year when fully phased in.

Phil Murphy has said that the only tax cut he would have supported was the increase in the EITC, but does that mean that he will undo any of the tax cuts the legislature did pass? I think that cutting the new veterans and retiree benefits tax cuts would be impossible politically and restoring the estate tax to its pre-TTF level would be very difficult too.

In any case, New Jersey is going to to have to find the revenue somehow to make up for the losses from the TTF deal.

Sum of Savings and New Money Estimates from Cutting Hedge Fund Investments, A Millionaire's Tax, Marijuana Legalization: $1.6 billion (728.4+615+11).

$1.6 billion is real money, but it's only half of our pension deficit alone.

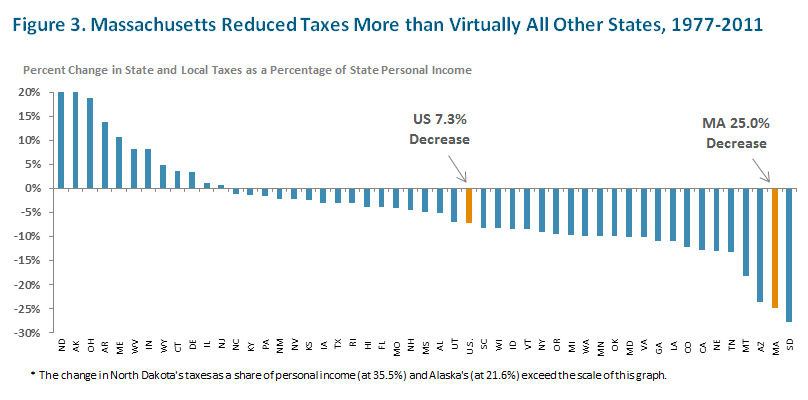

At this point, I beg Phil Murphy to stop making comparisons to Jerry Brown in California and look to Dannel Malloy in Connecticut, since NJ is more similar to Connecticut than it is to any other state.

|

| CT Gov Dannel Malloy: Malloy's Billion Dollar Tax Increases Have Been Followed by Billion Dollar Deficits |

After his reelection in 2014 and faced another large deficit, Malloy proposed a $1.5 billion tax increase. Businesses were incensed and Malloy reduced the increase to $1.3 billion. This second round increase still angered the business community and contributed to GE's decision to leave Connecticut. Unbelievably, despite that tax cut, Connecticut's revenue is lower now than it was in 2013.

By 2016 Malloy, facing yet another deficit, shifted dramatically and announced that the latest budget deficit would be dealt with by cutting spending, not raising taxes. Malloy's progressive allies were furious, but Malloy said:

“What’s changed is that the money’s not coming in the door. We live in a new dynamic in the United States where most states’ revenue is not growing at a rate to which we became accustomed.” He said he stood by the tax increases that were enacted earlier in his tenure as part of broader budget deals that also fully funded the state pension system for the first time in years. As for the left’s demand that taxes go up even further, he said, “At some point, you simply can’t raise taxes to an extent that you price yourself out of the market.”Now, for FY2017, despite the cuts Malloy made, Connecticut is in the red again and Connecticut's deficit for next year is estimated at another $1.3 billion. For FY2019 Connecticut is facing a $1.4 billion deficit.

...the administration of Gov. Dannel P. Malloy is already warning state agencies to start planning for big reductions in discretionary spending in the following two fiscal years.

“Most agencies will likely face discretionary spending reductions of at least 10 percent below fiscal 2017 levels in fiscal 2018. As a result, we will be significantly challenged to provide all of the services and programs that many have come to expect,” Benjamin Barnes, the Democratic governor’s budget chief wrote all state agency leaders Wednesday.

“In many cases, I expect agencies may need to further reduce, or perhaps cease delivering altogether, certain programs or services, and additional headcount reductions may be necessary,” Barnes wrote. “Fiscal 2018 will be even more challenging than fiscal 2017. … Your planning and development of reduction options for fiscal 2018 should begin now.”

The deficit is due to “disappointing revenue results.... largely produced by an economy that has yet to reach past recovery growth levels, as well as considerable stock market volatility."

In my opinion, Connecticut's chronic economic malaise belies the claims that New Jersey can tax and "invest" its way out of its budget crisis.

Hollow Promises

Phil Murphy's spending agenda is not affordable even if the state's economy continues to grow. His proposals are not suited for a state like New Jersey, whose ability to borrow is limited, whose taxes are already excessive, and whose economy is relatively stagnant.

If we have a recession Murphy's promises are even more unaffordable.

In any case, voters who hear Phil Murphy's promises for more education aid, more PreK, higher college aid, new tax credits, and a raft of new spending on various small items and treat such promises with deep skepticism.

-----

See Also:

Phil Murphy's spending agenda is not affordable even if the state's economy continues to grow. His proposals are not suited for a state like New Jersey, whose ability to borrow is limited, whose taxes are already excessive, and whose economy is relatively stagnant.

If we have a recession Murphy's promises are even more unaffordable.

In any case, voters who hear Phil Murphy's promises for more education aid, more PreK, higher college aid, new tax credits, and a raft of new spending on various small items and treat such promises with deep skepticism.

-----

See Also: