When people in New Jersey talk about the pensions crisis the focus is always on

who underfunded the pensions, never

why. Surprisingly few people wonder about the paradox of how New Jersey, whose credit rating was once AAA, whose income is the second highest in the country, whose taxes are high, and whose pension generosity is average, could become so hopelessly indebted.

When New Jerseyans look for whom to blame the state’s gigantic indebtedness on the villains are always our governors, as if the governors were the only people who controlled New Jersey’s fiscal policy. The explanation for the crisis is rarely deeper than “the governors raided the pension funds.”

The political series of events in the early 1990s that created the pension crisis is very complex, but at the same time the problem was simple: the pension system had fundamental problems that grew into disaster as the state taxed too little and spent too much.

This essay focuses on where New Jersey spent too much. The Abbott decision is not the primary cause of pension underfunding, but neither is it unrelated. Without pension underfunding, the massive Abbott spending rampup would have required tax increases that the public would not have tolerated. The Republican tax cuts of 1992-1996 removed more money that could have gone to pensions than the Abbott mandate did, but those tax cuts did not last as long as the Abbott regime has lasted. Of items on the spending side of the ledger, the Supreme Court’s mandate for “Parity Plus Funding” in the Abbott districts plus two years of Pre-K and 100% state construction responsibility were and remain major contributors to pension underfunding.

1990

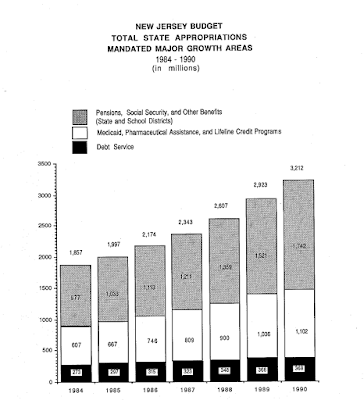

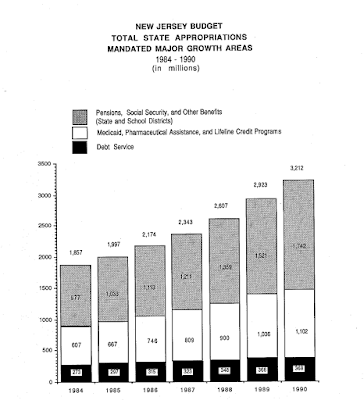

There may not have been any good time for New Jersey to embark on as expensive a program as Abbott, but 1990 was a particularly bad time to do it in New Jersey. New Jersey’s economy was already in recession, a federal Social Security tax increase had kicked in, the state had a $600 million deficit that year and a forecast of a $1 billion deficit for the next year.

The deficit was mostly due to the recession, but there was a structural deficit due to pension costs.

|

Source

https://tinyurl.com/yc9obxdr |

The pension system at the time was fully funded, but costs were increasing by 10% a year. Analysts even then were calling the pension system a "ticking time bomb." During the previous eight years state government costs in Jersey had doubled, but pension costs had tripled, and COLA costs had quadrupled. Policy makers had realized that in creating a teacher pension system paid by the state but determined by salaries agreed to by local school districts the state had given local districts a blank check.

The locally determined/state funded hybrid pension system incentivized school districts and unions to agree to salary guides that backloaded pay because high pay at the end of a career would translate into salary savings for the school district, but a high pension paid for by state taxpayers.

New Jersey’s governor in 1990 was a former Congressman named Jim Florio. In Congress he had distinguished himself on environmental issues as the author of the Superfund law, but one thing that helped him win the governorship was an oft-repeated statement that the saw “no need for new taxes.”

But in addition to the recession, New Jersey's budget problems were exacerbated by the Abbott II decision of June 5th, 1990. In lofty language, Chief Justice Robert Wilentz said of urban poor students:

The students of Newark and Trenton are no less citizens than their friends in Millburn and Princeton. They are entitled to be treated equally, to begin at the same starting line. Today the disadvantaged are doubly mistreated: first, by the accident of their environment and, second, by the disadvantage added by an inadequate education. The State has compounded the wrong and must right it.

The urban districts were indeed less well-funded than the richest suburban districts, but contrary to popular belief, the future Abbott districts

were actually only slightly below the state's average. Nonetheless, many expected (and wanted) the New Jersey Supreme Court to order more money for urban poor districts, hopefully bringing them up to the 60th percentile in spending.

But the New Jersey Supreme Court went farther than most anticipated with the “Parity Plus Doctrine;”

Obviously, we are no more able to identify what these disadvantaged students need in concrete educational terms than are the experts. What they don't need is more disadvantage, in the form of a school district that does not even approach the funding level that supports advantaged students. They need more, and the law entitles them to more.

Wilentz’ Parity Plus Doctrine meant that the children of the low-resource urban districts (and only low-resource urban districts) had a Constitutional right to the same school spending that children in the richest 108 suburbs got, plus additional money for supplemental programs. The consequence of the “Parity Plus” doctrine was that the state had to find at least $440 million to the Abbott districts within four years at a time when the state’s budget was only $12 billion and the recession was deepening.

Jim Florio praised the Abbott decision as "a clear cut victory for the children of our state," but he knew that it would be politically impossible (and unfair) to give new money to only the Abbott districts, so he thus crafted a proposal to direct over $1 billion in new state aid to the Abbotts plus another 330 districts. The Abbott districts and the other districts to gain aid represented a 75% majority of New Jersey students and, critically, their Assemblymen and Senators represented a majority of the New Jersey legislature.

Despite his statements about seeing “no need” for a tax increase, Florio persuaded the legislature to pass a $2.8 billion tax increase for Abbott plus other programs, the largest proportional tax increase in American state history. Florio and the legislature doubled the top tax rate to 7.0%, increased other rates, added a penny to the sales tax, and created new taxes on everything from trucks to telephone bills to toilet paper.

But new money from taxes wasn’t enough.

If the “Parity Plus Doctrine” was ever going to be affordable the state not only had to give more money to the Abbotts, but it had to reduce and restrain spending in the suburbs whose spending the state now had to match in the Abbotts.

Two more mechanisms to both free up money for the Abbotts and restrain suburban spending were necessary.

- Require all school districts to now pay for the pensions, retiree health care, and Social Security costs of their employees, but give new state aid to compensate for those costs to all but “wealthy” school districts. 150 “affluent” school districts would be completely on their own for retiree benefits while another 70 would be partially on their own.

- Eliminate almost all state aid from the 220 “affluent” districts and give it to the poorer districts.

Florio passed this far-reaching and expensive reforms and tax increases in a legislative blitz of less than one month.

The State Says "No"

The result of these unprecedented tax and education finance changes was the most ferocious tax and interest group rebellion in New Jersey’s or even any state’s modern history.

Taxpayers were incensed. A group “Hands Across New Jersey” sprung up to protest the tax hikes and change New Jersey’s constitution to allow recalls and voter-initiated referenda. The leader of the “Hands Across New Jersey,” John Budzash of Howell Township, said he was personally unaffected by Florio’s income tax hikes, but his opposition to them was on principle: “It’s ridiculous to try to take money away from people that work and earn their money and give it to people that don’t.”

No less furious was the NJEA. The teachers were adamantly against making local school districts

|

One Chart Says It All.

Source, Dept of Education |

assume responsibility for retiree benefits because they knew that school districts would harden their opposition to raises if they later had to pay pensions on them. As the president of the NJEA said, "If you have to pay the pensions and you want to keep the cost of pensions down, you keep down the salaries." The NJEA did not believe the Florio administration’s assurances that their pensions would be protected if school districts were unable to make their contributions.

Finally, suburban school districts were irate at the near-complete loss of state aid and the new pension mandate, realizing that taxes would double in five years. Faced with inevitable cuts, one superintendent warned “Excellent school systems in the state will become mediocre.” Another said ''

Anything that makes our district unique will be put on the chopping block.” When the Florio administration promised to set up a “blue ribbon panel” to help suburban districts deal with their losses of aid Livingston's superintendent said "It's like shooting someone in the kneecap and then appointing a committee to help that person learn to walk with crutches." Since pension costs were increasing by 10% a year, suburban residents felt like Jim Florio was thrusting a ticking time bomb into their arms.

Additionally, Florio’s list of “wealthy” districts slated to lose aid included many districts and many individuals that had never been considered “wealthy” before. Working class towns like Belleville, Hackensack, and Clifton were even slated to lose at least some aid.

As one South Orange resident wrote in the local newspaper:

Yes, I am for equal education, but how many people must I be responsible for? I happen to be a single parent who resides in the so-called “wealthy” village of South Orange. But, we moved into South Orange before the divorce and my family and I are still here because of lots of hard work. Now, as it might happen, when the taxes go up, we might have to move. You ask, how do I feel? I am furious. Furious enough to write.

...Yes, we will be destroyed. We are being destroyed very slowly but it is happening. Maybe not the wealthy, but we, the blue collar workers won’t be around…. I know where I fit in. I work too hard, I am tired and I am scared. I don’t want to lose my home, uproot my family and have them change schools and friends. I don’t want to change my lifestyle because I must be responsible for other people.

To the residents of many middle class New Jerseyans whose communities faced huge tax increases or cuts, the transformation in state aid and pensions was no “clear cut victory” for their children. The advocates for Abbott may have seen themselves as Robin Hoods, but Robin Hood stole from the rich and in the eyes of the state

Jim Florio stole from the middle class.

Jim Florio’s approval rating plummeted to 18%. “Florio Free in ‘93” bumper stickers appeared everywhere. Despite near-immediate backpedaling from the Democratic party, hundreds of Democrats who had nothing to do with Abbott or Florio were voted out of office. Bill Bradley barely won reelection to the Senate in 1990 against an underfinanced and obscure county freeholder named Christine Todd Whitman. The NJEA endorsed scores of Republican candidates in the legislative elections.

The Democrats and Jim Florio

went into a rapid retreat before 1990 even ended. $360 million originally intended for education was redirected to tax relief. The aid cuts to suburban schools were suspended. The plan to have local school districts pay for retiree benefits was suspended. The suspension and later cancellation of aid cuts to the suburbs and offloading pension responsibility was doubly costly in the long-run. First, the state lost the offset it needed to pay for Abbott; second, by removing a constraint from suburban spending the suburbs could spend more than they would have otherwise. Since the funding for the Abbott districts was judicially tied to spending in the suburbs, when wealthy districts approved large budget increases it automatically meant large percentage increases in the Abbotts.

All of Florio's retreat wasn't enough to save the legislative Democrats and hundreds of Democratic office holders at the county and local level. In 1991 Republicans won veto-proof control of the legislature.

Pension Responsibility Dropped

Despite the tax rebellion and the reversal of his plans to financially support the “Parity Plus Doctrine,” Florio, the Education Law Center, and the NJ Supreme Court were still determined to increase state aid for the Abbotts. Florio had become notorious for his “$2.8 billion tax increase” but the tax increase hadn’t created that much revenue and the state still had a deficit. The Republicans, for their part, were still determined to undo Jim Florio’s sales tax increase, a $600 million annual loss. For a solution to the budget crunch and to avert severe cuts to middle-income school districts, Florio and the legislature turned to reducing the state's annual pension contribution.

The New York Times

wrote simply:

The protests [from middle income districts over lost aid] quickly dissipated when education officials announced plans for the extra infusion of $341 million, which would be made possible by reducing the state's contribution to public employee pension funds.

The reduction of state contributions was made legal by the

Pension Reevaluation Act of 1992. The Pension Reevaluation Act changed the actuarial valuation of NJ's pension assets and increased the expected rate of return from 7.0% to 8.75%. Overnight, the value of NJ’s pension funds rose from $24 billion to $29 billion. Due to PRA, New Jersey could legally spend $770 million less in FY1993 and FY1994 (combined) on pensions and $570 million less thereafter, much of which could go to schools.

It should be noted that pension reevaluation had been considered before and many states reevaluated their pensions in the same way. The Pension Reevaluation Act’s reassessments turned out to be correct given that they preceded the booming 1990s stock market and economy.

Most of the public sector unions accepted pension reevaluation, however, there was one group from the AFL-CIO that sued the state and denounced pension reevaluation "They'll want to balance the budget with our pension monies."

It was under Christine Todd Whitman that the state totally committed to "buy now, pay later." Whitman kicked the last leg out of Florio’s strategy to pay for Abbott and the rest of government by cutting income taxes by 30%.

The top two brackets remained higher than they were pre-Florio, but the tax cuts cost NJ hundreds of millions of dollars a year and that could have gone into the pensions. Whitman also stopped pre-funding retiree health costs too in the "

Pension Reform Act of 1994."

Despite the tax rebellion and the absence of any offsets to fund Abbott, over the next decade the New Jersey Supreme Court repeatedly overruled the legislature on state aid laws, ignored warnings about pensions being underfunded, and added new mandates for Abbott funding, such as two years of “free” Pre-K and 100% facilities funding (which eventually cost $8.9 billion). Flush with money from the booming 1990s economy, Whitman sent a tidal wave of money to the Abbotts. From

1989-90 to 1995-96, state aid for the Abbotts increased from $1 billion to $1.8 billion. By 1997 the Supreme Court’s Parity Plus mandate was reached and the Abbotts equaled or exceeded spending in NJ’s richest districts.

|

| Source, DOE Public Data for 1996-97 onward, OPRA request data from 1989-1996. http://pension360.org/chart-a-history-of-new-jerseys-pension-payments/ and WSJ for pension data. |

From 1996-1997 to 2000-2001 the state increased Abbott aid from $1.8 to $2.5 billion. Even the early 2000s recession put no dent in Abbott funding, with funding increasing even more rapidly as the Pre-K mandate kicked in, reaching $4.1 billion a year 2004-2005 and $5 billion now. From the early 1990s to 2010, the percentage of state education aid going to the Abbotts rose from 28% to 61% even as their share of the state student population fell from 25% to 20%.

And in 2000 the legislature authorized $8.6 in bonding for (mostly) Abbott construction, the largest bond offering in NJ history. ($8.6 billion = $11.83 billion in 2015 dollars)

As the state put more and more money into the Abbotts it put

less and less into pension system. In 1990 New Jersey had put $750 million into the pension system. From 1994-1996 the state only put in $200-250 million. The PRA’s assumptions turned out to be correct, so even the lower funding should not have been fatal to the pension system, but then in 1997 and 1998 the state started to ignore actuarial recommendations and put in less than $100 million per year. Even after the stock market bubble burst in 2001, Gov. Donald Di Francesco increased pension generosity by 9% (retroactively to retirees). Starting in 2001 the state began a multiyear streak of contributing nothing while it massively increased Abbott funding.

It is not a coincidence that the big rampup of Abbott spending in the early 2000s were the worst years for pension contributions.

Ultimately, when the state couldn’t offload pension obligations onto local districts it

dropped them altogether.

The Impossible Compromise

Abbott was implemented after a four-way compromise between the taxpayers, suburban districts, the NJEA, and the Education Law Center.

The compromise was supposed to be that taxes stayed moderate, the suburbs kept their aid, pension costs remained a state responsibility, and the Abbotts saw massive increases in aid. But the state drastically reduced its pension contributions and then abandoned contributions altogether.

Policy makers have been slow to realize that a tidal wave of pension debt is hitting New Jersey. The full actuarial contribution NJ should be making for pensions is at least $5 billion and the unfunded liability is $83 billion. Annual payouts are

$9.65 billion and rising. Even if the funds meet their investment benchmarks, the pension funds will “zero out” starting in 2021 and the teachers’ own fund will zero-out in 2027. No version of a “Millionaire’s Tax” brings in anywhere near enough money even for the actuarial payment. The debts are on the verge of unpayable.

The Abbott decision represented as far as any American state has come in attempting to give (some) poor children opportunity equal to wealthier children. NJ’s urban districts did need more aid than they were getting in 1990 and Jim Florio tried honestly to deal with the costs of Abbott funding and preexisting issues in pensions, but the fierce counterreaction showed that the state was not ready to accept higher taxes and the teachers were not willing to give up future wage growth in order to have a sustainable pension system.

Arguing over the relative roles of the Whitman tax cuts and Abbott funding in creating the pension disaster is a moot argument because the Whitman tax cuts have already been reversed and income tax rates in New Jersey are higher now than they were under Florio. The high funding levels of the Abbott districts do still exist and the Supreme Court remains blind to the state’s fiscal reality as well as the

non-results of Abbott funding. In 2011, even after revenues had fallen by billions and the ticking of the pension time bomb was audible again, the Supreme Court blocked the cuts to the Abbotts, while allowing cuts to all other districts. Christie accepted the decision and the state reverted to making negligible pension contributions.

Implementation of the Abbott decision is not the sole reason New Jersey has pension problems, nor even the primary reason, but it is

a major reason. The Abbott decisions was more or less of a factor at different times, but the early 2000s, when pension payments were $0 and Abbott funding increased enormously, were a time when Abbott and pension underfunding are the most clearly linked. New Jersey’s governors have been irresponsible, but so has the whole political establishment, including the NJ Supreme Court, the legislature, and special interest groups.

At this point New Jersey's pension debts are so enormous that allowing the Abbott districts to have more modest levels of funding would not be sufficient to balance the pension system, but just because something doesn’t completely solve a problem doesn’t mean that it isn’t, unfortunately, necessary. If New Jersey is ever going to put its house in order cuts to the Abbott districts must be made.

See Also: