"They're bursting at the seams. We've got kids being taught in the hallway, on stages, wherever they can find room, and they can't do it anymore. We have to redistribute the state aid."

Senator Jennifer Beck on Freehold Boro:

Finally, the New Jersey State Senate is addressing the savage inequalities that entrap tens of thousands of New Jersey school children in schools nowhere near adequately staffed or equipped and tens of thousands of taxpayers shouldering tax burdens that are beyond the point of fairness.

At a Senate hearing, in front of over 50 community members from Red Bank Boro and Freehold Boro, the Senate Budget committee discussed ways to address the desperate need of some of New Jersey's neediest school districts.

According to the reporting I've read, Senator Jennifer Beck (Red Bank Boro's and Freehold Boro's Senator) was the leading spirit in pushing for a fairer distribution of school aid.

Beck said when [SFRA] first passed, districts poised to lose aid were held harmless and allowed to keep funding that would have otherwise been lost. That aid, meant as a short-term concession, continues even though other districts remain cash-strapped.

Beck said 111 school districts are considered "over-adequacy" and still receive about $175 million in “hold harmless” aid. Her proposal aims to redistribute these dollars to the districts that need it.

Although it appears that the state will keep Adjustment Aid in overaided districts that are below Adequacy and thus leave over $300 million in excess aid untouched, even $175 million going to the neediest districts in New Jersey is a huge boost compared to what they have gotten in the last five years.

Commissioner of Education David Hespe indicated that this is something he was open to:

Once the formula stops running, districts that rely on the formula for increased enrollments or increases in the special populations funded in the formula, are treated unfairly... They cannot provide the quality education these other districts can without putting their local taxpayers into an almost impossible situation.”

However, not everyone at the meeting was sympathetic or willing to look at the statewide picture. Senator Paul Oroho (R, Sussex) talked about "fairness" for districts that had lost enrollment.

Also, if the Christie administration is open to redistribution, why is it waiting for legislation? The Christie Administration did not wait for legislation to create PARCC Readiness Aid, Student Growth Aid, Professional Community Aid, or, the worst, "Additional Adjustment Aid." The governor already has the de facto power to ignore SFRA and yet it has preserved the aid packages of overaided districts.

We need a new funding formula that would be significantly fairer and more accountable for those specific areas where you have declining enrollment.

Apparently the aid of under Adequacy/overaided districts will be left in place for the time being, but Jersey City, the poster child for a district that undertaxes so much that it is under Adequacy despite being overaided by $4,272 per student.

Something I was pleased to see is that Senator Beck gets it that some districts are above Adequacy just because they pay high taxes:

One complication is that the amount a district spends is based on both local school tax collections and state aid. Beck and other officials said they want to be careful not to penalize districts that use local taxes, rather than state monies, to fund their schools at close to or higher than the state recommendation.

“We want to make sure the changes we make don’t have unintended consequences,” Beck said. “There are some districts that are over adequacy, but it very well may be because their local property taxpayers chose to provide additional funding to the district, not that the state is giving them too much money.”

However, if the Sweeney/Beck legislation only takes Adjustment Aid away from districts who are above Adequacy than the amount of money that could possibly be redistributed is nowhere near the $550 million amount that the state distributes in Adjustment Aid. Beck herself gives a figure of $175 million.

The $175 million figure appears to come from the (partly erroneous) Education Law Center Policy Brief on Adjustment Aid, but the ELC was not saying that Adjustment Aid districts were $175 million above Adequacy. The ELC was saying that districts that were above Adequacy got $175 million in Adjustment Aid.

This is significant because many Adjustment Aid districts that are above Adequacy still undertax and therefore their "Adequacy Surplus" is less than their Adjustment Aid. For instance, even though Pemberton gets $32 million in Adjustment Aid, it is only above Adequacy by $14 million and many more over-Adequacy Adjustment Aid districts are like Pemberton.

It looks like this round of redistribution will skip Jersey City because Jersey City is under Adequacy (due to undertaxing), but Jersey City did come up and Sen. Sandra Cunningham makes a specious argument in favor of sustaining JC's aid.

The $175 million figure appears to come from the (partly erroneous) Education Law Center Policy Brief on Adjustment Aid, but the ELC was not saying that Adjustment Aid districts were $175 million above Adequacy. The ELC was saying that districts that were above Adequacy got $175 million in Adjustment Aid.

This is significant because many Adjustment Aid districts that are above Adequacy still undertax and therefore their "Adequacy Surplus" is less than their Adjustment Aid. For instance, even though Pemberton gets $32 million in Adjustment Aid, it is only above Adequacy by $14 million and many more over-Adequacy Adjustment Aid districts are like Pemberton.

It looks like this round of redistribution will skip Jersey City because Jersey City is under Adequacy (due to undertaxing), but Jersey City did come up and Sen. Sandra Cunningham makes a specious argument in favor of sustaining JC's aid.

[Beck] said the state also needs to account for towns that do not contribute enough in local property-tax revenues to the schools, but still receive adjustment aid. The poster child for that phenomenon is Jersey City, which is “slightly” under adequacy, according to commissioner of education David Hespe. The district receives $114.5 million in adjustment aid, in addition to other education aid, but contributes $224 million less in local taxes than it should according to the state’s “fair share” calculation, Beck said.

“Jersey City has had enrollment growth, but I think some of us would argue that they’re locally not doing what they’re supposed to do to help fund the cost of that enrollment growth -- which is counter to a lot of our other school districts, like Freehold Borough,” she said.

Jersey City is not contributing enough in part because of its frequent use of municipal tax abatements, which spur development but have the effect of shifting more of the burden for school funding to the state, Beck said.To the suggestion that Jersey City wasn't paying enough in local school taxes, Senator Sandra Cunningham shot back:

“When we think of Jersey City we think of the tall buildings, the glass buildings, the Citi Bike and all the other crazy things that you see when you hear Jersey City,” she said. “What you don’t see in Jersey City is … most of these minority children who are growing up in crime-ridden areas, they’re growing up in drug-ridden areas, they’re growing up in areas in which some of their schools have been there since Abraham Lincoln. Let’s keep in perspective where the people really are that are really using this money, and it’s not downtown.”

Senator Cunningham was against SFRA in the first place in 2008, even though she also represents Bayonne.

Ok, we all know that JC's student population isn't representative of JC's population at large, but this is irrelevant in discussing Jersey City's aid. There are parts of many towns, from Cherry Hill to West Orange, and even Summit which have very poor sections, but no one says that Cherry Hill, West Orange, and Summit should get massive amounts of aid. The common sense reason for this is because it's the overall financial picture which matters.

Here we go again.

So, Jersey City's student population is 70% FRL eligible, but it's a proportionally small population. Jersey City only has 34,000 students compared to an overall population of ~275,000. Jersey City's population is almost the same size as Newark's now, but Newark has almost 20,000 more kids. Jersey City has 120,000 more people than Paterson, but Jersey City only has about 6,000 more students and since Paterson's FRL-eligibility is higher, Paterson actually has more FRL-eligible kids.

More importantly, Jersey City's Equalized Valuation is $21.3 billion, which, combined with Jersey City's Aggregate Income, comes to $330 million in Local Fair Share. JC's tax base would be at least $9 billion larger if its PILOTed property were included. Divide that Local Fair Share by the number of students in Jersey City and you get $10,196 per student; an amount which is slightly below NJ's median, but above districts like Bloomfield ($9,366 per student) and almost double higher than what some poor non-Abbotts like Dover ($5,576) and Manchester Regional ($5,226) have.

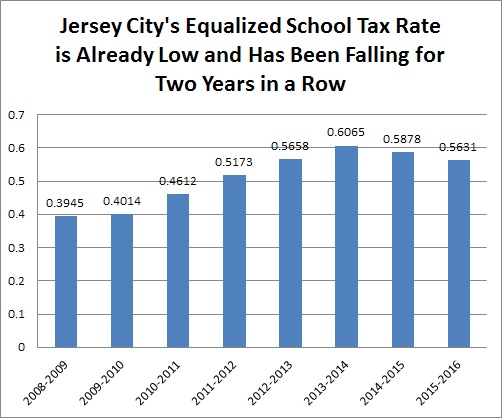

In fact, Jersey City's Equalized Valuation is increasing so rapidly that its Effective (aka "Equalized") Tax Rate is dropping:

So Sandra Cunningham's resistance to doing anything that would raise Jersey City's taxes is indefensible.

Sometimes I feel like I write too much about Jersey City on this blog, but its emblematic of the problems of school finance in New Jersey and if the legislature and Christie refuse to redistribute aid out of Jersey City the amount of aid to be transferred is going to be limited.

Again, I'm encouraged by what I've read of the Senate Budget Committee hearing, even though I worry about that the amount to be redistributed will be very limited. Anyway, I look forward to the Assembly hearing which will take place on Wednesday, April 20th.

No comments:

Post a Comment