One of the most contentious financial battles in New Jersey public education is between the three constituent towns of Manchester Regional High School - North Haledon, Haledon, and Prospect Park - over how to pay for Manchester Regional High School.

If you aren't familiar with this long-running case, the background is that Haledon and Prospect Park are relatively poor towns (DFG B) bordering Paterson's high-poverty North Side. North Haledon (DFG FG) is better off.

All three towns have their own K-8 districts with 700-1,000 students each, but share Manchester Regional High School. For twenty years, North Haledon has wanted to leave the regional district or change the funding formula to a per pupil calculation, saying that it is being unfairly asked to subsidize children from the two other towns.

This case is in the news again because in 2013 the funding formula was changed from being a 67%/33% Equalized Valuation/per pupil split to a 50% Equalized Valuation/50% pupil enrollment split and Prospect Park and Haledon are saying (with much merit) that they are taxed beyond their limit.

Prospect Park and Haledon are now seeking to change the formula again to weigh Equalized Valuation more heavily than enrollment so North Haledon pays a higher percentage of Manchester Regional's costs again.

As Prospect Park's mayor, Mohamed T. Khairullah, states:

"We are hoping that someone uses common sense and realizes you can’t squeeze water out of a rock. Our residents are not as financially able to fund the Manchester Regional High School as North Haledon residents are. The Commissioner of Education ignores that fact and continues to apply financial pressure on our community. We are at the point where we feel we should go back to the Supreme Court and ask them for better clarification that we think will benefit our community."

The fiscal background of this case that is never adequately reported is that

Manchester Regional is New Jersey's MOST underaided district. According to SFRA, Manchester Regional should be getting $17,474 per student, but in actuality it only gets $6,770 per student. Manchester Regional's aid per student deficit is

$10,704, an amount greater than any other district's, including Freehold Boro's.

(Prospect Park and Haledon are also severely underaided for their K-8 systems)

The aid deficits are so enormous because

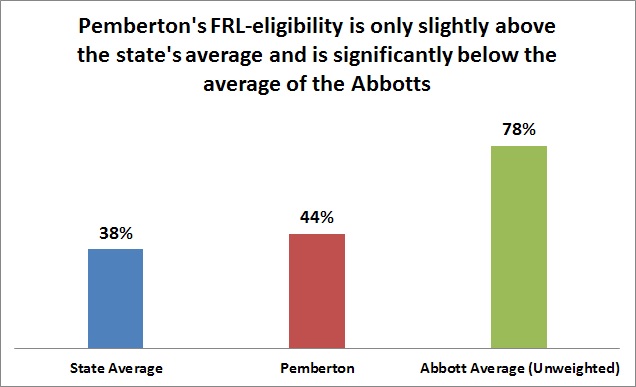

Haledon, Prospect Park, and Manchester Regional are peers of the Abbotts, both economically and demographically, and therefore SFRA thus sets very high aid targets for them. Prospect Park, in particular, is exceptionally poor and its lack of adequate aid should be statewide shame.

For its K-8 district, Prospct Park has only $3,747 in Local Fair Share per student, the

13th lowest tax base in New Jersey and actually inferior to what Newark, Elizabeth, New Brunswick, Millville and many other Abbotts possess. Prospect Park is also 85% FRL-eligible, the 22nd highest percentage in New Jersey. Prospect Park FRL-eligibility rate is equal to Elizabeth's, Perth Amboy's, Pleasantville's, and Orange's. It is higher than Harrison's, Long Branch's, East Orange's, Keansburg's, Jersey City's, Vineland's, and Hoboken's.

Prospect Park also has very few homeowners. Of 5,700 residents, only

1,200 are direct taxpayers. In the 2010 census, 16% of Prospect Park residents were on food stamps. A third of Prospect Park's land is actually a quarry.

For its K-8 district, Haledon only has $5,846 in Local Fair Share per student, the 43rd lowest in New Jersey. Haledon's LFS per student is lower than several Abbotts, including Jersey City, Long Branch, Neptune Township, Vineland, and (of course), Hoboken. Haledon is 72% FRL-eligible, again, a higher figure than several Abbotts, including Jersey City, Pemberton, Hoboken, Garfield, Vineland, Phillipsburg, and Hoboken.

Manchester Regional High School itself is 77% FRL-eligible, which is only one point below the Abbott average. Manchester Regional has $6,091 in Local Fair Share per student, which is below the (unweighted) Abbott average of $6,955 per student.

North Haledon Fights to Change Apportionment or Leave the Regional District

When Manchester Regional was formed in 1957 the tax apportionment was on a strict per pupil basis, so that each town paid for Manchester Regional in proportion to how many students it sent there.

However, in 1975 the state legislature unilaterally changed the rules for tax apportionment in regional districts when it required that apportionment had to be solely by Equalized Valuation, regardless of what apportionment plans regional districts had already established.

The consequence of this is that as the wealthiest town, North Haledon eventually had to pay for a share of Manchester Regional's costs that was disproportionate to the percentage of North Haledon kids at Manchester Regional High School. This disproportionality created mass resentment in North Haledon and North Haledon voters began to repeatedly reject budgets for Manchester Regional.

In 1993 the legislature reversed itself on tax apportionment in regional districts and said that regional districts could divide taxes by any basis they wished, but any change needed an affirmative vote from every member of a regional district to go into effect.

North Haledon organized a referendum on changing the cost apportionment in 1995, but, predictably, Haledon and Prospect Park rejected a change. Thus, North Haledon began a campaign to leave Manchester Regional completely. As its mayor said, "We should be paying to educate our children, no other town."

By the early 2000s North Haledon students were only 25% of the students at Manchester Regional HS, but North Haledon paid for 43.8% of the costs of the high school. North Haledon's costs at the time were $18,400 per pupil, compared to per-pupil costs of $5,300 for Haledon and $3,400 for Prospect Park.

(43.8% is much lower than North Haledon's share of the total Equalized Valuation of the three towns. We will learn why there is a gap momentarily.)

In 2002, North Haledon voted to leave Manchester Regional, hoping to send its children to Midland Park.

Haledon, Prospect Park, and the Manchester Regional School Board opposed North Haledon's departure and the case went all the way to the NJ Supreme Court. In 2004 Chief Justice Deborah Poritz of the NJ Supreme Court cited the "constitutional imperative to prevent segregation in our public schools" and declared that North Haledon could not leave Manchester Regional because doing so would have a "racially disparate impact." However, Poritz said that the tax formula for Manchester Regional could be changed.

Poritz did not order any additional state aid to Manchester Regional, thus any reduction in tax money from North Haledon had to be made up for by Haledon and Prospect Park.

North Haledon's High School Dropoff and its Financial Consequences

Something else that must be underscored is that North Haledon did not pay taxes to Manchester Regional purely on the basis of its Equalized Valuation even before the mid-2000s apportionment reform.

It is little known, but when there is a regional district that only educates kids in some grades (like MRHS only being a 9-12 district), that regional district must share its tax base with other school districts that educate kids from the same towns

in proportion to the percentage of students from that town are in the regional district.

If 70% of a town's public school children attend the local K-8 district and 30% attend the regional 9-12 district, then the two districts split the tax base 70:30.

If 80% of a town's public school children attend the K-8 district and 20% attend the regional 9-12 district, then the tax base is split 80:20.

North Haledon only has 11% of its students at Manchester Regional High School. (there are 87 North Haledon kids at MR, but 718 kids in the K-8 North Haledon Public Schools), so

only 11% of North Haledon's tax base can be taxed by Manchester Regional whereas Prospect Park and Haledon have 28-29% of their students at Manchester Regional and therefore 28-29% of their tax bases can be taxed by Manchester Regional.

This means that even though North Haledon has 61.9% of the valuation of the three towns, even before any per pupil adjustments are made, only 38.2% of Manchester Regional's tax base comes from North Haledon.

| Total Equalized Valuation (2014-15) | Public School Student Population 9-12 | Public School Population 9-12 (at MRHS) | Percentage of Students in 9-12 | Equalized Valuation Available to MRHS |

| Haledon | $538,293,732 (25.6%) | 1,004 | 394 | 28.2% | $151,691,174 (42.2%) |

| North Haledon | $1,300,741,578 (61.9%) | 718 | 87 | 10.8% | $140,610,165 (38.2%) |

| Prospect Park | $263,383,295 (12.5%) | 832 | 339 | 28.9% | $76,249,464 (20.7%)

|

The root cause of this disparity in available Equalized Valuation is that there is a large dropoff in public school enrollment for high school-aged North Haledon students. The average grade in K-8 in the North Haledon School District has 80 kids (718 / 9 ~ 80), but there are only 20 North Haledon kids per grade at Manchester Regional (87 / 4 20) Meaning, the large majority of North Haledon students who attended North Haledon Public Schools K-8 go to private school or homeschool for 9-12.

Whereas in the early 2000s 25% of Manchester Regional's students were from North Haledon, now barely 9% come from North Haledon (87 out of 958).

In the early 2000s, 51% of Manchester Regional students were white. North Haledon was prevented from leaving because if it had left Manchester Regional would have become only 38% white.

Now only 21% of Manchester Regional students are white.

Chief Justice Deborah Poritz had said that North Haledon could not leave Manchester Regional because it would upset the demographic balance there, but the demographic balance has been upset anyway because a large majority of North Haledon students decide not to attend Manchester Regional, plus modest, population growth in Prospect Park and Haledon and the addition of over 100 students through Interdistrict Choice.

The New Per Pupil Adjustments: Who's Paying a Disproportionate Share?

While North Haledon could not withdraw from Manchester Regional, it did win a change in the tax apportionment formula.

The mid-2000s formula was a compromise where the tax apportionment would be based 67% on Equalized Valuation and 33% on student enrollment. In 2013 the formula was again changed to one that was 50:50.

This means that half of Manchester Regional's tax levy would be divided based on

available Equalized Valuation ("available" meaning, the Equalized Valuation left over after money is reserved for the town's elementary school population) The other half of the tax levy is divided on a per pupil basis.

So in 2015-16 Manchester Regional had a

$10.7 million tax levy.

- Half of the levy, $5.35 million, was divided by Equalized Valuation, so 41% from Haledon, 38% from North Haledon, and 21% from Prospect Park.

- The other half of the levy, $5.35 million, was divided on a per pupil basis, so 48% from Haledon, 11% from North Haledon, and 41% from Prospect Park.

The final apportionment is thus:

- $4,773,638

from Haledon. (44%)

- $2,609,327

from North Haledon. (24%)

- $3,319,347

from Prospect Park. (31%)

The consequence of this arrangement is that North Haledon still pays much more per pupil than Prospect Park and Haledon.

But North Haledon's Equalized Tax rate for Manchester Regional is much lower than Prospect Park's and Haledon's.

Due to the 2013 apportionment change and North Haledon's shrinking contingent at Manchester Regional High School, the amount of taxes North Haledon pays for Manchester Regional is dropping and the costs are being made up by Prospect Park and Haledon.

The timing of the apportionment change is horrible for Haledon and Prospect Park because 2013 marked the year state aid froze and therefore they have gotten no new aid despite exceptional need.

New Jersey's Highest School Taxes

When the apportionment was further changed in North Haledon's favor in 2013 Manchester Regional's overall tax levy stayed the same, even though its wealthiest component town could now withdraw a large portion of its tax support.

North Haledon withdrawl of taxes, combined with the worst underaiding in New Jersey, combined with an attempt by Manchester Regional to tax its citizens to prevent education being cut to the bone, means that Manchester Regional's school taxes are

the highest in New Jersey in terms of Local Fair Share. (in terms of all-in Equalized Tax rate Prospect Park and Haledon's taxes are among the worst, but not the absolute highest.)

| County | Previous Year Tax Levy | Local Fair Share | Tax Levy as percentage of Local Fair Share |

| MANCHESTER REGIONAL | PASSAIC | $10,345,405 | 5,835,285 | 177.29% |

| MILFORD BORO | HUNTERDON | $1,783,737 | 1,088,988 | 163.80% |

| WOODLYNNE BORO | CAMDEN | $2,116,037 | 1,365,093 | 155.01% |

| WINFIELD TWP | UNION | $1,526,912 | 1,002,427 | 152.32% |

| LINDEN CITY | UNION | $84,115,176 | 59,855,353 | 140.53% |

What deepens the crisis for Prospect Park and Haledon is that they also have severely underaided K-8 systems to sustain.

Haledon is New Jersey's tenth most underaided district. Haledon should be getting $12,514 per student, but in reality it only gets $6,660 per student, a $5,854 per student deficit. Prospect Park is New Jersey's 13th most underaided district. Prospect Park is NJ's 13th most underaided district. It should be getting $14,587 per student, while in reality it gets $8,986 per student, a $5,601 per student deficit.

Prospect Park and Haledon, who are demographically and economically Abbotts, have no choice but to

pay taxes 3-4 times higher what the Abbotts pay and much higher than what affluent districts pay.

|

| (For 2015-16 Prospect Park and Haledon would have even higher taxes.) |

For 2014-15 Prospect Park taxpayers alone got hit by a $414 tax increase for Manchester Regional and another $270 a year for 2015-16.

A District Divided and Alone

The mayors of Prospect Park, Haledon, and North Haledon are all well aware that their districts should receive additional aid.

In April, Mayor Mohamed Khairullah organized

a bus trip from Prospect Park to Trenton to demand more money Manchester Regional's schools.

Mayor Khairullah said "The community is hurting tremendously, and that's why people are willing to take the time off from work and away from their families to come down to Trenton."

Mayor

Randy George of North Haledon has said "It's the State of New Jersey who is supposed to subsidize [poor] schools, not the neighboring town. I believe we are sending less than 15 percent of the students and still paying 30-some-odd percent of the budget. That's double of what I believe we should pay."

Chris Christie has doesn't give a sh*t about Manchester Regional or anything other than himself, but what is shocking even to me is that Manchester Regional hasn't attracted any allies or media attention.

If Manchester Regional were in fiscal crisis because of charter schools it would have legions of allies including the NJEA and Education Law Center, but since Manchester Regional is just New Jersey's most underaided district and there are no charter school villains, it has no one on its side. The fact that Manchester Regional pays

$844,022 to Passaic County Technical Institute for 305 students does not seem to raise anyone's ire.

Manchester Regional is so small that it lacks the political power of

Paterson, which got the legislature to try to give it over $19 million, even though Paterson is not remotely as underaided as Manchester Regional.

Unfortunately again, Manchester Regional is divided against itself in its battle over its own tax apportionment and therefore it cannot effectively get out the message that it is unbelieveably underaided.

Also disappointing is the fact that Manchester Regional

is New Jersey's MOST underaided district is not emphasized by the three towns' elected officials. This fact may not even be known to the elected officials since

uncapped SFRA aid figures are not widely disseminated by the Department of Education. The fact that Manchester Regional is New Jersey's most overtaxed district is just as unknown, since

Local Fair Share is also a virtual secret.

The sum of this all is that Prospect Park and Haledon pay taxes that they cannot afford and their communities are suffering severely. North Haledon cannot really be blamed for not wanting to pay taxes for Manchester Regional any more than any other well-off town can be blamed for not wanting to support poorer neighbors. It's not like Bridgewater-Raritan has to send money to Bound Brook, Franklin Lakes has to send money to Fairview, or Millburn has to send money to Belleville, even though Bridgewater-Raritan, Franklin Lakes, and Millburn are all much wealthier than North Haledon and Bound Brook, Fairview, and Belleville are all very needy.

Amidst all of this it needs to be noted that despite being thousands of dollars per student below Adequacy, Manchester Regional exceeds its demographic peers, who are all higher-funded Abbotts or Jersey Shore districts. Manchester Regional, despite its very low spending, is at the

87th percentile among its peers and is yet another example of the weakness of the Abbott premise of high spending having transformative powers in education.

Prospect Park and Haledon have valid grievances, but so does North Haledon. I am neutral on the Manchester Regional tax apportionment battle, but I wish it would end so that these three communities would focus their anger at Trenton for abandoning them and criticize aid hoarding districts for lording it over them in Adjustment Aid privilege while they and other poor non-Abbotts are taxed into decline.

----

See the 2013

Commissioner of Education decision on Manchester Regional for more information.