The theory is one of the most bipartisan ideas in the state, with people from even the extremes of both parties believing that government fragmentation is a major cause of our high taxes.

For instance, Republicans Kip Bateman and Joseph Kyrillos believe it.

New Jersey has more than 600 school districts to educate 1.37 million public school students, which leaves the average district with fewer than 2,400 students.

State Senators Christopher "Kip" Bateman and Joe Kyrillos sponsored the task force legislation to study consolidation and its potential benefits.

"We have to begin working in earnest to create a more efficient and sustainable school system and regionalization and consolidation of services needs to be a part of that discussion," Bateman wrote in a statement.

The senator – who represents portions of Somerset, Hunterdon, Middlesex and Mercer counties – said regionalization has a potential to "enhance educational opportunities, streamline services and address a leading contributor to New Jersey's highest-in-the-nation property taxes."

Supporters of consolidation say fewer school districts would mean less duplication of services and fewer administrators with six-figure salaries, pensions and benefits.Independents like former Long Hill mayor and independent gubernatorial candidate Gina Genovese believe it:

Of New Jersey's hundreds of school districts, more than 100 contain only one school, said Kyrillos, who represents portions of Monmouth County.

"There is clearly an opportunity to achieve efficiencies," he said in the statement.

Pundits, stakeholders, special interests and too many elected officials scoff at the idea of reducing the number of municipalities, school and fire districts. But how else will we be able to reduce expenses and drastically improve services? New Jersey has too much redundant government. Period.

If we do not make drastic changes to reduce the state’s nearly 600 school districts and 565 separate towns, then we will have to work even more days and weeks to keep up with our ever-increasing property tax bills....

So it is logical to ask, how does New Jersey deliver local services differently than the other 49 states? We are the only state in the nation to have hundreds of fractured school districts. Every other state has unified its K-12 school districts under one administrationAnd liberals believe it. Here's Jim Johnson making consolidation one of the key planks of his property tax plan (technically only speaking of municipalities):

Seek Municipal Consolidation and Shared Services Agreements. New Jersey has 565 municipalities, with many duplicative elected officials and departments. Shared services agreements can help municipalities save money by using their combined purchasing power to negotiate lower prices, resulting in taxpayer savings.The assertion itself that larger localities are significant more efficient seems unproven to me, but what's really annoying is that these politicians are wrong in the premise itself of their claim.

Yes, New Jersey has 590 school districts and that sounds like a lot. Yes, we have the country's highest property taxes too. Those facts are actually almost totally unreleated, but the human mind is evolutionarily programmed to see patterns, and so "lots of school districts > high taxes" is an irresistible conclusion.

FALSE PATTERN ALERT!!!

Yes, this claim is factually wrong in a critical respect.

In terms of school districts (or municipalities) per capita or in per student terms, we are average.

| State | # of Districts | # of Public School Students | Students Per District |

| Vermont | 286 | 76,102 | 266 |

| Montana | 410 | 144,122 | 352 |

| North Dakota | 177 | 101,408 | 573 |

| South Dakota | 151 | 127,772 | 846 |

| Connecticut | 196 | 531,923 | 928 |

| Missouri | 557 | 533,473 | 958 |

| New Hampshire | 161 | 183,981 | 1,143 |

| Nebraska | 245 | 312,281 | 1,275 |

| Oklahoma | 516 | 688,300 | 1,334 |

| Iowa | 337 | 506,336 | 1,502 |

| Georgia | 201 | 312,281 | 1,554 |

| Ohio, districts | 1,116 | 1,842,822 | 1,651 |

| Minnesota | 519 | 857,039 | 1,651 |

| Arizona | 627 | 1,068,192 | 1,704 |

| Kansas | 286 | 490,291 | 1,714 |

| Michigan | 841 | 1,499,041 | 1,782 |

| Arkansas | 254 | 475,778 | 1,873 |

| Washington, DC | 41 | 76,829 | 1,874 |

| Wyoming | 48 | 93,303 | 1,944 |

| Wisconsin | 424 | 873,767 | 2,061 |

| Idaho | 137 | 303,148 | 2,213 |

| NEW JERSEY | 590 | 1,347,166 | 2,283 |

| Alaska | 54 | 127,001 | 2,352 |

| Massachusetts | 405 | 955,844 | 2,360 |

| Illinois | 865 | 2,067,564 | 2,390 |

| Indiana | 402 | 1,028,654 | 2,559 |

| Rhode Island | 49 | 127,503 | 2,602 |

| Oregon | 196 | 538,634 | 2,748 |

| Colorado | 178 | 567,383 | 3,188 |

| Mississippi | 151 | 492,279 | 3,260 |

| Pennsylvania | 499 | 1,711,467 | 3,430 |

| Washington | 299 | 1,074,057 | 3,592 |

| Delaware | 37 | 134,074 | 3,624 |

| New York | 695 | 2,538,915 | 3,653 |

| New Mexico | 89 | 333,810 | 3,751 |

| Kentucky | 173 | 685,176 | 3,961 |

| Utah | 141 | 622,153 | 4,412 |

| California | 1,028 | 5,215,342 | 5,073 |

| West Virginia | 55 | 279,899 | 5,089 |

| Texas | 1,219 | 6,230,033 | 5,111 |

| Louisiana | 136 | 723,805 | 5,322 |

| Alabama | 136 | 733,089 | 5,390 |

| Tennessee | 141 | 971,803 | 6,892 |

| South Carolina | 86 | 756,866 | 8,801 |

| Maine | 198 | 1,744,240 | 8,809 |

| Virginia | 132 | 1,279,546 | 9,694 |

| North Carolina | 115 | 1,446,230 | 12,576 |

| Nevada | 17 | 496,480 | 29,205 |

| Maryland | 24 | 874,514 | 36,438 |

| Florida | 67 | 2,721,459 | 40,619 |

| Hawaii | 1 | 178,246 | 178,246 |

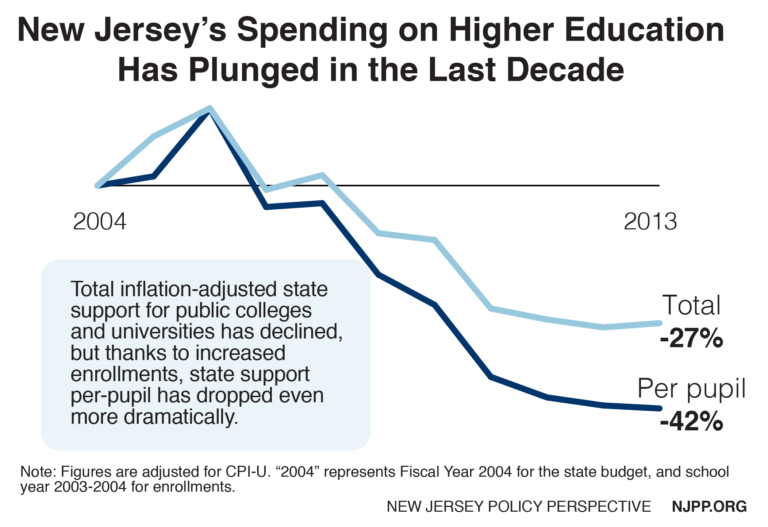

It's possible that New Jersey's taxes would be slightly lower if we had fewer districts since we could have slightly fewer superintendents, but what really drives New Jersey's sky-high property taxes is public employee salaries and the number of non-administrative public employees. To look at our education spending alone, New Jersey has the country's third lowest student:teacher ratio, has the country's fifth highest paid teachers, and, on top of that, has a state aid distribution which is exceptionally focused (compared to other states) on the poorest districts rather than broad-based tax relief.

According to the National Education Association's own 2016 Ranking & Estimates, the average New Jersey teacher makes $68,238, not counting pensions and other benefits, the fifth highest in the US, right behind New York, Massachusetts, California, and Connecticut and right ahead of Alaska, Maryland, and Rhode Island. Even when you account for differences in local costs, New Jersey teachers only drop into 7th place.

What puts New Jersey's school spending and taxes above its peers in high salaries is how many more teachers we have.

The national average for student:teacher ratio is 15.8:1, but NJ's ratio is the third lowest, at 11.9:1, after Vermont and New Hampshire.

What puts New Jersey's school spending and taxes above its peers in high salaries is how many more teachers we have.

The national average for student:teacher ratio is 15.8:1, but NJ's ratio is the third lowest, at 11.9:1, after Vermont and New Hampshire.

The four states who have higher teacher salaries than New Jersey have fewer teachers. New York has a 12.7:1 student:teacher ratio, Massachusetts has a 13.3:1 ratio, California as a 22.5:1 student:teacher ratio (!!!), and Connecticut has a 13.1:1 student teacher ratio. The states just behind New Jersey in teacher salaries are farther behind in student:teacher ratios. Rhode Island is 13:1, Maryland is 14.6:1. Alaska is 16.4:1.

Perhaps if New Jersey had fewer school districts we could have fewer teachers, fewer tutors, fewer custodians too, although if that theory were honestly believed, it's really a very stealthy way of seeking larger class size, less support, and dirtier schools?

Anyway, if I were a politician I'd probably pay some lip service to municipal and school district consolidation too, but honestly, New Jersey's sky-high property taxes have less to do with municipal fragmentation and much more to do with high staff salaries, lots of staff to get those salaries, and a very narrowly focused, Abbott-dominated distribution of school aid.

Additional factors in our extreme tax burden are low levels of federal support and having the country's highest percentage of special-needs student in Out of District placement.

Might consolidation save a few bucks by producing more administrative efficiency? Perhaps it would. But a serious strategy to reduce New Jersey's extreme property taxes would have to focus on the extremely high cost of government itself and secondly our narrow state aid distribution.

---

The invaluable study on the fact that New Jersey actually doesn't have that many local units and that there is no correlation between municipal size and per resident spending is the Rutgers study "Size May Not Be the Issue: An Analysis of the Cost of Local Government and Municipal Size in New Jersey."

Anyway, if I were a politician I'd probably pay some lip service to municipal and school district consolidation too, but honestly, New Jersey's sky-high property taxes have less to do with municipal fragmentation and much more to do with high staff salaries, lots of staff to get those salaries, and a very narrowly focused, Abbott-dominated distribution of school aid.

Additional factors in our extreme tax burden are low levels of federal support and having the country's highest percentage of special-needs student in Out of District placement.

Might consolidation save a few bucks by producing more administrative efficiency? Perhaps it would. But a serious strategy to reduce New Jersey's extreme property taxes would have to focus on the extremely high cost of government itself and secondly our narrow state aid distribution.

---

The invaluable study on the fact that New Jersey actually doesn't have that many local units and that there is no correlation between municipal size and per resident spending is the Rutgers study "Size May Not Be the Issue: An Analysis of the Cost of Local Government and Municipal Size in New Jersey."