I was reading old articles and op-eds about state aid, Abbott, and SFRA written back in the late Corzine era (2007-2009) and found a piece by Paul Mulshine - "Corzine v. the Courts" - where he correctly understood how SFRA was not a reform of Abbott per se so much as an Abbottization of all working class and poor districts in New Jersey:

At issue is the governor's new plan for education funding. The Democrats seem determined to jam that bill through in the final session of the lame-duck Legislature tomorrow. Whether they will succeed is an open question. But if they do, Corzine will be on a colli sion course with the court.

The fight will be over court decisions in school-funding cases going back to 1976, when the income tax was implemented to equalize school funding. The court wasn't satisfied by the new tax, however, and kept taking more power over the schools. By the time Corzine took office two years ago, more than half of the state's school aid had been confiscated by the court for the 31 so-called "Abbott" districts, which are largely urban and deemed by the court to be in need of special aid. That made it impossible for Corzine to get any substantial property tax relief to the remaining 580 districts, which are mostly suburban.

Corzine has come up with a novel solution. If the court wants Abbott districts, he'll give them Abbott districts. His new school funding plan has the effect of creating more than 100 new districts that will be virtually indistinguishable from the court-created districts. These new districts would all get free state-funded preschools just as the court had ordered for the Abbott districts in its 1998 decision. They would also get lots more state aid under a new formula.

The big disadvantage to the plan is the obvious one: It would require half a billion dollars in new revenue, and the state's broke. But no one in Trenton talks about that, so there's no point in discussing it here.

Instead, the people in Trenton fight over the imaginary money.

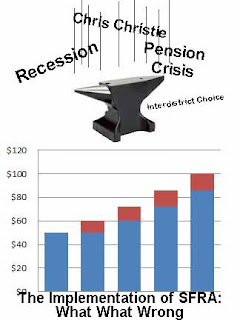

Yep. That's pretty much it, but the real (ie, uncapped and with PreK) full funding of SFRA back in 2008-09 would have cost A LOT more than a half a billion. According to information I received via an OPRA request, the deficit for 2008-09 for K-12 alone was $1 billion. (see "SFRA Was Never Fully Funded")

Nowadays full funding of SFRA with Pre-K and with the preservation of Adjustment Aid (which, benightedly, is in SFRA) would cost $2.7 billion.

Mulshine doesn't get into the details of how SFRA represents a geographic expansion of Abbott more than a form of Abbott, but if you look at the details of how SFRA calculates an Adequacy Budget, the per student premium is as much as $10,000 per student in districts with concentrated poverty:

Using the weights that are in effect for 2016-17, this is how SFRA calculates an Adequacy Budget:

- The Adequacy Budget is $11,009 per student for non-at-risk, elementary schoolers.

- It is $12,770 for non-at-risk high schoolers.

- It is $16,183 per student for FRL-eligible elementary schoolers.

- It is $17,284 for FRL-eligible high schoolers at low FRL-eligible schools.

- It is $20,222 per student for FRL-eligible high schoolers who attend schools that are 60% or more FRL eligible.

- It is $22,750 per student for FRL-eligible, LEP high schoolers who attend schools that are 60% or more FRL eligible.

However, in addition to these moneys for Equalization Aid, all districts receive Special Education Aid, Security Aid, and Transportation Aid as well. The three categorical aids are weighted toward poor districts, so high-FRL districts (like the Abbotts) would get about another $1,000 per student from them. At the time SFRA was passed the Abbotts were over-funded compared to what SFRA recommended, so originally Adjustment Aid was more Abbott focused than it is now.

The only thing the Abbotts lost in SFRA was the right to receive off-formula "Supplemental Aid." The Supplemental Aid process was always unpredictable for the state, exacerbated inequalities, and heavily tied up in litigation, so the elimination of Supplemental Aid is the one achieved "reform" of Abbott.

Mulshine also has a fascinating history of the Assembly hearing on SFRA, in which Abbott reactionaries like (former) Justice Gary Stein and Richard Shapiro attacked SFRA.

Before the hearing the legislators received a three-page memo from Gary Stein, a former justice of the Supreme Court, warning that "a vote in favor of the bill is, in reality, an invitation to a series of lawsuits that will embroil the state and the advocates for the groups that oppose the bill in contentious litigation that will last for many years."

Aren't judges supposed to stay out of politics? Not in Jersey. Here they rule both from the bench and from retirement.

The Democrats had a competing memo of their own. It was from state Attorney General Anne Mil gram, and it stated that the bill is in fact constitutional. So the stage was set for a fight.

The Democrats didn't disappoint. The fight came over the issue of "local fair share," a euphemism for property tax hikes. The state plans to limit many Abbott districts to a mere 2 percent hike in aid next year. If they want to spend more money, they'll have to raise it the same way the non-Abbotts have to raise it -- through property taxes.

Lawyer Richard Shapiro, an advocate for several Abbotts, argued that the bill is unconstitutional be cause "the Abbott districts do not have the capacity to tax." At that point Assemblyman Joe Malone, a Republican from Bordentown, pointed out that the towns in his district have to pay both for their schools through the property tax and Abbott schools through the in come tax.

"How much money is enough?" Malone demanded. "I don't think any amount of money is enough to satisfy certain groups."

Committee chairman Lou Greenwald took Malone's side against Shapiro and the other Abbott advocates who followed.

"Cherry Hill has been flat- funded for over a decade and they have had to raise their property taxes," said Greenwald, a Democrat from Camden County. He went on to cite several other towns in his district. "When those school districts were flat-funded, how did they do it? They don't have the capacity to tax either."

Joe Cryan jumped in, eager as always for a fight.

"The court doesn't run for election," said Assemblyman Cryan, who is also the state Democratic chairman. "And let me tell you, man, all I hear about is property taxes. The idea that the court develops and manages taxation policy just is mind-boggling."

By the time the shouting died down, it was clear that this was a historic moment. For the first time ever, the state's leading Democratic politicians were lined up against the seven justices on the question of school funding.

So if that bill passes tomorrow we may see a historic fight. We should have had it three decades ago, but better late than never.

|

| Source: Pew Fiscal Fifty |

See Also:

No comments:

Post a Comment