As Wilentz wrote:

1. Municipal Overburden “Municipal overburden” is the excessive tax levy some municipalities must impose to meet governmental needs other than education. It is a common characteristic in poorer urban districts, a product of their relatively low property values against which the local tax is assessed and their high level of governmental need. The governmental need includes the entire range of goods and services made available to citizens: police and fire protection, road maintenance, social services, water, sewer, garbage disposal, and similar services. Although the condition is not precisely defined, it is usually thought of as a tax rate well above the average.

The underlying causes of municipal overburden are many and complex. Its consequences in this case, however, are clear and simple. The poorer urban school districts, sharing the same tax base with the municipality, suffer from severe municipal overburden; they are extremely reluctant to increase taxes for school purposes. Not only is their local tax levy well above average, so is their school tax rate. The oppressiveness of the tax burden on their citizens by itself would be sufficient to give them pause before raising taxes. Additionally, the rates in some cases are so high that further taxation may actually decrease tax revenues by diminishing total property values, either directly because of the tax-value relationship, or indirectly by causing business and industry to relocate to another municipality.

Indeed, there is much truth to what Wilentz said of the Abbotts and excessive taxes.

In FY1990, the average NJ property owner paid an all-in 2.041 tax rate, but the average Abbott property owner would have paid 2.918, a significantly higher figure. A reasonable person could conclude that most (NOT ALL) of the Abbotts required significantly more state aid than they were then receiving.

Looking at the high (superficial) average, the high Abbott tax rate would seem to justify Wilentz' dictates, but the overall 2.918 Abbott average masks great diversity and completely omits any consideration of the many high-tax non-Abbotts who were left behind.

The problem with the New Jersey Supreme Court's decision in Abbott isn't the idea that poor districts needed more state aid to avoid municipal overburden, it's what districts the NJ Supreme Court designated as having those special needs.

Instead of using a data-based method to determine what districts had the highest taxes and should be the ones to get that extra aid, the NJ Supreme Court unilaterally decided that districts who were both in DFG A or B and classified as "urban" by the Department of Community Affairs had a claim to the money that poor or poorer non-urban districts didn't have.

A number of the Abbott districts indeed suffered from municipal overburden, but not all of them did and there were a great many non-Abbotts that also had acute municipal overburden who were completely left out of the Abbott decision.

(I got the historical tax data from the Dept of Treasury. I've put it up on my Historical State Aid Data Spreadsheet.)

Instead of using a data-based method to determine what districts had the highest taxes and should be the ones to get that extra aid, the NJ Supreme Court unilaterally decided that districts who were both in DFG A or B and classified as "urban" by the Department of Community Affairs had a claim to the money that poor or poorer non-urban districts didn't have.

A number of the Abbott districts indeed suffered from municipal overburden, but not all of them did and there were a great many non-Abbotts that also had acute municipal overburden who were completely left out of the Abbott decision.

(I got the historical tax data from the Dept of Treasury. I've put it up on my Historical State Aid Data Spreadsheet.)

In terms of taxes, the creation of the Abbott list had more mistakes of exclusion than inclusion.

Most of the Abbotts did indeed have high taxes; but most of NJ's highest tax districts were not Abbotts.

Hence, if you actually look at the 50 towns in NJ with the highest tax rates, only 15 were Abbottized in 1990. (Salem City was not Abbottized until 2004)

|

| Click to Enlarge |

However, punishing taxes also existed in other low-DFG districts. 20 of the non-Abbott districts who were also among the 50 highest taxed towns were in DFG A or B: Salem City (then DFG A), Penn's Grove (DFG A), Pine Hill (DFG B), Woodlynne (DFG B), Commercial Township (DFG A), Lawnside (DFG B), Clemonton (DFG B), Lawrence Township (DFG A), Chesilhurst (DFG A), Egg Harbor City (DFG A), Clayton (DFG B), Bellmawr (DFG B), Brooklawn (DFG B), Maurice River (DFG A), Fairfield Township (DFG A), Paulsboro (DFG A), Lakehurst (DFG A) Elk (DFG B), National Park (DFG A), and Greenwich (DFG B). (these are 1980s DFG classifications)

Of the future Abbotts, you would not be able to say that Garfield, Burlington, Harrison, Perth Amboy, Neptune Township, Phillipsburg, and Hoboken had any kind of real municipal overburden. (And Hoboken also already outspent Millburn in 1989-90.)

|

| Click to Enlarge |

Today the immensity of state aid for the Abbotts has reduced their school taxes significantly and taken many Abbotts out of the realm of acute municipal overburden.

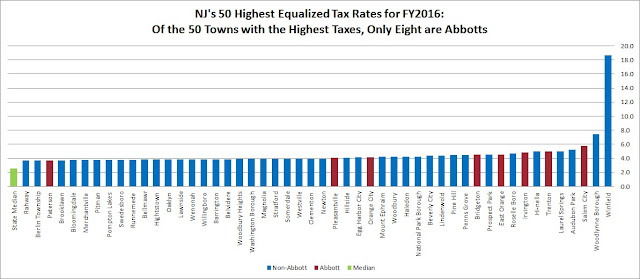

In 1990, fifteen of the 50 worst-taxed towns in NJ were Abbotts. In 2016 only eight are.

|

| Click to Enlarge: Source: http://www.state.nj.us/dca/divisions/dlgs/resources/property_tax.html#1 |

In terms of school taxes alone, even fewer Abbotts were among the 50 highest taxed districts.

The Abbott decision was wrongheaded for multiple theoretical reasons. Abbott was wrongheaded for its insistence that money was the dominant factor in academic success, for its belief that the state could rigidly demarcate "urban poor" from all other districts, from its blindness towards the many struggling non-Abbotts who would be left behind. Lastly, Abbott was wrongheaded because of the Supreme Court's repeated contempt for democracy and the elected branches.

However, the more I did into Abbott history the more I realize it was wrong even on factual reasons. The Abbotts weren't New Jersey's lowest spending, Pemberton was no instance of "society is failing," and the Abbotts, as a class, didn't have New Jersey's worst municipal overburden.

Finally, the relevance of the Abbotts not having NJ's worst municipal overburden cannot be emphasized enough in response to the Education Law Center's threats to launch another Abbott case.

The relevance of the Abbotts cannot be emphasized enough in condemning Chris Christie's failure to update the Abbott list.

I've said this before and said it again, but Abbott is judicial activism at its worst.

More Abbott History:

No comments:

Post a Comment