This post has been moved to

http://njeducationaid.blogspot.com/2016/05/the-abbott-list-has-always-been-unfair_25.html

Monday, May 2, 2016

Thursday, April 28, 2016

The Origins of Lakewood's Budget Disaster

Note: The information about the cuts was accurate when I wrote this blog post. Since then, the Lakewood BOE has approved a much larger than planned tax increase and the planned cuts have been scaled back. See this Asbury Park Press story.

New Jersey has hundreds of districts in budgetary stress, scores in budgetary crisis, but perhaps only one in true budgetary disaster.

Lakewood.

Next year Lakewood is facing a $12 million deficit on an operating school budget that is only $120.8 million. To resolve the huge deficit, Lakewood is laying off 68 teachers, pushing average class size up to FORTY.In addition to the 68 teacher layoffs, Lakewood will lay off three guidance counselors, cut sports, cut middle school clubs, cut late busses, and eliminate courtesy bussing.

I don't use the word "disaster" lightly, but I'll use it for Lakewood because there is no other word.

Of the many growing NJ districts who are nevertheless forced to cut teachers, Lakewood stands out as perhaps still the worst-off situation because Lakewood's total spending and classroom spending are already among the lowest in New Jersey. Lakewood's classroom spending is currently 12th from the bottom,but after this round of cuts sets in for 2016-17 it may be in absolute last place. (Lakewood will probably not be in last place now since the cuts have been scaled back.)

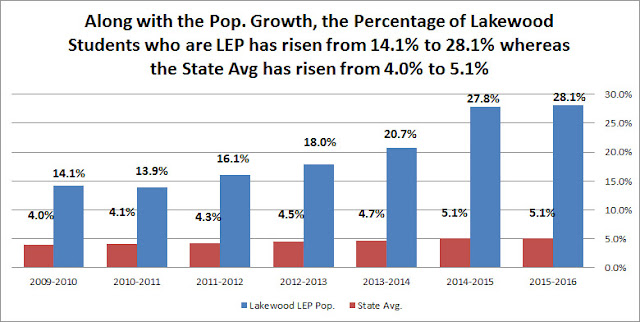

Since Lakewood's students are classified as 87% FRL eligible and 28% Limited English, a budget that would be inadequate for a middle-class district is even more inadequate for a district like Lakewood.

Lakewood also has extremely high transportation spending ($18-20 million a year). Toms River, which has over 4,000 more (public school) students than Lakewood, only spends $12.8 million on transportation. Brick, another larger district, spends only $8 million.

If you are unfamiliar with NJ's law on private school transportation, all private school children living in bussing districts (like Lakewood) get a bus or an $884 check if they are in K-8 and live more than 2.0 miles from their school or more than 2.5 miles if they are in 9-12.

Lakewood's transportation spending is so high because it must provide bussing to over 11,000 private schoolers and has chosen to provide "courtesy" bussing to a few thousand more for whom there is no mandate to provide transportation. (most Lakewood private school children get to school without any public expenditure at all.) Although the state has focused on courtesy bussing for private schoolers, there were 2,700 public school children who got it too.

High transportation spending is a foundational budget problem for Lakewood, but it is not a proximate cause of the disaster like Out of District tuition is since Lakewood's Transportation Budget has been falling recently and will fall even more after courtesy bussing is is discontinued for 2016-17 (saving $6.2 million).

Again, the problem is that Lakewood has to provide transportation to private schoolers and this does not factor into Lakewood's Adequacy Budget. Non-public transportation is a component of the formula for Transportation Aid, but like with Out of District tuition, the school district is expected to pick up the rest of the cost with local tax dollars and/or Equalization Aid and since Lakewood's private school population is out of proportion to its public school population, Lakewood doesn't get enough Equalization Aid. (and is underaided compared to what it is supposed to get.)

Also, despite all the transportation spending, the percentage of its budget that Lakewood spends in the classroom (according to the Taxpayer Guide to Education Spending) is nearly the state's average.

Lakewood's Orthodox-dominated BOE resisted cancelling Courtesy Bussing for many years. Some critics see this as an inappropriate use of Orthodox power (or you could see it as democratic power since the Orthodox are a majority, after all), but the BOE had some legitimate reasons for supporting courtesy bussing, like wanting to prevent traffic chaos.

I don't think Lakewood BOE chairman Barry Iann was wrong either when he defended courtesy bussing with a a safety justification:

The Prospects

Lakewood's budget prospects are extremely bad due to the trend of continuing public school population growth and the growth of the town overall, which increases the Out of District placement population.

Since the state is not going to be able to fully fund SFRA and even a total redistribution of Adjustment Aid would only give a few million more to Lakewood, Lakewood's chances at getting a state rescue or are very small and are non-existent of Lakewood is unaware of the depths of its own underaiding and the township is divided.

People can legitimately blame Lakewood's municipal government for its laissez-faire posture on housing development and people can legitimately criticize NJ's private school transportation law, but it's unfair to attack Lakewood's BOE and Orthodox community without talking about how SFRA doesn't work for Lakewood and Lakewood doesn't even get what it is supposed to get.

Lakewood is often compared to East Ramapo, a district in Rockland County, New York that also has an Orthodox majority. The parallels with East Ramapo are there, no doubt, but Lakewood is also very similar to districts like Red Bank Boro, Freehold Boro, and Dover that have growing Latino populations and whose state aid has not kept up.

Lakewood is a topic that merits media coverage and conversation because of its demographic uniqueness, because of its incredible population growth, and because of the educational budget disaster unfolding there, but certain pieces of context have to be in this conversation: such as that Lakewood's taxes exceed its Local Fair Share, that Lakewood is badly underaided by SFRA, and that SFRA's calculation of Adequacy Budget does not produce a sufficient amount for Lakewood anyway.

---

Please, if you want to help Lakewood and other underaided districts, please sign this state aid petition from Our Fair Share!

----

See an earlier, less sophisticated piece by me on Lakewood being an underaided district.

New Jersey has hundreds of districts in budgetary stress, scores in budgetary crisis, but perhaps only one in true budgetary disaster.

Lakewood.

Next year Lakewood is facing a $12 million deficit on an operating school budget that is only $120.8 million. To resolve the huge deficit, Lakewood is laying off 68 teachers, pushing average class size up to FORTY.

I don't use the word "disaster" lightly, but I'll use it for Lakewood because there is no other word.

Of the many growing NJ districts who are nevertheless forced to cut teachers, Lakewood stands out as perhaps still the worst-off situation because Lakewood's total spending and classroom spending are already among the lowest in New Jersey. Lakewood's classroom spending is currently 12th from the bottom,

Since Lakewood's students are classified as 87% FRL eligible and 28% Limited English, a budget that would be inadequate for a middle-class district is even more inadequate for a district like Lakewood.

New Jersey has many underaided districts and Lakewood is certainly underaided (officially by $19.3 million, or $3,049 per student for opex aid and another $2 million for Extraordinary Aid), but the complexity of Lakewood is that SFRA does not work for Lakewood in the first place and even if Lakewood (by some miracle), got its full uncapped aid, it would still be in severe budgetary stress.

Lakewood's Underaiding

The factormost commonly always blamed for Lakewood's budget crisis is Lakewood's Orthodox majority and their representatives on the Lakewood BOE. While I don't claim that everything Lakewood's BOE does is right, to exclusively blame the BOE or the Orthodox majority is ignorant of multiple other factors, primarily that Lakewood's tax levy is above its Local Fair Share and that its official state aid deficit is $19.3 million.

Lakewood should be getting $6,955 per student in state aid, but in reality it only gets $3,906 per student. The $3,049 per student aid deficit places Lakewood in the state's bottom 15% for underaiding.

The $6,955 aid target is actually low for a district with Lakewood's demographics. For instance, Freehold Boro's aid target is $13,342 per student and Dover's is $13,655.

Lakewood's aid target is low because Lakewood's student population is very small proportionally and Lakewood thus has an above-average per student tax base. Lakewood's tax base is not spectacular, but it is approximately equal to Metuchen's and Haddonfield's, though spread out among a much larger, poorer population.

Not all demographically poor districts should get a lot of state aid if their tax bases are large (eg, many districts at the Jersey Shore, Hoboken), but Lakewood is different from other other poor-student/high-tax base districts because its tax base is only deceptively high due to so many homes being occupied by private-school families who contribute towards Local Fair Share but actually do make some demands on the school system.

I will talk more about how SFRA doesn't work for Lakewood later, but what is rarely said about Lakewood is that its public school population (and not just the private school population) is increasing rapidly and this is also a major factor in Lakewood's budgetary disaster. Since 2009-10, Lakewood has gained 1,200 students, or 24% (using the 2016-17 estimate of a 6,300 student population for Lakewood), in contrast to the state seeing a 1% loss of student population.

Soaring Out of District Tuition is the Proximate Cause

The Proximate Cause of Lakewood's budget disaster is increasing costs for Out of District Special Education.

Lakewood's Out of District spending has risen from $15.3 million in 2008-09 to $28.1 million in 2015-16, or $12.8 million. Since Extraordinary Aid only increased by $4 million, from $524,000 in 2008-09 to an estimated $4.5 million in 2015-16 (and this is $2 million below what Lakewood should get), an extra $9 million has to effectively come out of the Lakewood schools' operating budget.

During this time, Lakewood has increased its Local Tax Levy by $21 million, from $69 million to $90 million, but when Lakewood's public school population increase has been among the largest in New Jersey and there has been inflation, there is still much less available to public school students.

The huge OOD cost increases are due to the surge in Lakewood's overall population, as Lakewood grows by 4,000- 5,000 people a year and is by far New Jersey's most rapidly growing town. The new families of Lakewood have special-needs children in roughly the same proportion as every other town in New Jersey and Lakewood's public schools must pay to educate those education in a "free and appropriate" setting.

Many other rapidly growing districts are not getting proportionate aid increases, but at least as their student populations increase, their (theoretical) uncapped aid would increase and there would be some hope in SFRA, but Lakewood's population surge is among Orthodox Jews, whose children do not use the public schools except when they have special needs children and for transportation.

The Asbury Park Press and of NJLeftBehind have written many times about Lakewood having a large number of Jewish special needs children at a school called the "School for Children with Hidden Intelligence." The SCHI was founded by a rabbi and even the Jewish Press has said that the SCHI has a "decidedly Jewish" atmosphere. Although there may be something afoot to the controversy around the School for Children with Hidden Intelligence, the school is in the middle of Lakewood and in terms of transportation it is a sensible place for the Lakewood BOE to send special needs children.

Lakewood's former special education coordinator, Helen Tobia, had tenure charges filed against her for alleged illegal and unethical practices in special education placements, but even if there are inappropriate or illegal practices in Lakewood Out of District placements, it doesn't seem like it would negate the tendency of Lakewood to have a Out of District population disproportionate to its public school enrollment no matter what.

This is how Equalization Aid (the most important aid stream) is supposed to be calculated

Equalization Aid = Adequacy Budget - Local Fair Share.

Where Adequacy Budget is the demographic determination of a district's needs based on its public schoolers only. It depends on enrollment and has extra weights for "at-risk" students.

Equalization Aid is not tied to any particular budget item. Districts can spend it on teachers, basketballs, transportation, textbooks, and tuition for children with special needs.

And herein is where Lakewood's problem lies: the enormous non-public school population doesn't figure into the calculation of Lakewood's Adequacy Budget and thus state aid, but receives transportation services and contributes to Out of District special needs population.

Lakewood's state aid problem is specifically in how the state expects districts to pay for tuition for special needs kids and transportation.

Extraordinary Aid is the aid stream for extremely high Out of District tuition, but (to simplify) Extraordinary Aid only kicks in at tuition bills at about $55,000 per student and even above that point, it only pays for 75% of tuition. (and Extraordinary Aid is underfunded)

The state expects school districts to be able to pay for the first $55,000 of tuition with their operationg funds (from local taxes and/or Equalization Aid) and the 25% cost share above $55,000 with their operating funds too.

Lakewood already is NJ's largest recipient of Extraordinary Aid, but Lakewood's problem is that it doesn't have enough operating money to pay for its end of tuition bills because 1) it is underaided 2) the aid target is too low anyway.

If you were to compare the 339 children in Lakewood who are in Out of District placement for 2015-16 to Lakewood's 6,100 student public school population, Lakewood is wildly out of proportion to any other district in New Jersey; however, if you compare the number of Lakewood children to its overall young person population of about 28,000-30,000, Lakewood would be in rough proportion to New Jersey's other largest towns.

Transportation

Lakewood's Underaiding

The factor

Lakewood should be getting $6,955 per student in state aid, but in reality it only gets $3,906 per student. The $3,049 per student aid deficit places Lakewood in the state's bottom 15% for underaiding.

The $6,955 aid target is actually low for a district with Lakewood's demographics. For instance, Freehold Boro's aid target is $13,342 per student and Dover's is $13,655.

Lakewood's aid target is low because Lakewood's student population is very small proportionally and Lakewood thus has an above-average per student tax base. Lakewood's tax base is not spectacular, but it is approximately equal to Metuchen's and Haddonfield's, though spread out among a much larger, poorer population.

Not all demographically poor districts should get a lot of state aid if their tax bases are large (eg, many districts at the Jersey Shore, Hoboken), but Lakewood is different from other other poor-student/high-tax base districts because its tax base is only deceptively high due to so many homes being occupied by private-school families who contribute towards Local Fair Share but actually do make some demands on the school system.

I will talk more about how SFRA doesn't work for Lakewood later, but what is rarely said about Lakewood is that its public school population (and not just the private school population) is increasing rapidly and this is also a major factor in Lakewood's budgetary disaster. Since 2009-10, Lakewood has gained 1,200 students, or 24% (using the 2016-17 estimate of a 6,300 student population for Lakewood), in contrast to the state seeing a 1% loss of student population.

Soaring Out of District Tuition is the Proximate Cause

The Proximate Cause of Lakewood's budget disaster is increasing costs for Out of District Special Education.

Lakewood's Out of District spending has risen from $15.3 million in 2008-09 to $28.1 million in 2015-16, or $12.8 million. Since Extraordinary Aid only increased by $4 million, from $524,000 in 2008-09 to an estimated $4.5 million in 2015-16 (and this is $2 million below what Lakewood should get), an extra $9 million has to effectively come out of the Lakewood schools' operating budget.

During this time, Lakewood has increased its Local Tax Levy by $21 million, from $69 million to $90 million, but when Lakewood's public school population increase has been among the largest in New Jersey and there has been inflation, there is still much less available to public school students.

The huge OOD cost increases are due to the surge in Lakewood's overall population, as Lakewood grows by 4,000- 5,000 people a year and is by far New Jersey's most rapidly growing town. The new families of Lakewood have special-needs children in roughly the same proportion as every other town in New Jersey and Lakewood's public schools must pay to educate those education in a "free and appropriate" setting.

Many other rapidly growing districts are not getting proportionate aid increases, but at least as their student populations increase, their (theoretical) uncapped aid would increase and there would be some hope in SFRA, but Lakewood's population surge is among Orthodox Jews, whose children do not use the public schools except when they have special needs children and for transportation.

The Asbury Park Press and of NJLeftBehind have written many times about Lakewood having a large number of Jewish special needs children at a school called the "School for Children with Hidden Intelligence." The SCHI was founded by a rabbi and even the Jewish Press has said that the SCHI has a "decidedly Jewish" atmosphere. Although there may be something afoot to the controversy around the School for Children with Hidden Intelligence, the school is in the middle of Lakewood and in terms of transportation it is a sensible place for the Lakewood BOE to send special needs children.

Lakewood's former special education coordinator, Helen Tobia, had tenure charges filed against her for alleged illegal and unethical practices in special education placements, but even if there are inappropriate or illegal practices in Lakewood Out of District placements, it doesn't seem like it would negate the tendency of Lakewood to have a Out of District population disproportionate to its public school enrollment no matter what.

Why SFRA's Aid Target Isn't Enough for Lakewood

Equalization Aid = Adequacy Budget - Local Fair Share.

Where Adequacy Budget is the demographic determination of a district's needs based on its public schoolers only. It depends on enrollment and has extra weights for "at-risk" students.

Equalization Aid is not tied to any particular budget item. Districts can spend it on teachers, basketballs, transportation, textbooks, and tuition for children with special needs.

And herein is where Lakewood's problem lies: the enormous non-public school population doesn't figure into the calculation of Lakewood's Adequacy Budget and thus state aid, but receives transportation services and contributes to Out of District special needs population.

Lakewood's state aid problem is specifically in how the state expects districts to pay for tuition for special needs kids and transportation.

Extraordinary Aid is the aid stream for extremely high Out of District tuition, but (to simplify) Extraordinary Aid only kicks in at tuition bills at about $55,000 per student and even above that point, it only pays for 75% of tuition. (and Extraordinary Aid is underfunded)

The state expects school districts to be able to pay for the first $55,000 of tuition with their operationg funds (from local taxes and/or Equalization Aid) and the 25% cost share above $55,000 with their operating funds too.

Lakewood already is NJ's largest recipient of Extraordinary Aid, but Lakewood's problem is that it doesn't have enough operating money to pay for its end of tuition bills because 1) it is underaided 2) the aid target is too low anyway.

If you were to compare the 339 children in Lakewood who are in Out of District placement for 2015-16 to Lakewood's 6,100 student public school population, Lakewood is wildly out of proportion to any other district in New Jersey; however, if you compare the number of Lakewood children to its overall young person population of about 28,000-30,000, Lakewood would be in rough proportion to New Jersey's other largest towns.

|

| Click to Enlarge |

If you are unfamiliar with NJ's law on private school transportation, all private school children living in bussing districts (like Lakewood) get a bus or an $884 check if they are in K-8 and live more than 2.0 miles from their school or more than 2.5 miles if they are in 9-12.

Lakewood's transportation spending is so high because it must provide bussing to over 11,000 private schoolers and has chosen to provide "courtesy" bussing to a few thousand more for whom there is no mandate to provide transportation. (most Lakewood private school children get to school without any public expenditure at all.) Although the state has focused on courtesy bussing for private schoolers, there were 2,700 public school children who got it too.

High transportation spending is a foundational budget problem for Lakewood, but it is not a proximate cause of the disaster like Out of District tuition is since Lakewood's Transportation Budget has been falling recently and will fall even more after courtesy bussing is is discontinued for 2016-17 (saving $6.2 million).

Again, the problem is that Lakewood has to provide transportation to private schoolers and this does not factor into Lakewood's Adequacy Budget. Non-public transportation is a component of the formula for Transportation Aid, but like with Out of District tuition, the school district is expected to pick up the rest of the cost with local tax dollars and/or Equalization Aid and since Lakewood's private school population is out of proportion to its public school population, Lakewood doesn't get enough Equalization Aid. (and is underaided compared to what it is supposed to get.)

Also, despite all the transportation spending, the percentage of its budget that Lakewood spends in the classroom (according to the Taxpayer Guide to Education Spending) is nearly the state's average.

Lakewood's Orthodox-dominated BOE resisted cancelling Courtesy Bussing for many years. Some critics see this as an inappropriate use of Orthodox power (or you could see it as democratic power since the Orthodox are a majority, after all), but the BOE had some legitimate reasons for supporting courtesy bussing, like wanting to prevent traffic chaos.

I don't think Lakewood BOE chairman Barry Iann was wrong either when he defended courtesy bussing with a a safety justification:

Also, despite the fact that courtesy bussing was the only thing some Lakewood private school families get for their local and state education taxes, an overwhelming majority of them opposed paying higher taxes to continue it in a January 2016 referendum on a special tax on courtesy bussing that was defeated 99% to 1%.

"This problem is about the children of Lakewood who will be forced to walk to school on the most hazardous and congested roadways in the State of New Jersey — most of which do not even have sidewalks."

“I pray that it will not take the death of a child (G-d forbid) before the gravity of this problem is finally addressed"

The Prospects

Lakewood's budget prospects are extremely bad due to the trend of continuing public school population growth and the growth of the town overall, which increases the Out of District placement population.

Since the state is not going to be able to fully fund SFRA and even a total redistribution of Adjustment Aid would only give a few million more to Lakewood, Lakewood's chances at getting a state rescue or are very small and are non-existent of Lakewood is unaware of the depths of its own underaiding and the township is divided.

People can legitimately blame Lakewood's municipal government for its laissez-faire posture on housing development and people can legitimately criticize NJ's private school transportation law, but it's unfair to attack Lakewood's BOE and Orthodox community without talking about how SFRA doesn't work for Lakewood and Lakewood doesn't even get what it is supposed to get.

Lakewood is often compared to East Ramapo, a district in Rockland County, New York that also has an Orthodox majority. The parallels with East Ramapo are there, no doubt, but Lakewood is also very similar to districts like Red Bank Boro, Freehold Boro, and Dover that have growing Latino populations and whose state aid has not kept up.

Lakewood is a topic that merits media coverage and conversation because of its demographic uniqueness, because of its incredible population growth, and because of the educational budget disaster unfolding there, but certain pieces of context have to be in this conversation: such as that Lakewood's taxes exceed its Local Fair Share, that Lakewood is badly underaided by SFRA, and that SFRA's calculation of Adequacy Budget does not produce a sufficient amount for Lakewood anyway.

---

Please, if you want to help Lakewood and other underaided districts, please sign this state aid petition from Our Fair Share!

----

See an earlier, less sophisticated piece by me on Lakewood being an underaided district.

Monday, April 25, 2016

Our Fair Share Launches Petition for State Aid Fairness

Our Fair Share, an activist group founded in Delran for fair school funding, has launched a petition for state aid fairness.

The heart of the petition is this call for Adjustment Aid to be redistributed:

https://www.change.org/p/chris-christie-nj-students-deserve-fair-school-funding

The heart of the petition is this call for Adjustment Aid to be redistributed:

Please sign and forward!

We demand that $575 million in “adjustment aid” be reallocated. This was support that was originally intended to "hold harmless" districts that saw aid reductions as a result of the new formula signed into law in 2008. This process has been recommended to take place over five years, however no money has been reallocated in the past 8 years. We believe 8 years is enough advance notice for districts to realize they should not be receiving any more adjustment aid.

We ask that until SFRA can be fully funded, all districts be funded fairly, and share the sacrifice that so many districts have been making since 2008. If the formula can only be funded at 85%, then fund ALL school districts throughout the state with the formula at 85%. Students, taxpayers, and school districts from all over the state have been the innocent victims of the State's inefficient and unlawful distribution of school funds.

https://www.change.org/p/chris-christie-nj-students-deserve-fair-school-funding

Thursday, April 21, 2016

Education Law Center Reiterates Opposition to Aid Redistribution

The ELC is in full reactionary mode and has has reiterated its opposition to any reduction in Adjustment Aid.

ELC's warning about cutting aid from NJ "over-adequacy" districts https://t.co/PLqhtbOMMo— Education Law Center (@EdLawCenter) April 21, 2016

The ELC can't even use the word "over adequacy" without quotes, like it is not a real concept.

This comes just weeks after the Education Law Center threatened another Abbott lawsuit, a case that John Mooney of NJSpotlight estimates could cost New Jersey another $500 million. It comes six months after the ELC demanded another round of Abbott construction spending.

The ELC named Jersey City specifically as a district it didn't want to see lose aid.

NJ lawmakers: hands off adjustment aid in Jersey City & 70 other districts spending below constitutional level https://t.co/PLqhtbOMMo— Education Law Center (@EdLawCenter) April 21, 2016

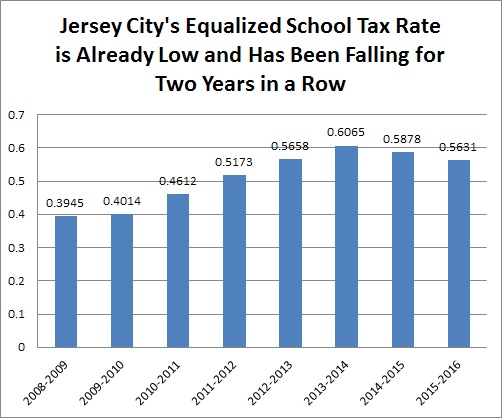

What the ELC ignores is that JC and many more under-Adequecy Adjustment Aid districts, local taxes are nowhere near what it is capable of paying:

I'm not saying that Jersey City is rich, but it is much more prosperous than it used to be and can pay a much higher tax levy.

Given that Christie won't agree to any tax increases and even a Democratic governor would prioritize the pension funds and the Transportation Trust Fund, there is no way that NJ can fully fund SFRA.

Although we also need to find at least some more money forK-12, NJ's economic/debt realities means that the only hope for underaided districts is redistribution, a process that the ELC has announced its opposition to.

Tuesday, April 19, 2016

New Jersey's Lowest and Highest Spending Districts 2015-16

This post is about New Jersey's lowest and highest spending districts. It is a follow-up to previous posts I've written about New Jersey's most overaided and underaided districts, richest districts, and its most overtaxed.

The source of these data is the 2016 Taxpayer Guide to Education Spending and the data are for the 2015-16 school year.

The DOE produces two measures of spending, Total Spending Per Pupil which includes things like pensions, FICA, and debt service, and Total Comparative Cost Per Pupil, which only includes direct district expenditures. I use Total Comparative Cost Per Pupil because it includes only factors that a district has under its direct control.

The DOE formats its data very confusingly, so I've created a public table of per student spending in Google Spreadsheets for you to refer to and evaluate.

The Lowest Spending

First, many of New Jersey's lowest spending "districts" are actually charter schools.

Six NJ charter schools spend less than $8,000 per student, with the Vineland Charter School at the bottom, with $7,435 in per student spending, barely half of the state median.

There is always a lot of overheated argument around charter schools and their funding. When the argument is between charter school spending versus host district spending and why charters almost always spend less, talented researchers/writers like Mark Webber and Julia Sass Rubin that charter enrollment is non-representative and that charters educate a less challenging population than their host districts. Furthermore, many charters educate children younger than high school, so lower spending is expected since younger children require fewer services. Finally, charters also do not provide some services that host districts provide, like transportation. These factors combine to justify the lower spending levels that charters have compared to their host districts.

HOWEVER, it must be noted that even if a charter school has less challenging and younger students, spending levels at the $8,000 per student level are WAY below Adequacy. Even if a charter school were 0% FRL-eligible, spending $7400 per student is is inadequate.

For regular public schools, the thirty lowest spending districts are the following:

These are all non-Abbotts and nearly all of them have high-FRL eligibility. Fairview only spends $10,288 per student, or 29% below the state's median, even though Fairview is 77% FRL-eligible and 14% LEP.

(Given how four of the lowest spending districts are in Vincent Prieto's legislative district (East Newark, Fairview, Edgewater, and Guttenberg are part of Prieto's District 32), Prieto's indifference to school finance is incomprehensible to me.)

The lowest spending Abbott is West New York (also in District 32), which spends $14,263 per student. That is slightly below the state's median and is significantly below Adequacy given West New York's demographics (about 80% FRL eligible). However, West New York's spending is still $4,000 per student above Fairview's. Moreover, West New York's deficit is due to undertaxing and underaiding equally, so state culpability is no higher than local culpability.

The lowest spending districts are a mixture of undertaxers and overtaxers, but every single one of them is underaided.

The Highest Spenders

FYI: The following are the highest spending school districts:

It is difficult to generalize about the highest spenders. Some are very wealthy, some have had significant population loss, some are tax tolerant, and a few get massive state aid or some combination of the previous four factors.

Notice however, that large conventionally affluent districts like Millburn, Princeton, and Livingston are not among the highest spenders.

Non-Abbotts Need Help

Helping the lowest spending districts requires a combination of new revenue and redistribution, but what will not help them is another Abbott lawsuit, as the Education Law Center has threatened. For perverse legal reasons, non-Abbotts including Fairview, have "no standing" in the eyes of the New Jersey Supreme Court. If the state were forced to pay another $500 million to the Abbotts the money would have to come from other districts (either directly through or indirectly through flat aid) and the prospect of new money for these crisis districts would recede.

(At the risk to alienating my anti-charter readers, many charter schools across New Jersey need help too.)

The Education Law Center and New Jersey Supreme Court have a staggering immunity to common sense, but if we do everything we can to inject into the public discourse that the 31 Abbotts are NOT New Jersey's 31 poorest districts and certainly not the 31 lowest spending, then maybe there's some hope for the least fortunate in New Jersey.

----

Please, if you want to help underaided districts, please sign this state aid petition from Our Fair Share!

The source of these data is the 2016 Taxpayer Guide to Education Spending and the data are for the 2015-16 school year.

The DOE produces two measures of spending, Total Spending Per Pupil which includes things like pensions, FICA, and debt service, and Total Comparative Cost Per Pupil, which only includes direct district expenditures. I use Total Comparative Cost Per Pupil because it includes only factors that a district has under its direct control.

The DOE formats its data very confusingly, so I've created a public table of per student spending in Google Spreadsheets for you to refer to and evaluate.

The Lowest Spending

First, many of New Jersey's lowest spending "districts" are actually charter schools.

Six NJ charter schools spend less than $8,000 per student, with the Vineland Charter School at the bottom, with $7,435 in per student spending, barely half of the state median.

|

| Click to Enlarge |

HOWEVER, it must be noted that even if a charter school has less challenging and younger students, spending levels at the $8,000 per student level are WAY below Adequacy. Even if a charter school were 0% FRL-eligible, spending $7400 per student is is inadequate.

For regular public schools, the thirty lowest spending districts are the following:

|

| Click to Enlarge |

These are all non-Abbotts and nearly all of them have high-FRL eligibility. Fairview only spends $10,288 per student, or 29% below the state's median, even though Fairview is 77% FRL-eligible and 14% LEP.

(Given how four of the lowest spending districts are in Vincent Prieto's legislative district (East Newark, Fairview, Edgewater, and Guttenberg are part of Prieto's District 32), Prieto's indifference to school finance is incomprehensible to me.)

The lowest spending Abbott is West New York (also in District 32), which spends $14,263 per student. That is slightly below the state's median and is significantly below Adequacy given West New York's demographics (about 80% FRL eligible). However, West New York's spending is still $4,000 per student above Fairview's. Moreover, West New York's deficit is due to undertaxing and underaiding equally, so state culpability is no higher than local culpability.

The lowest spending districts are a mixture of undertaxers and overtaxers, but every single one of them is underaided.

The Highest Spenders

FYI: The following are the highest spending school districts:

|

| Click to Enlarge |

It is difficult to generalize about the highest spenders. Some are very wealthy, some have had significant population loss, some are tax tolerant, and a few get massive state aid or some combination of the previous four factors.

Notice however, that large conventionally affluent districts like Millburn, Princeton, and Livingston are not among the highest spenders.

Non-Abbotts Need Help

Helping the lowest spending districts requires a combination of new revenue and redistribution, but what will not help them is another Abbott lawsuit, as the Education Law Center has threatened. For perverse legal reasons, non-Abbotts including Fairview, have "no standing" in the eyes of the New Jersey Supreme Court. If the state were forced to pay another $500 million to the Abbotts the money would have to come from other districts (either directly through or indirectly through flat aid) and the prospect of new money for these crisis districts would recede.

(At the risk to alienating my anti-charter readers, many charter schools across New Jersey need help too.)

The Education Law Center and New Jersey Supreme Court have a staggering immunity to common sense, but if we do everything we can to inject into the public discourse that the 31 Abbotts are NOT New Jersey's 31 poorest districts and certainly not the 31 lowest spending, then maybe there's some hope for the least fortunate in New Jersey.

Please, if you want to help underaided districts, please sign this state aid petition from Our Fair Share!

Thursday, April 14, 2016

State Aid Dominates Senate Budget Hearing

"They're bursting at the seams. We've got kids being taught in the hallway, on stages, wherever they can find room, and they can't do it anymore. We have to redistribute the state aid."

Senator Jennifer Beck on Freehold Boro:

Finally, the New Jersey State Senate is addressing the savage inequalities that entrap tens of thousands of New Jersey school children in schools nowhere near adequately staffed or equipped and tens of thousands of taxpayers shouldering tax burdens that are beyond the point of fairness.

At a Senate hearing, in front of over 50 community members from Red Bank Boro and Freehold Boro, the Senate Budget committee discussed ways to address the desperate need of some of New Jersey's neediest school districts.

According to the reporting I've read, Senator Jennifer Beck (Red Bank Boro's and Freehold Boro's Senator) was the leading spirit in pushing for a fairer distribution of school aid.

Beck said when [SFRA] first passed, districts poised to lose aid were held harmless and allowed to keep funding that would have otherwise been lost. That aid, meant as a short-term concession, continues even though other districts remain cash-strapped.

Beck said 111 school districts are considered "over-adequacy" and still receive about $175 million in “hold harmless” aid. Her proposal aims to redistribute these dollars to the districts that need it.

Although it appears that the state will keep Adjustment Aid in overaided districts that are below Adequacy and thus leave over $300 million in excess aid untouched, even $175 million going to the neediest districts in New Jersey is a huge boost compared to what they have gotten in the last five years.

Commissioner of Education David Hespe indicated that this is something he was open to:

Once the formula stops running, districts that rely on the formula for increased enrollments or increases in the special populations funded in the formula, are treated unfairly... They cannot provide the quality education these other districts can without putting their local taxpayers into an almost impossible situation.”

However, not everyone at the meeting was sympathetic or willing to look at the statewide picture. Senator Paul Oroho (R, Sussex) talked about "fairness" for districts that had lost enrollment.

Also, if the Christie administration is open to redistribution, why is it waiting for legislation? The Christie Administration did not wait for legislation to create PARCC Readiness Aid, Student Growth Aid, Professional Community Aid, or, the worst, "Additional Adjustment Aid." The governor already has the de facto power to ignore SFRA and yet it has preserved the aid packages of overaided districts.

We need a new funding formula that would be significantly fairer and more accountable for those specific areas where you have declining enrollment.

Apparently the aid of under Adequacy/overaided districts will be left in place for the time being, but Jersey City, the poster child for a district that undertaxes so much that it is under Adequacy despite being overaided by $4,272 per student.

Something I was pleased to see is that Senator Beck gets it that some districts are above Adequacy just because they pay high taxes:

One complication is that the amount a district spends is based on both local school tax collections and state aid. Beck and other officials said they want to be careful not to penalize districts that use local taxes, rather than state monies, to fund their schools at close to or higher than the state recommendation.

“We want to make sure the changes we make don’t have unintended consequences,” Beck said. “There are some districts that are over adequacy, but it very well may be because their local property taxpayers chose to provide additional funding to the district, not that the state is giving them too much money.”

However, if the Sweeney/Beck legislation only takes Adjustment Aid away from districts who are above Adequacy than the amount of money that could possibly be redistributed is nowhere near the $550 million amount that the state distributes in Adjustment Aid. Beck herself gives a figure of $175 million.

The $175 million figure appears to come from the (partly erroneous) Education Law Center Policy Brief on Adjustment Aid, but the ELC was not saying that Adjustment Aid districts were $175 million above Adequacy. The ELC was saying that districts that were above Adequacy got $175 million in Adjustment Aid.

This is significant because many Adjustment Aid districts that are above Adequacy still undertax and therefore their "Adequacy Surplus" is less than their Adjustment Aid. For instance, even though Pemberton gets $32 million in Adjustment Aid, it is only above Adequacy by $14 million and many more over-Adequacy Adjustment Aid districts are like Pemberton.

It looks like this round of redistribution will skip Jersey City because Jersey City is under Adequacy (due to undertaxing), but Jersey City did come up and Sen. Sandra Cunningham makes a specious argument in favor of sustaining JC's aid.

The $175 million figure appears to come from the (partly erroneous) Education Law Center Policy Brief on Adjustment Aid, but the ELC was not saying that Adjustment Aid districts were $175 million above Adequacy. The ELC was saying that districts that were above Adequacy got $175 million in Adjustment Aid.

This is significant because many Adjustment Aid districts that are above Adequacy still undertax and therefore their "Adequacy Surplus" is less than their Adjustment Aid. For instance, even though Pemberton gets $32 million in Adjustment Aid, it is only above Adequacy by $14 million and many more over-Adequacy Adjustment Aid districts are like Pemberton.

It looks like this round of redistribution will skip Jersey City because Jersey City is under Adequacy (due to undertaxing), but Jersey City did come up and Sen. Sandra Cunningham makes a specious argument in favor of sustaining JC's aid.

[Beck] said the state also needs to account for towns that do not contribute enough in local property-tax revenues to the schools, but still receive adjustment aid. The poster child for that phenomenon is Jersey City, which is “slightly” under adequacy, according to commissioner of education David Hespe. The district receives $114.5 million in adjustment aid, in addition to other education aid, but contributes $224 million less in local taxes than it should according to the state’s “fair share” calculation, Beck said.

“Jersey City has had enrollment growth, but I think some of us would argue that they’re locally not doing what they’re supposed to do to help fund the cost of that enrollment growth -- which is counter to a lot of our other school districts, like Freehold Borough,” she said.

Jersey City is not contributing enough in part because of its frequent use of municipal tax abatements, which spur development but have the effect of shifting more of the burden for school funding to the state, Beck said.To the suggestion that Jersey City wasn't paying enough in local school taxes, Senator Sandra Cunningham shot back:

“When we think of Jersey City we think of the tall buildings, the glass buildings, the Citi Bike and all the other crazy things that you see when you hear Jersey City,” she said. “What you don’t see in Jersey City is … most of these minority children who are growing up in crime-ridden areas, they’re growing up in drug-ridden areas, they’re growing up in areas in which some of their schools have been there since Abraham Lincoln. Let’s keep in perspective where the people really are that are really using this money, and it’s not downtown.”

Senator Cunningham was against SFRA in the first place in 2008, even though she also represents Bayonne.

Ok, we all know that JC's student population isn't representative of JC's population at large, but this is irrelevant in discussing Jersey City's aid. There are parts of many towns, from Cherry Hill to West Orange, and even Summit which have very poor sections, but no one says that Cherry Hill, West Orange, and Summit should get massive amounts of aid. The common sense reason for this is because it's the overall financial picture which matters.

Here we go again.

So, Jersey City's student population is 70% FRL eligible, but it's a proportionally small population. Jersey City only has 34,000 students compared to an overall population of ~275,000. Jersey City's population is almost the same size as Newark's now, but Newark has almost 20,000 more kids. Jersey City has 120,000 more people than Paterson, but Jersey City only has about 6,000 more students and since Paterson's FRL-eligibility is higher, Paterson actually has more FRL-eligible kids.

More importantly, Jersey City's Equalized Valuation is $21.3 billion, which, combined with Jersey City's Aggregate Income, comes to $330 million in Local Fair Share. JC's tax base would be at least $9 billion larger if its PILOTed property were included. Divide that Local Fair Share by the number of students in Jersey City and you get $10,196 per student; an amount which is slightly below NJ's median, but above districts like Bloomfield ($9,366 per student) and almost double higher than what some poor non-Abbotts like Dover ($5,576) and Manchester Regional ($5,226) have.

In fact, Jersey City's Equalized Valuation is increasing so rapidly that its Effective (aka "Equalized") Tax Rate is dropping:

So Sandra Cunningham's resistance to doing anything that would raise Jersey City's taxes is indefensible.

Sometimes I feel like I write too much about Jersey City on this blog, but its emblematic of the problems of school finance in New Jersey and if the legislature and Christie refuse to redistribute aid out of Jersey City the amount of aid to be transferred is going to be limited.

Again, I'm encouraged by what I've read of the Senate Budget Committee hearing, even though I worry about that the amount to be redistributed will be very limited. Anyway, I look forward to the Assembly hearing which will take place on Wednesday, April 20th.

Subscribe to:

Posts (Atom)