The opinions herein belong solely to the author and not to any group or other individual. He writes this solely as a private citizen.

On February 27th the New Jersey Department of Education released state aid amounts for each school district in the state.

Here are some highlights:

- Overaiding and Underaiding are back. The overaided districts have a surplus of

$395,912,037 and the underaided districts have a deficit of -$382,529,105.

- New Jersey's finances were tighter than in the last few years, so the total K-12 formula aid increase was only $386 million, as opposed to as much as $900 million, as in 2023-24 and 2024-25. The small increase in Equalization Aid caused Local Fair Share to jump from 1.29% to 1.49%.

- Like previous governors, the Murphy administration unilaterally changed SFRA's funding mechanisms without waiting for the NJ Legislature to make the changes.

The Whole Enchilada of NJ Education Spending ($22.2 billion!)

When superintendents, legislators, education activists, the Boards of Education talk about "state aid," they almost always mean what's only just K-12 formula aid, aka "opex aid." IE, state money going directly to districts that they control and can spend on various educational operations.

K-12 formula aid is critically important, but it's actually only 54% ($12 billion) of New Jersey's $22.2 billion all-in education spending. As you see below, the State of New Jersey spends $22.2 billion on other items that are essential to public education, from the Teachers Pension and Annuity Fund, teachers Social Security, post-retirement medical, and multiple forms of debt servicing ($6.5 billion). New Jersey school districts also receive large amounts in Extraordinary Aid and PreK aid ($1.7 billion), although those are semantically not defined as "formula aid."

Other state aid sources, like Extraordinary Aid and Debt Servicing Aid, are funded below statutory targets, but writing about that would be a separate blog post.

In a huge contrast to the Christie-era, when debt-related education spending got the largest increases, K-12 formula aid has gotten the biggest increases under Murphy, with the $386 million net gain making up 85% of new education spending.

The $386 million increase is the smallest increase since 2017-18 (excluding Covid) and many districts are losing state aid, but at least it's better than the cuts municipal governments are seeing.

Note: this is the fifth straight year that NJ has made the full actuarially recommended contribution to TPAF. (Post-Retirement Medical is PAYGO)

The 2025-26 Formula Aid Distribution

The total K-12 formula aid increase was $387 million, but 144 districts lost $67 million in state aid and seven vo-techs had no change. Because of that limited redistribution, the 391 aid-gaining districts gained $454 million in state aid. (see my 2025-26 State Aid spreadsheet for more detailed information)

The $386 million net increase (+3%) is the smallest increase since the middle-Christie years, which is because NJ's income taxes are only expected to increase by $845 million. (See page 53 of the Budget in Brief)

As happens every year, half of the aid gain (+$227 million) was concentrated in only a handful of districts. For 2025-26, only ELEVEN districts, Newark, Paterson, Trenton, Camden, Elizabeth, New Brunswick, Plainfield, Irvington, East Orange, Vineland, and Orange, will get half the new money.

Note, those eleven districts educate 208,984 K-12 students, which is 16% of NJ's total of 1,318,781 K-12 students.

State Aid Disparities

2024-25 was the first year in the history of NJ state aid where all districts were at least 100% funded, but New Jersey fiscally could not sustain that for 2025-26.

The reemergence of state aid deficits is due to the state's fiscal difficulties, which hinder our ability to increase K-12 formula aid at the same rate as inflation. Deficits are also fiscally due to a preference to cap aid losses at -3% of the prebudget year's state aid. Hence, state aid deficits (and surpluses) are back.

For 2025-26, there will be

- 191 overaided districts, with a total excess of $395,912,037 (not counting Choice Aid and Military Impact Aid).

- 114 districts who are funded at exactly 100%.

- 282 underaided districts with a total deficit of -$382,529,105.

The largest state aid surplus is Jersey City's, with $77.7 million, or $2,704 per student. Elizabeth has the second largest surplus in total dollars, with $28 million.

These amounts are nothing compared to Asbury Park's surpluses, which were over $11,000 per student, but they are quite large.

The largest deficit in total dollars is Newark, with $37 million, or -$652 per student. The largest deficit in dollars per student is Netcong, with -$4,147 per student, or $1.3 million total for 308 students.

If NJ did not use a 3% maximum aid loss*, another $395.9 million would be available for underaided districts and the 100% funding floor would be intact for another year, but that would have caused pain for aid-losing districts, so the Murphy administration heeded the appeals of overaided districts, legislators like Sen. Vin Gopal, and outside groups like the New Jersey School Boards Association, and preserved more of their state aid. Although a more subtle and better process would have been one that allowed larger cuts for districts with low tax rates.

*Aid losing districts would argue that their aid losses were greater than 3%, since the 3% maximum was cut from the original 2024-25 state aid proposal, and so did not include the $45 million in Stabilization Aid that was restored late in the FY2025 budget cycle)

Local Fair Share Increase and Local Fair Share Disparities

From 2024-25 to 2025-26, NJ's statewide Adequacy Budget jumped from $27,153,664,048 to $29,912,221,002, which is +$2.75 billion or +10%. Since NJ only could put in another +$386 million (+3%) into K-12 formula aid, Local Fair Share soared.

The reason for such a huge jump in the statewide Adequacy Budget is not enrollment growth, which is estimated to be only +4,000, but rapid inflation itself, plus a technical problem with the 2023 Education Adequacy Report in that it had stopped tracking inflation in mid-2021 (see page 14), before inflation accelerated. The 2026 Education Adequacy Report did include that rapid period of inflation, and hence made a bigger increase in the statewide Adequacy budget than current inflation.

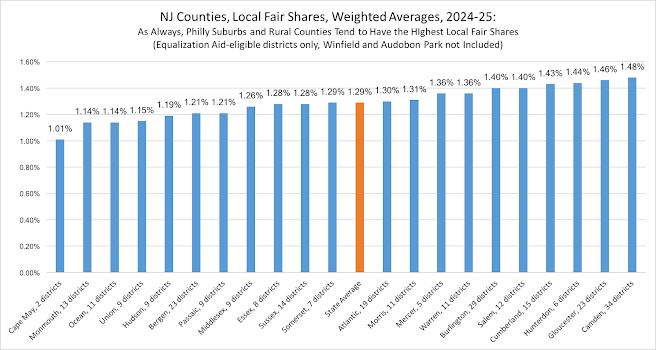

Local Fair Share inequality comes from New Jersey's highly unusual method of calculating a district's local share. Whereas in most states, the equivalent of Local Fair Share is based solely on tax base, in New Jersey it is a hybrid of Equalized Valuation and Aggregate Income, where each Equalized Valuation and Aggregate Income each comprises 50% of the weight.

This is an illustration of a rarely made point that, on a statewide basis, Local Fair Share depends on the amount of Equalization Aid available, so the real statewide formula is:

(Statewide) Adequacy Budget - (Available) Equalization Aid = Local Fair Share

The formula for Equalization Aid you often see:

Adequacy Budget - Local Fair Share = Equalization Aid

is only true for individual districts, after the Local Fair Share multipliers have already been determined.

To further expound on how insufficient Equalization Aid raises Local Fair Share, this is the provision of SFRA which governs Local Fair Share:

In the event that these [LFS] rates, when used in accordance with the provisions of this section and assuming that each district's general fund levy is equal to its local share, do not result in equalization aid for all districts equal to the Statewide available equalization aid, the commissioner shall adjust these rates appropriately, giving equal weight to each. (see pages 14-16)

It is the 2025-26 increase in Local Fair Share that accounts for the much larger number of districts who lost state aid.

For 2025-26, the Local Fair Share formula is

(Equalized Valuation x 0.014949314 + Aggregate Income x 0.059963161)/2

which is an increase from 2024-25's

(Equalized Valuation x 0.012707978 + Aggregate Income x 0.050601493) / 2

Hence, New Jersey's average Local Fair Share ROSE again, after four years of decline. For 2025-26, the median Equalization Aid-eligible district will pay a LFS that is a 1.58% tax rate, with 1.49% as the weighted average and 1.58% as the unweighted average.

|

| Includes the 14 Vo-Techs who are eligible for Equalization Aid, but not their LFS tax rates, since LFS tax rates do not exist for vo-techs |

As usual, there is a stark bias against the Philly suburbs and rural areas, however, this is the first time I've seen Hunterdon districts with the highest expected tax rates.

Conclusion:

The 2025-26 state aid distribution should remind state aid activists that changing the state aid formulas like for special education or multiyear averaging of Local Fair Share do nothing if the state's overall budget picture is difficult and/or the governor has other budget priorities. NJ's expected income tax growth in FY2026 is simply not as robust as it was for the previous few years, but Adequacy Budget soared, hence Local Fair Share soared with it, and the 2025-26 state aid distribution comes as a disappointment or shock to many.

Thus, while the Murphy administration did use multi-year averaging for Local Fair Share, it did not have a large impact in stabilizing state aid compared to the 3% aid-loss floor.

The 10% increase in the Adequacy Budget also did not mean 10% more school aid. The effect of raising the Adequacy Budget was to raise Local Fair Shares and cut Equalization Aid for even more districts.

In many ways, the most honest ways to demand higher state education aid are

1) call to raise income taxes. (this has been happening gradually since NJ's income tax brackets are not indexed to inflation.)

2) call to cut spending on other state services paid for by the Property Tax Relief Fund, eg, municipal aid and tax rebates. (this has also been occurring very gradually, as non-education spending has not seen the increases education spending has received).

Both have drawbacks, but they, along with natural revenue growth, are what would definitely increase and stabilize state aid for NJ's school districts.

-----

See Also: