Now that Adjustment Aid is being phased out, the biggest problem in the School Funding Reform Act is its use of Aggregate Income to calculate Local Fair Share. To see how bad Local Fair Share disparities can get, check these out:

If you are unfamiliar with the problems of Local Fair Share, New Jersey's formula for local share is nearly unique in the United States in that it is a 50:50 hybrid of a district's Equalized Valuation and its Aggregate Income.

The use of Aggregate Income means Local Fair Share is unequal and the following categories of districts have high Local Fair Shares:

- Where residents live in houses that are inexpensive relative to income.

- Districts that lack non-residential property and/or vacation homes because non-residential + vacation property has no income "attached" to it.

- Districts where many residents live in tax-exempt housing.

- Districts with high-income outliers.

The districts who are the most hurt by the use of Aggregate Income tend to be Philadelphia suburbs, then rural districts, and then some random ones in Northeastern New Jersey. Woodlynne's Local Fair Share is the highest and fluctuates around 2%. The state's median Local Fair Share fluctuates at 1.4%. In 2021-22 the median was 1.46% and in 2022-23 the median will be 1.38%.

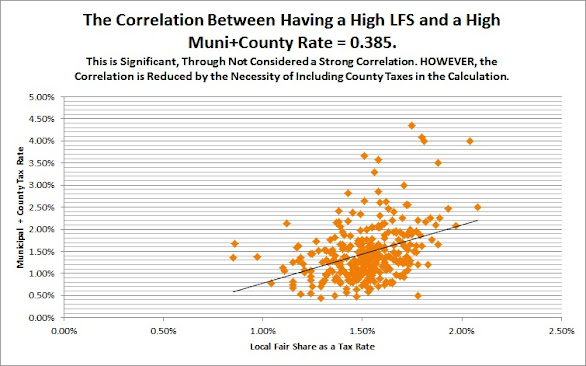

Due to the penalty against districts that have high percentages of residential property and those towns are already disadvantaged, having a high Local Fair Share correlates with having high municipal taxes.

Ideally what New Jersey would do to fix Local Fair Share is base it solely on taxable property (ie, Equalized Valuation, which would make the tax rate the same for all Equalization Aid-eligible districts, but I realize that equalizing Local Fair Share would require some districts to pay higher taxes and that is politically difficult.

What I propose instead of an equal Local Fair Share that there be a cap on how high a Local Fair Share would be. It would not require low LFS districts to pay more, but at least lessen the extremes of high Local Fair Shares that afflict some districts.

The costs are not high.

The costs aren't even that high if LFS were capped at 1.6% or 1.5%.

Several more districts who are not ineligible for Equalization Aid would become eligible if Local Fair Share were capped. Haddon Heights and Wenonah become eligible for Equalization Aid at a 1.6% cap. Medford, Washington Twp (Morris), and Haddonfield become eligible at a 1.5% cap. (their totals are included in the table above)

There is a lot of inertia behind keeping Aggregate Income in the Local Fair Share formula, but at least capping the contribution at a certain point above the state median would eliminate the worst victimization by the formula.

-----

See Also

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteJoeme has been an incredible addition to my fitness journey, providing tailored workout plans that really work.

ReplyDeletePrioritise your health with the easy-to-use Health Watch: health watch. A perfect blend of fitness tracking and everyday style.

ReplyDeleteDiscover the latest in wearable technology with Smart Watches: smart watches. Ideal for tracking your health and staying connected.

ReplyDeleteDFS Cargo Service in Mirpur, AJK, offers reliable and efficient cargo solutions for businesses and individuals. DFS Cargo Specializing in both local and international shipping, DFS ensures your goods are delivered safely and on time. With a commitment to customer satisfaction, they provide door-to-door services, competitive pricing, and secure handling of all types of cargo. Whether you're shipping small packages or large freight, DFS Cargo Service makes logistics easy, giving you peace of mind with every delivery.

ReplyDeleteMake calls and track your fitness with ease using the multi-functional F800 Watch: F800 Watch. A complete health and connectivity solution.

ReplyDeleteYour relentless pursuit of excellence is truly commendable. It's clear that your hard work pays off. huawei distributor in dubai

ReplyDeleteTake control of your fitness and overall well-being with the health watch, designed to provide real-time health insights and activity tracking.

ReplyDeleteFrom workout plans to nutrition advice, joeme fit supports you with tools that make achieving your health goals easier.

ReplyDeleteWelcome to Orange Foods Expert, where quality meets convenience. Since our founding in 2018, we’ve been committed to delivering the finest frozen foods in Pakistan. As a trusted frozen foods manufacturer, we proudly serve major cities like Lahore, Islamabad, and Faisalabad, offering organic, high-quality products with integrity.

ReplyDeleteLooking for a stylish yet practical smartwatch? Check out the F400 watch, offering precise health monitoring and sports data tracking.

ReplyDelete探索為什麼玩家都信任gameone HK,享受頂級遊戲和無與倫比的娛樂體驗。

ReplyDeleteReady to start your fitness journey? Joeme APP download today for personalized workout plans and expert guidance!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteStay connected and monitor your health all day long with the F800 watch, a smartwatch built for the modern lifestyle.

ReplyDeleteMarrakech Desert Trips offers an unforgettable 3-day desert tour from Marrakech , exploring the stunning landscapes of the Atlas Mountains, Berber villages, and the vast Sahara Desert. Enjoy camel trekking, a night in a desert camp under the stars, and visits to iconic sites like Ait Benhaddou and the Dades Valley. Experience authentic Moroccan culture and breathtaking scenery throughout your journey.

ReplyDeleteHousing disrepair in the UK refers to issues within a rental property that affect its safety, comfort, or habitability, such as damp, leaks, or broken heating systems. Tenants have legal rights to live in a safe and well-maintained home, and landlords are responsible for carrying out necessary repairs. If a landlord fails to address disrepair, tenants can take legal action to request repairs or seek compensation. This profile provides information on understanding housing disrepair, the steps tenants can take to resolve issues, and their rights under UK law to ensure safe and habitable living conditions.

ReplyDelete來到game one hongkong,進入創新的遊戲世界,感受獨一無二的娛樂魅力!

ReplyDeleteDiscover top-notch feedback about our cleaning solutions on maid to clean reviews, and see why customers trust us for a spotless home!

ReplyDeleteExplore Creatix Digitals for innovative digital marketing solutions.

ReplyDeleteDownload the Joeme APP now to easily manage your fitness goals, track progress, and get the most out of your Joeme devices.

ReplyDeleteIf you need guidance from employment lawyers in Edmonton, many offer free consultations to get started. This ensures you understand your legal position and options before committing to any services. It's an excellent way to get informed about your case.

ReplyDelete了解 GameOne 娛樂城: GameOne 娛樂城。頂級娛樂體驗,結合多元遊戲選擇,讓您沉浸於無窮的遊戲世界。

ReplyDeleteDeep tissue massage Asheville Carolina DeepFeet offers expert deep tissue and relaxation massage therapy in Asheville, helping clients relieve pain, reduce stress, and restore balance. Experience the healing power of skilled bodywork for ultimate relaxation and well-being.

Deletebest truck tires in Louisville

ReplyDeleteDiscover the Shillong Teer formula, a powerful tool for predicting winning numbers. Learn how to calculate your bets effectively and increase your chances of success. Click here to learn more about calculation of teer formula

ReplyDeleteThe Woodlands Yard Greetings offers unique and customizable yard sign rentals for birthdays, anniversaries, graduations, and special celebrations in The Woodlands, Texas. Their vibrant and eye-catching displays add a fun and memorable touch to any occasion. card my yard

ReplyDelete探索 GameOne 的精彩世界:GameOne。沉浸在刺激的遊戲體驗中,享受無限樂趣。

ReplyDelete體驗頂級遊戲娛樂,盡在 GameOne Casino:GameOne Casino。享受多種刺激遊戲,沉浸於精彩的娛樂世界。

ReplyDelete發掘 GameOne HK,享受極致遊戲體驗:GameOne HK。讓您感受創新的娛樂魅力。

ReplyDeleteWarehouse Block Lexington is a vibrant destination in Lexington, KY, featuring a unique mix of local shops, restaurants, and businesses. This revitalized district offers a blend of shopping, dining, and community experiences, making it a must-visit spot for locals and tourists alike. Shopping in Lexington KY

ReplyDeleteExplore the F67 Smartwatch with IP68 waterproof rating: F67 Watch. Designed for durability and style.

ReplyDeleteIntimus offers a range of high-quality paper shredder , including industrial paper shredders and heavy-duty paper shredders, designed for secure and efficient document disposal. Whether you need the best paper shredder for office use or a commercial paper shredder for large-scale operations, Intimus provides reliable solutions for data protection.

ReplyDeleteVer StoryAnonimo es una plataforma que facilita la visualización de historias de Instagram de manera anónima. Con esta herramienta, puedes disfrutar de contenido sin que los creadores sepan que estás viendo sus historias, lo que te brinda una mayor libertad al navegar por la red social.

ReplyDeleteI've been using Mello Power, and it’s incredible how fast it charges my devices. Highly recommend checking out their products!

ReplyDeleteArtists and designers use the tool to generate numeric patterns from words. These patterns can inspire digital art, music, or creative projects.

DeleteIt’s a bridge between language and visual creativity. Visit the tool website

theBestBusinessAdvice is a resource hub for digital entrepreneurs worldwide, sharing valuable insights on long-term business goals and effective management practices to drive growth

ReplyDeleteThe rise of the local AI video generator is transforming how individuals and businesses create video content. Unlike cloud-based solutions, local AI video generators run directly on your device, offering enhanced privacy, faster processing, and greater control over your projects. These tools use advanced algorithms to automate video editing, generate animations, and even create voiceovers, making high-quality video production accessible to everyone

ReplyDeleteFind the best Canadian scholarships for international students 2026 and pursue your studies in one of the most welcoming destinations in the world. Canada offers numerous fully funded programs covering tuition fees, living expenses, health insurance, and travel allowances for deserving international students. Opportunities are available for undergraduate, master’s, and PhD programs in leading Canadian universities. With its high academic standards and diverse cultural environment, Canada attracts thousands of students every year. Prepare for 2026 by learning about eligibility criteria, deadlines, and step-by-step application tips. Secure your chance with Canadian scholarships for international students 2026 today.

ReplyDeleteBastiaankollen.com is de persoonlijke website van Bastiaan Kollen, een mindset- en high-performance coach die mensen helpt hun mentale potentieel te ontgrendelen en een buitengewoon leven te creëren op het gebied van gezondheid, rijkdom, geluk en prestaties. financiële vrijheid coaching Utrecht

ReplyDeleteBaymingo Boat Rentals offers top-notch boat rental services in Fort Lauderdale. With a variety of boats and yachts available, Baymingo ensures an unforgettable experience on the water, whether you're planning a sightseeing tour, a celebration, or a relaxing day out. haulover sandbar

ReplyDeleteDiscover the wonders of China with our expert travel guides. Explore ancient landmarks, vibrant cities, and breathtaking landscapes while uncovering local culture, cuisine, and hidden gems. Make your travel China adventure unforgettable with tips, itineraries, and insider advice.

ReplyDeleteMaster Your Mental Game is een uitgebreid programma van Bastiaan Kollen dat je helpt mentaal sterker te worden, zodat je onder druk meer focus, vertrouwen en plezier ervaart — vooral binnen tennis, maar ook in andere aspecten van je leven. Het combineert mindsettraining, workshops, clinics en coaching om innerlijke blokkades te doorbreken en je te laten spelen én leven vanuit kracht en vrijheid sport mindset coach

ReplyDelete