As always, New Jersey's governor releases his overall budget proposal two days prior to the State Aid Notices, which contain how much money is being slated for every district.

Although we don't have the critical district-specific state aid numbers, the budget speech itself and the 2021 Budget In Brief provide information that every NJ budget watcher needs to know.

Phil Murphy's FY2021 Budget Proposal is a $40.8 billion package, of which $16.3 billion will be for PreK-12 education, or 40% of the budget, not counting lottery money.

Education getting 40% of the budget is stable from the last few years, although it should be noted that as late as 2001 education spending was only 31% of the budget.

The $16.3 billion for education is 88% of the Property Tax Relief Fund, and that is a record high. By contrast, in the 1990s, education spending was only 70% of the Property Tax Relief Fund. See below for more discussion of the Property Tax Relief Fund.

The increase in education spending is based on an assumption that income taxes will increase by $993.8 million (hereinafter rounded up to $1 billion). Of that $993.8 million increase, $ $500 million is organic revenue growth and $494 million comes from lowering the threshold for the 10.75% bracket from $5 million to $1 million.

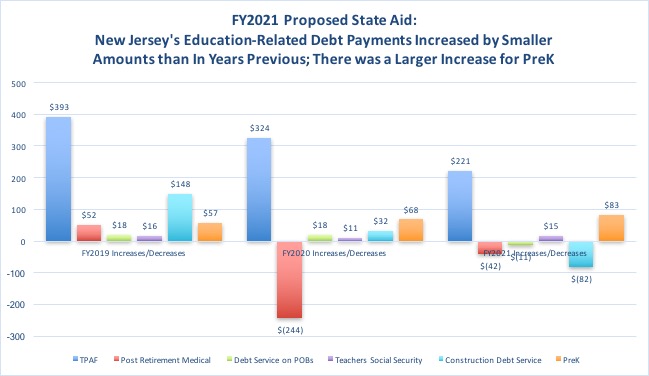

The FY2021 budget had been eased by Phil Murphy's ability to find $42.2 million in savings in post-retirement healthcare, which is impressive considering there were $244 million in savings in Post-Retirement Healthcare last year.

Murphy's increases for TPAF is $220 million, the smallest increase in recent years, compared to $324 million increase for FY2020 and increases of about $400 million in FY2019 and the late Christie years. There were also reductions in debt service for Whitman-era Pension Obligation Bonds and School Construction Debt Service.

Of the $16.3 billion for education $ 9.0135 billion is proposed for K-12 opex aid, aka "Formula Aid," a net increase of $336.5 million (+3.9%), however, underaided districts will gain more than $336.5 million due to the redistribution of an unknown amount of Adjustment Aid, but which should be at least $150 million.

The $336.5 million increase would have been $386.5 million if it weren't for $50 million in "Stabilization Aid" for overaided districts and had that money gone to underaided districts. The $50 million could also have been put in Extraordinary Aid, which is slated to get an increase of $0.

PreK aid will increase to $889.2 million, up $82.7 million (+10.3%) from FY2020. The increase for

PreK is greater than the combined increases for miscellaneous items like Extraordinary Aid, which is flat-funded at $250 million, Debt Service Aid (+$9.6 million), "Other Aid" (+$22.4 million), as well as Municipal Aid, Direct Tax Rebates.

School Building Aid is cut by $23.1 million.

No Increases for Other Property Tax Relief Fund Items

In continuation of recent years, municipal aid and Direct Tax Rebates are flat-funded from FY2020, although the Murphy administration did raise the deductability of property taxes from $10,000 to $15,000 for FY2020, and that is considered a form of Direct Tax Rebates in the Budget-In-Brief, although it is heavily tilted to wealthy New Jerseyans and it is not literally a "direct rebate."

"Other Local Aid" is being increased by $70 million, which is the first substantial increase in years, although it is unclear where that money is going, of of my writing. (It *could* be part of the community college increase, in which case it is not a clear-cut example of "property tax relief" so much as additional spending.)

----

No comments:

Post a Comment