Connecticut’s political class is at war with itself now over what is responsible for General Electric’s decision to move its corporate headquarters from Fairfield, Connecticut to Boston, Massachusetts' South Seaport. Republicans emphasize that Connecticut's high taxes pushed GE out, but Democrats argue that it was Boston's economic ecosystem that pulled GE away.

Although this is a blog about New Jersey education aid, as we will see, the Nutmeg State's saga with GE has many parallels for the Garden State too.

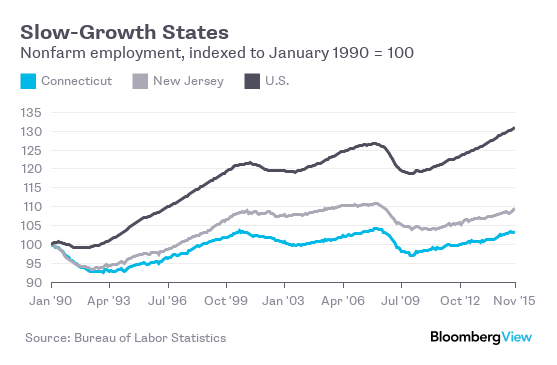

Connecticut, like New Jersey, has a pension system that is less than 50% funded. Connecticut's mean income is very high, but its economy has been stagnant for decades and has been growing by less than 1% a year. The Tax Foundation ranks Connecticut as having the country's 44th worst taxes, just a few notches above New Jersey, which comes in 50th. Governing Magazine ranks Connecticut as the country's most indebted state per capita. Moody's ranks Connecticut's indebtedness second worst. Connecticut the country's second most indebted. Connecticut also has zero or negative population growth and is losing its young especially.

Connecticut is also a suburban state, without a large, prosperous city.

|

| Source: http://www.bloombergview.com/articles/2016-01-14/connecticut-and-new-jersey-rich-states-poor-economies |

To respond to Connecticut's huge projected deficit, Gov. Daniel Malloy proposed in the spring of 2015 $1.5 billion in tax increases for the next two years, of which $700 million came from increased taxes on corporations. This tax increase came only four years after Daniel Malloy passed another $1.5 billion tax increase in 2011.

The business tax increases are complex, but, included an increase in the sales tax on data processing from 1% to 3%, a reduction in tax credits, and a change to Connecticut's tax accounting rules to require something called "Combined Reporting."

Combined Reporting (also called "Unitary Reporting") is a policy that prevents corporations from using subsidiaries to shift profits from high tax states to low tax states. In a sense, Combined Reporting closes a loophole, but corporations also say that it is unfair because it taxes businesses on income genuinely earned in other states.

Whatever the merits of Combined Reporting, GE derived little revenue from Connecticut subsidiaries and paid next to nothing in Connecticut state taxes. Since Connecticut has a 9% corporate income tax (tied with NJ for the 6th highest in the US) and it did not have a "Throwback Rule," the imposition of Combined Reporting was tantamount to a large tax increase for many multistate Connecticut companies.

You can argue til the cows come home that Combined Reporting is fair and budgetarily necessary, but GE did not care and immediately announced that it was considering moving to a state with a "more pro-business environment."

In a press release:

FAIRFIELD, CT – June 1, 2015 – Reports that Connecticut officials intend to raise taxes by another $750 million dollars [for one year] are truly discouraging . Retroactively raising taxes again on Connecticut’s residents, businesses and services makes businesses, including our own, and citizens seriously consider whether it makes any sense to continue to be located in this state. The Connecticut economy continues to struggle as other states offer more opportunities and a better environment for business growth. It is essential that Governor Malloy and legislative leaders find a more prudent and responsible path forward for Connecticut and its citizens in their current budget negotiations.GE executives presumably did not want to be in a location whose top income tax bracket to was 6.99%, either, but they were silent in public on this.

Gov. Malloy scaled back his tax increases by over $200 million, agreed to delay by one year the Combined Reporting imposition, cancelled the data processing tax, and agreed to give GE very large tax write-offs, but GE elected to leave anyway.

Republicans said that GE was concerned about the long-term tax picture and thus Connecticut's special offers to GE were not enough to keep the company in Fairfield.

Much later (in Dec 2016) Dannel Malloy confirmed that GE was worried about out-of-control CT pension costs:

The governor acknowledged that when he tried to convince General Electric officials to keep their headquarters in Connecticut, company leaders expressed concern over the rapidly escalating pension bill. GE announced in January 2015 that it would move its headquarters from Fairfield to Boston.

As Republican state rep John Frey said “They just wanted the taxes that were imposed to go away. They didn’t go away entirely. They were hoping that that the root cause – unfunded pensions – would be addressed, and they weren’t. Their confidence in Connecticut government was shaken.”

Connecticut Democrats explain the relocation by saying it is about a reorientation in corporate strategy where GE is moving away from finance and towards technology and that therefore Boston, with its unmatched constellation of top-flight universities, was a superior place to be located than suburban Connecticut. Liberals and many neutral commentators also state that it would be advantageous to GE to be 15 minutes from Logan Airport and a flight anywhere in the world.

Democrats can cite GE itself, which had spent most of 2015 protesting planned tax increases in Connecticut, for not mentioning taxes at all in its final relocation announcement.

GE perhaps did not want to public draw attention to the fact that it paid no Connecticut business taxes, so in its relocation announcement, GE praised Boston's diverse, educated workforce as the primary motivation to relocate:

“Today, GE is a $130 billion high-tech global industrial company, one that is leading the digital transformation of industry. We want to be at the center of an ecosystem that shares our aspirations. Greater Boston is home to 55 colleges and universities. Massachusetts spends more on research & development than any other region in the world, and Boston attracts a diverse, technologically-fluent workforce focused on solving challenges for the world. We are excited to bring our headquarters to this dynamic and creative city. ”Both Republicans and Democrats are correct in my opinion, since there are two decisions that GE made here. The first decision was to leave Connecticut in the first place. CEO Jeffrey Immelt said that GE had been considering a move for three years, but did not initiate a formal review until June, when the tax increases were proposed. The second decision was to relocate to Boston. The first could be caused by Connecticut's terrible tax burden, the second could be caused by Boston's many workforce advantages.

Some might diminish the tax motivations of the move because Massachusetts is a "high tax" state, but this belief about Massachusetts is false.

It is a myth that Massachusetts is "Taxachusetts." Massachusetts had high taxes a generation ago, but today Massachusetts' taxes are AVERAGE.

Massachusetts is ranked by the Tax Foundation as only having the 25th highest taxes in the country. Indeed, Massachusetts' personal income tax is a flat 5.1%, which is the 13th lowest in the USA. Massachusetts' 8% corporate income tax is higher than average, but still a full percentage point lower than Connecticut's (or New Jersey's).

Also, Massachusetts' pension system is over 70% funded. That isn't great, but it is much better than Connecticut's ratio and thus GE could have some confidence that there would not be another round of huge tax increases in another four years. By contrast, even after Connecticut's latest round of tax increases, there is still a $1.7 billion deficit forecast for the next two year budget cycle.

The New Jersey Connection

There are a several aspects of GE’s departure from Connecticut that are relevant to New Jersey aside from the overriding fact that New Jersey also has an impossible pension crisis.

First, New Jersey also has lost some high-profile businesses to Massachusetts either entirely or in part. Sanofi Aventis reduced its Bridgewater presence in favor of Cambridge, Massachusetts. Bristol-Meyers Squibb also moved from New Jersey to Cambridge. Other New Jersey pharmaceuticals companies like Johnson & Johnson, Novartis, and Pfizer have passed up opportunities to open new centers in New Jersey in favor of Massachusetts.

Some New Jerseyans might argue that the "Second Massachusetts Miracle" disproves the conservative contention that high taxes kill jobs and that therefore New Jersey can and should increase its own taxes.

The New Jersey Policy Perspective provides an example of this argument:

... state corporate income taxes represent a tiny share of business costs and are far from being the main driver of business location and investment decisions. Total state and local taxes paid by corporations averageless than three percent of corporate expenses, with state corporate income taxes representing less than 10 percent of that three percent, on average. It is highly unlikely that combined reporting would have enough impact on corporate bottom lines to affect decisions about whether to invest in New Jersey. Corporate executives typically rank taxes low on their list of site selection factors, well below the availability of a high-quality workforce and transportation infrastructure – assets that are harder to pay for when states are deprived of revenue through corporate tax avoidance.Indeed, the conservative contention is wrong as a blanket statement, but Massachusetts is not a high-tax state anymore and Massachusetts' university-industrial complex and urban (ie, Boston) advantages cannot be duplicated. In other words, a business pays a lot to be located in Boston, but they get back a lot too.

Some New Jerseyans might compare New Jersey to New York State, which does indeed have very high taxes and yet is dramatically outperforming New Jersey, but this is a specious comparison because three-quarters of the growth New York State is concentrated in New York City.

The rest of New York State is not doing well. Upstate New York's economic problems are well-known and population loss continues, but even Long Island's economy is anemic and highly dependent on New York City commuters.

High-growth can exist with high-taxes, but only if other conditions are met, such as a "creative and dynamic" city and a highly-educated, tech savvy workforce. New Jersey lacks the former completely and does not possess the latter in comparison to high-growth places like Boston, New York City, and parts of California. New Jersey is losing the young, educated, innovative people that corporations want to employ.

Second, the imposition of Combined Reporting is also highly relevant to New Jersey because there are progressive groups who are calling for New Jersey to impose Combined Reporting too.

Under combined reporting New Jersey could collect a substantial amount of revenue it is legally owed. Combined reporting could boost corporate tax collections by 10 to 20 percent, bringing in hundreds of millions of dollars that would help preserve education, health care and other services that boost the state’s economy.The New Jersey Policy Perspective estimates that Combined Reporting could bring in $235-$470 million in revenue annually.

The CWA echoes the NJPP's call for Combined Reporting (plus other tax hikes, including a 1.5% corporate tax surcharge that would give NJ the second highest corporate taxes in the US after Iowa and the highest among Combined Reporting states.)

|

| Source: http://taxfoundation.org/sites/taxfoundation.org/files/docs/TaxFoundation_FF463.pdf |

However, the NJPP's estimate assumes that higher corporate taxes won't drive away a single business. Even if New Jersey corporations are bluffing on leaving the state, a governor doesn't know that with total confidence and NJ corporations could use the threat of relocation to extort large tax concessions for themselves, as GE did from Connecticut before GE left anyway.

Also, New Jersey (like Connecticut) has a structural budget deficit primarily due to pension payments. Connecticut's 2011 $1.5 billion tax increase was followed only four years later by another $1.5 billion increase and there is no end in sight to Connecticut's budget problems. If New Jersey were to raise taxes it would only temporarily close the budget gap.

The liberal contention that educated workforce = strong economic growth and therefore we should tax ourselves to long-term prosperity has some significant exceptions. New Jersey and Connecticut, even if they are behind Massachusetts, both have highly educated populations and prestigious colleges that other states would love to have, and yet, as we have seen, their economies have lagged the national average for years.

Conservatives don't have it right either about having low taxes = a great economy either. New Jersey needs to invest more in education and infrastructure, but that investment should be in research-centered higher education more than the exceptionally high Pre-K and K-12 spending called for in SFRA to satisfy the benighted NJ Supreme Court's Abbott obsession. Maybe it's time to finish the Hudson-Bergen Light Rail to help Hudson County and Bergen County become the kind of exciting urban environments where Millennials want to live and where economic growth is happening?

Conservatives don't have it right either about having low taxes = a great economy either. New Jersey needs to invest more in education and infrastructure, but that investment should be in research-centered higher education more than the exceptionally high Pre-K and K-12 spending called for in SFRA to satisfy the benighted NJ Supreme Court's Abbott obsession. Maybe it's time to finish the Hudson-Bergen Light Rail to help Hudson County and Bergen County become the kind of exciting urban environments where Millennials want to live and where economic growth is happening?

In conclusion, Connecticut's economic stagnation and budgetary problems belie the claim that New Jersey's problems are all due to Chris Christie and that the state would somehow be doing significantly better if we had a Democratic governor. GE's departure from Connecticut - which was at least partly due to taxes combined with a desire to be in an exciting, dynamic city - should also give anyone caution that New Jersey can use tax increases solely to get itself out of its budget crisis. At least some businesses will leave and take their taxes and spending with them.

And fully funding SFRA, which the Education Law Center glibly demands in order to deflect proposals that Adjustment Aid be eliminated, is preposterous.

And fully funding SFRA, which the Education Law Center glibly demands in order to deflect proposals that Adjustment Aid be eliminated, is preposterous.

Real pension reform (ie, reductions to current retirees) is necessary.

--------

See Also: Gutting Pension Reform = Gutting State Aid

--------

See Also: Gutting Pension Reform = Gutting State Aid

No comments:

Post a Comment