There are numerous problems with New Jersey’s Abbott funding system, but there is no facet of Abbott more problematic - nay, morally obscene - than the fact that Hoboken, New Jersey’s richest K-12 district, remains an Abbott.

Although Hoboken is a uniquely high-resource, high-aid district, the continuing overaiding of Hoboken amidst the severe underaiding of the rest of the state exemplifies the rigidity of New Jersey distribution of education aid and its failure to adjust to changing economic realities.

Hoboken is Rich

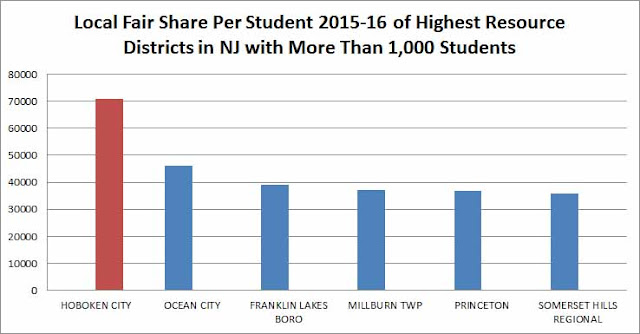

If you thought that Princeton, Millburn, or Paramus had a lot of money for schools, Hoboken dwarfs them all.

Hoboken now has $13.26 billion in equalized valuation, the fourth highest in New Jeersey, but only 2,705 K-12 students, or $4.9 million a student. Hoboken has so much ratables, so few kids, and gets so much state aid that its tax rate is 0.3237. This means that someone with a condo with a $1,000,000 market value would pay $3,237 in school taxes a year. Even with that tiny tax rate, Hoboken spends $22,199 per student, the highest of any K-12 district in NJ other than Asbury Park.

If Hoboken had just a 1.0 school tax rate it would raise $130 million a year, enough to send every Hoboken child to a Swiss boarding school.

Just how high is $4.9 million a student? Paramus, an upper middle class town that is home to the biggest shopping mecca of New Jersey, “only” has $2.2 million per student. Princeton, with its mansions and corporate office parks, “only” has $1.9 million. Millburn, which also has mansions and a large mall, “only” has $1.7 million per student. (Yes, that 2,705 figure includes Hoboken’s charter school students).

In income Hoboken isn’t an outlier like it is in property wealth, but its median income is $108,000, which is similar to Princeton and Scotch Plains, two more towns not considered poor by anyone.

However, Hoboken's Total Income, which is used by the DOE to calculate Local Fair Share, is $3.6 billion for 2015-16, the fifth highest in New Jersey.

Since the formula for Local Fair Share is:

Equalized Valuation x 0.014909959 x 50% + District Income x 0.052921406 x 50%

$12,431,717,099 (the 2015-16 amount) x 0.014909959 x 50% + $3,567,442,637 x 0.052921406 x 50%

Hoboken's Local Fair Share works out to a staggering:

$187,075,236

This is the fourth highest in New Jersey, after Jersey City, Edison, and Toms River and ahead of Newark, all of whom have much, much larger student populations.

Hoboken Pulls in Lots of Aid

Its unequaled wealth would allow Hoboken to have low taxes and high school spending no matter what, but on top of all that local wealth, Hoboken receives $20.8 million in state aid for its schools from taxpayers statewide; $10.6 million for K-12 and $10.2 million in Pre-K aid. Hoboken’s $20.8 million in aid is three times higher than West Orange’s $6.9 million, even though West Orange has almost three times as many children and an $850,000 per student property base.

Hoboken’s K-12 aid works out to $4,200 a student, dramatically more that what working class districts with average property valuations like Clifton and Red Bank Boro get. Even these disparities underestimate how privileged Hoboken is, since as an Abbott it gets its capital improvements paid for by state taxpayers.

To be fair, Hoboken doesn't receive more aid than every district that is lower-resource than it is, but it receives more aid than many.

Hoboken's aid aid combined with its immense property wealth puts it in a league of its own for student spending.

The other $58,000 in new money is for Pre-K. Hoboken is an Abbott and therefore the New Jersey Supreme Court requires that state pay for “free” Pre-K for all three and four year old children living there, no matter how wealthy their parents are. This fact means that the children of investment bankers in Hoboken receive two years of “free” Pre-K. While the state has tens of thousands of children living in poverty outside of the Abbotts, they usually have no Pre-K access at all. Clifton, Belleville, and Bloomfield receive $0, but their low-income residents, as state taxpayers, pay for “free” Pre-K in Hoboken.

And if that isn't bad enough, $255,000 of Hoboken's aid is for students who aren't even there via Chris Christie's "Additional Adjustment Aid" program. Additional Adjustment Aid is given to Interdistrict Choice districts that once lost Choice students. Rather than let any district lose aid, Christie lets Choice districts keep their total aid amount by redirecting the lost Choice Aid via "Additional Adjustment Aid."

What’s more, Hoboken also has hundreds of millions of dollars of ratables hidden from the state’s aid formula behind PILOT agreements. When a town grants a development a PILOT town receives money from the building’s owner that are akin to taxes, but in the eyes of the state’s formulas for school aid, the PILOTed buildings are invisible and are equivalent to a tax-exempt church, hospital, or private school, ie, it doesn’t count as property wealth.

However, residents of PILOTed properties get all the same privileges of other Hoboken/Abbott residents, including two years of “free” Pre-K paid for by taxpayers statewide.

Comprehensive and up to date figures are difficult to come by, but the state comptroller in 2010 gave a “conservative” assessment for Hoboken’s PILOTed property at $298 million (which is the official valuation, not the Equalized valuation). Even at Hoboken’s extremely low school tax rate that property would produce over $1,000,000 for the schools a year.

Hoboken’s original status as an Abbott goes back to its poverty and low resources in the early 1980s, when the Abbott lawsuit emerged and when Hoboken was indeed one of NJ’s poorest districts.

Hoboken’s student population has not changed as dramatically as its ratable situation, but change has occurred and Hoboken’s students are now 49% FRL-eligible, which is not significantly above the state’s average of 36% FRL eligible. 95% of Hoboken students speak English at home.

Hoboken’s students still more disadvantaged than average , but this is financially irrelevant. The point is that at a 0.36 tax rate and $4.2 million in property valuation per student, Hoboken easily has the local resources to fund its schools, including Pre-K. When NJ is in a budget crisis and cannot increase aid, state aid is zero sum and that every dollar that Hoboken clings to is one dollar less that is available to children in the rest of New Jersey. If poor children in Hoboken deserve extra resources than poor children in other districts with even more economic disadvantage and barely a tenth of Hoboken’s property wealth deserve it either more.

Additionally, it needs to be underscored that Hoboken's public student population is proportionally miniscule. Hoboken's total population is 52,000, but it only has 2,600 students (yes, that includes students in charters), or barely 6% of its total population.

This is a third of New Jersey's average.

Hoboken's tiny student population means that even though the student population may proportionally have a high FRL-eligible rate, there are few FRL-eligible students there period.

Many diverse suburbs in New Jersey actually have more or almost as many FRL-eligible students than Hoboken (plus many non-FRL eligible students.) These districts are not remotely as rich as Hoboken and yet get far less aid.

| Total Student Pop. | % FRL Eligible | Number of FRL-eligible students | Amount of K-12 State Aid | |

| Hoboken | 2,639 | 49% | 1,293 | $10,656,560 |

| Montclair | 6,743 | 22% | 1,483 | $6,722,691 |

| South Orange-Maplewood | 6,846 | 20% | 1,369 | $4,216,218 |

| Teaneck | 4,044 | 30% | 1,213 | $5,266,235 |

| West Orange | 7,026 | 38% | 2,670 | $6,950,527 |

Hoboken's ELL percentage is only 1%, the lowest percentage in Hudson County. The state average is 5%.

Conclusion

Since the recession hit in 2010 and state aid has be cut, numerous critics, especially Save Our Schools NJ and the Education Law Center, have slammed the state and Chris Christie for underfunding the state’s school aid law, the School Funding Reform Act of 2008 (SFRA).

Underaiding is a valid criticism (if one is oblivious to the pension crisis) but the problem with state aid in New Jersey isn’t only underfunding, it is the rigidity of the distribution. Powerful legislators and special interests prevent districts from losing aid, no matter how unjustified that aid is in light of more acute budget problems elsewhere.

Hoboken is not the only district in New Jersey that is overaided. There are over 200 districts that get more than 100% of what SFRA recommends and a few dozen that would lose aid even if SFRA were funded at capped aid levels. Hoboken only stands out because of its extraordinary wealth and the scale of its overaiding. The contrast between poverty stricken families in non-Abbotts getting nothing for Pre-K while affluent families in Hoboken with six-figure incomes getting “free” Pre-K is grotesque and just one of the most unfair results of the Abbott decision.

See: "Dear Hoboken, Your Charter Schools are Not Bankrupting You."

See: "Even Demographically, Hoboken has no right to be an Abbott."

No comments:

Post a Comment