New Jersey's 2022-23 state aid distribution is another big step towards state aid fairness.

Thanks to the addition of $650 million of new K-12 opex aid plus $186 million in redistributed Adjustment Aid, underaided districts will gain $836 million. Their deficit will shrink from $1.2 billion in 2021-22 to only $618 million for 2022-23. The overaided districts will have a surplus of $232 million.

The net deficit, ie deficit minus surplus, is only $386 million.

Below is an analysis of 2022-23 state aid and education spending, organized in the following way:

- Details About the Underaided.

- The Education Adequacy Report Misses the late 2021-22 Inflationary Spike.

- Details About the Overaided.

- Other Education Spending.

- Local Fair Share Disparities.

As usual, I've put all the data available on a spreadsheet:

2022-23 NJ State Aid.

Likewise, the surplus for the overaided districts will shrink from $362 million in 2021-22 to $232 million in 2022-23. Since 2017-18, New Jersey has redistributed $687 million.

| Amount Redistributed |

| 2022-23 | $186 million |

| 2021-22 | $193 million |

| 2020-21 | $155 million |

| 2019-20 | $90 million |

| 2018-19 | $32 million |

| 2017-18 | $31 million |

Without state aid redistribution, the deficit would be $1.3 billion.

Because S2 calls for a 76% reduction of Adjustment Aid in 2023-24, this means that at least $176 million in Adjustment Aid will be redistributed in 2023-24, which, combined with the state aid increases we've seen in the last few years, brings 100% state aid for all districts within reach.

Details About the Underaided

Counting vo-techs and non-operating districts, there are 391 underaided districts with a total enrollment of 961,649, or 74% of the total.

In total dollars, the district with the largest deficit is Newark, at -$98,901,597, or -$1,799 pp. Newark's state aid has risen from $742 million in 2017-18 to $1 billion in 2022-23, but its deficit was originally so large ($146 million) and its Adequacy Budget has grown so much, that the deficit has not yet been eliminated despite getting $258 million in additional state aid.

The districts with the largest deficits per pupil are Cumberland County Vo-Tech at -$3,109 pp and Atlantic City at -$3,057 pp. Cumberland County Vo-Tech and Atlantic City are the only two districts with per pupil deficits over $3,000 per pupil. Their deficits are large, but in 2017-18 Atlantic City and Bound Brook

had deficits of over $8000 per student.

In percentage terms, Loch Arbour is the most underaided, but it 69%, $23,359 out of $33,685. No other district is below 70%. Only five other districts are even below 80%.

This is a huge contrast to 2017-18, when 96 districts got less than 50% of their recommended state aid. It's a huge contrast to when Chesterfield got only 10% of its state aid target.

The Education Adequacy Report Misses InflationSecond reason this year's deficit decreased so much is that the triannual

Education

Adequacy Report's inflationary adjustment stopped in June 2021. Hence, SFRA's Base Payment per pupil barely budged, from only $12,177 per student to $12,451 per student. (see at right)

From June 2021 to February 2022 inflation has been 4.4% and is running even faster now.

This is an important fact because it means aid increases to the underaided are smaller than they initially appeared and aid cuts are larger to the overaided.

Since New Jersey's projected enrollment fell from 1,316,864 in 2021-22 to 1,304,773, the statewide Adequacy Budget did not increase very much despite the inflationary adjustment.

Details About The Overaided

The 201 overaided districts have 343,124 students, or 26% of the total. Their $232 million surplus is the smallest it has ever been.

Asbury Park's state aid loss merits attention: In 2019-20 Asbury Park's surplus was $22.9 million, or $11,026 per student. Now it is only $7 million, or $3,653 per student. Asbury Park's K-12 state aid per student has fallen from $25,000 per student (it was the

highest spending K-12 district in the US), to only $15,176 per student.

Jersey City's aid loss merits attention too. In 2018-19 its surplus peaked at $171 million, or $5542 per student. Now it is only $56 million, or $1903 per student. In total K-12 opex aid, Jersey CIty's aid has gone from $419 million to $185 million, a loss of $234 million.

Jersey City has actually lost more than $115 million, but it has a constant growth in tax base which converts its Equalization Aid to Adjustment Aid, which is then phased-out per the process laid out in S2. In 2022-23 Jersey City

will still be eligible for $82 million in Adjustment Aid.

The redistribution of state aid for 2022-23 was not something I was sure would happen after the Biden administration, acting on a vicious Education Law Center complaint,

interpreted a provision in the ARP to prohibit state aid cuts to high-poverty districts (which Hoboken and Jersey City technically are), but apparently the Murphy administration has found a way to continue aid redistribution.

Other Education Spending

New Jersey's budget for FY2023 is going to be $49 billion, of which $19.16 billion, or 39%, is considered school aid (see

page 58). That ~40% percentage has been constant for the last decade, although it's worth noting that in 2001 education spending was only 31% of the budget.

On the other hand, education spending actually exceeds the income tax's $18.15 haul due to education getting money from the lottery and a half cent of the sales tax. Education spending has come to be nearly synonymous with the Property Tax Relief Fund, although the new

ANCHOR credit will represent a long-overdue increase for direct tax rebates.

K-12 opex aid is just $9.9 billion, so 52% of the total education spending. Here are some looks at the other major education spending categories.

|

| Amounts in millions. |

Extraordinary Aid will be $400 million.

Below are the net changes year over year for the above categories. As you can see, the major debt categories of Teacher Pension And Annuity Fund, post-retirement healthcare, construction debt, and Pension Obligation Bonds did not require substantial increases and TPAF and Construction Debt service actually fell. This is a tremendous contrast to the past, when TPAF payments increased by over $400 million in some years.

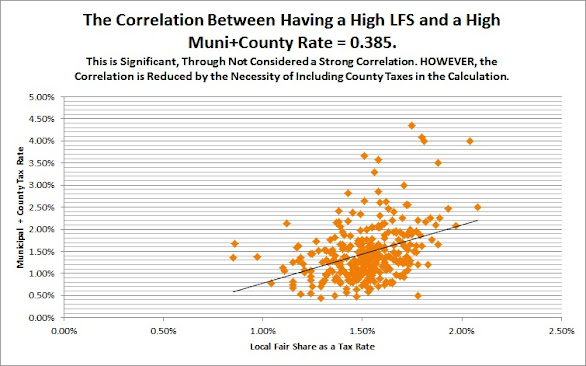

Disparities in Local Fair Share

Readers of this blog know that New Jersey's

Local Fair Share is NOT a constant tax rate due to it being based 50% on Equalized Valuation and 50% on Aggregate Income. Thus, towns where residents live within their means in properties that are inexpensive relative to income must pay higher school taxes, as well as property owners in towns without non-residential property and vacation homes.

The decrease in Local Fair Share also decreased the number of districts who are ineligible for Equalization Aid from 272 in 2020-21 to 260 in 2022-23. (Note, in SFRA's first year only 180 districts were ineligible for Equalization Aid).

The extremes of LFS are here:

The 2022-23 Local Fair Share formula is:

(0.013089410 x Equalized Valuation + 0.045610629 x Aggregate Income)/2

Conclusion

FY2022-23 was another good year for K-12 opex aid equity. We have come a long way from the time when New Jersey's state aid formula was inoperative in the early 2010s (which was Christie's fault) and when huge education-debt increases crowded out K-12 opex aid increases (which was not Christie's fault). If the state's revenues continue to grow, in 2023-24 it's possible that every district will reach 100% funding.

SFRA is always a work in progress and the legislature is moving to revamp the state aid law. If it does

so, I hope it includes the following.

- The tax cap must be loosened for under-Adequacy non-Abbotts who are losing state aid.

- The state must move up the timetable on its inflationary adjustment due to the 2022 Education Adequacy Report stopping its inflationary measurement in June 2021

- New Jersey should base its Local Fair Share solely on taxable property.

Overall, Phil Murphy has been a positive surprise on state aid. Although I knew that he would increase K-12 opex spending, I did not expect him to prioritize fairness of the distribution as much as he has.