What a different world February 25th, 2020 was, the day Gov. Phil Murphy gave his budget speech for FY2021.

There wasn't Coronavirus. There wasn't talk of state bankruptcy. There wasn't Depression-level unemployment. Phil Murphy proposed a FY2021 Budget with 4.3% (+$1.7 billion) revenue growth, for which PreK-12 education was slated for a boost of 3.7% (+$577 million).

We all understand today's reality and the crashing of state revenues. New Jersey has already cut $1 billion from its remaining FY2020 budget and has redirected federal COVID-19 money to sustain K-12 state aid. Phil Murphy is also proposing that New Jersey borrow as much as $9 billion.

I assume that New Jersey will get additional federal support and make some borrowing, but New Jersey fixing the short-term problem of the 2020-21 recession won't be enough, because New Jersey was already the most indebted state in the US before the Coronavirus appeared, and had not honestly balanced a budget since the early 1990s.

New Jersey must fight for federal aid and borrowing might be justified in this emergency, but we also have to seriously rethink our budgeting and that includes making cuts to some sacrosanct programs, including state aid for all school districts and "free" PreK.

There are taxes New Jersey could increase (see below), but there are going to have to be cuts, and education cannot be spared.

Spending Cuts

PreK-12 Education Spending has be ON the Table

Spending Cuts

PreK-12 Education Spending has be ON the Table

New Jersey's "fiscal effort" on education is the second highest in the country.

Under an analysis that did not include the $800 million New Jersey spends on PreK, even the Education Law Center acknowledged that New Jersey spend 5.39% of GDP on education, compared to a national average of 3.79%.

To put NJ's state education spending in terms of NJ's budget, $15.74 billion of NJ's $39.96 billion FY2020 budget (39.4% of New Jersey's budget) is devoted to PreK-12 education, compared to spending 31% of the budget on education in 2001. Thus, ruling out cuts to education would force deeper cuts on budget categories that have been far more neglected by the state for 20 years.

Under an analysis that did not include the $800 million New Jersey spends on PreK, even the Education Law Center acknowledged that New Jersey spend 5.39% of GDP on education, compared to a national average of 3.79%.

To put NJ's state education spending in terms of NJ's budget, $15.74 billion of NJ's $39.96 billion FY2020 budget (39.4% of New Jersey's budget) is devoted to PreK-12 education, compared to spending 31% of the budget on education in 2001. Thus, ruling out cuts to education would force deeper cuts on budget categories that have been far more neglected by the state for 20 years.

But if New Jersey accepts the necessity of making education cuts, it cannot repeat the method Chris Christie used in 2010, when he cut state aid equivalent to 5% of a district's budget and totally ignored how much state aid a district got compared to its SFRA target and what its tax base was.

Cut State Aid from High Tax-Base Districts

"High Tax-Base" has a subjective threshold, but for 2019-20, districts whose Local Fair Share was 150% or more of their full Adequacy Budgets got $118 million in opex aid, of which only $8 million is Adjustment Aid. (See Note 1 on definitions of Adequacy Budget.)

If you scale down the threshold of "high tax-base" the savings to the state are greater:

These districts also indirectly get tens of millions more in state-paid TPAF and Social Security, although I do not know the exact amounts. The districts whose Local Fair Share is over 150% of the full Adequacy budget have 87,000 students, or 6% of NJ's total. If they received 6% of New Jersey's TPAF and Social Security spending (a combined $3.5 billion for FY2020), that would be $211 million.

Cutting at least $300 million from New Jersey's highest tax-base districts is a large amount, but deeper cuts will likely be necessary.

We Can't Afford PreK

Since FY2008, New Jersey has spent at least $8.35 billion on PreK.

This is despite New Jersey hƒaving a deeper deficit than any other American state and indeed is a reason why New Jersey has had a deeper deficit than any other state.

New Jersey's Fiscal Balance is even worse than Illinois', the second most irresponsible state. Whereas New Jersey has only taken in 91.1% of necessary revenues, even Illinois has taken in 94.1%.

Alabama, Mississippi, and Louisiana, three states that New Jerseyans mock and falsely present as representative of Red States, have all had positive balances during this period.

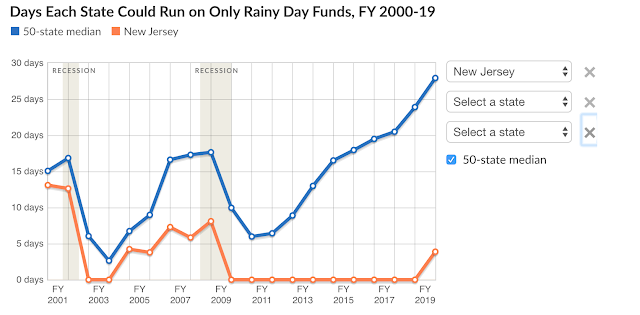

New Jersey's rainy day fund has been well below national averages in the 21st century. The three state-funded pension funds, the Judges, State Police, and Teachers Pension and Annuity Fund are all expected to zero-out this decade.

For the entire post-2004 period that the Pew Fiscal 50 provides data on how states have covered their expenses, New Jersey has been in last or second to last place every single year.

New Jersey's fiscal mismanagement has persisted despite taxes that are among the USA's highest, that tax brackets have not been indexed for inflation, and that New Jersey has underfunded K-12 opex aid and municipal aid against statutory targetsand underfunded public higher education against New Jersey's recent past and national averages (see more below about higher ed).

Whatever federal aid NJ gets and whatever borrowing we do, New Jersey's economic weakness is likely to last longer than the national average based on the fact that New Jersey took an additional three years to recover from the Great Recession (2017 vs 2014 nationwide).

I acknowledge there are downsides.

Many people would contend that cutting PreK could exacerbate achievement gaps, but the Abbotts do not outperform DFG A and B non-Abbotts, so the long-term academic benefit of PreK is undemonstrated to me.

It's also not PreK versus Other State Obligations. It's PreK versus K-12 aid and PreK versus and Post-Retirement Healthcare. Preserving New Jersey's $800 million PreK expense and hiking it to $900 million takes resources away from other services that also disproportionately benefit New Jersey's low-income residents and communities. It also takes money away from severely underaided school districts.

Further, not all recipients of state-funded PreK are poor. The large majority of PreK students in Hoboken are affluent (which got $14.2 million in PreK money in FY2020), and a majority in Jersey City ($69.3 million) are. As PreK has been expanded to middle-class suburbs under Phil Murphy, even more non-poor students are included.

Don't Cut Other Property Tax Relief Fund Items

An underlying reason that education spending, including aid to high-wealth districts and PreK must be on the table is that the other Property Tax Relief Fund items have been so neglected in the last 20 years.

- Districts where the Local Fair Share is 140% of their Adequacy Budget, got $148 million in 2019-20.

- Districts where the Local Fair Share is 130% of their Adequacy Budget, got $178 million in 2019-20.

These districts also indirectly get tens of millions more in state-paid TPAF and Social Security, although I do not know the exact amounts. The districts whose Local Fair Share is over 150% of the full Adequacy budget have 87,000 students, or 6% of NJ's total. If they received 6% of New Jersey's TPAF and Social Security spending (a combined $3.5 billion for FY2020), that would be $211 million.

Cutting at least $300 million from New Jersey's highest tax-base districts is a large amount, but deeper cuts will likely be necessary.

We Can't Afford PreK

Since FY2008, New Jersey has spent at least $8.35 billion on PreK.

|

| Source, Budgets in Brief. |

This is despite New Jersey hƒaving a deeper deficit than any other American state and indeed is a reason why New Jersey has had a deeper deficit than any other state.

New Jersey's Fiscal Balance is even worse than Illinois', the second most irresponsible state. Whereas New Jersey has only taken in 91.1% of necessary revenues, even Illinois has taken in 94.1%.

Alabama, Mississippi, and Louisiana, three states that New Jerseyans mock and falsely present as representative of Red States, have all had positive balances during this period.

New Jersey's rainy day fund has been well below national averages in the 21st century. The three state-funded pension funds, the Judges, State Police, and Teachers Pension and Annuity Fund are all expected to zero-out this decade.

|

| New Jersey's Fiscal Balance is Palpably Worse than Illinois'. |

New Jersey's fiscal mismanagement has persisted despite taxes that are among the USA's highest, that tax brackets have not been indexed for inflation, and that New Jersey has underfunded K-12 opex aid and municipal aid against statutory targetsand underfunded public higher education against New Jersey's recent past and national averages (see more below about higher ed).

Whatever federal aid NJ gets and whatever borrowing we do, New Jersey's economic weakness is likely to last longer than the national average based on the fact that New Jersey took an additional three years to recover from the Great Recession (2017 vs 2014 nationwide).

New Jersey cannot afford to spend $800 million (plus associated FICA, construction aid, and TPAF) (2% of the budget) on a service that other states don't provide when New Jersey has chronically slow growth and and cannot balance its budget.

Although in no year have PreK's costs been greater than New Jersey's budget deficit, one has to remember that liabilities mount over time, so failing to put $x money into something now means needing to put $2x or $3x money in the future.

Although in no year have PreK's costs been greater than New Jersey's budget deficit, one has to remember that liabilities mount over time, so failing to put $x money into something now means needing to put $2x or $3x money in the future.

|

| TPAF Unfunded Liability, from TPAF Actuarial Valuation Report 2018. |

I acknowledge there are downsides.

Many people would contend that cutting PreK could exacerbate achievement gaps, but the Abbotts do not outperform DFG A and B non-Abbotts, so the long-term academic benefit of PreK is undemonstrated to me.

New Jersey also need not cut all of PreK to have large savings. We could eliminate it for 3s and restrict it to low-income families to save at least $400 million.

The academic loss from restricting PreK to 4s only would be less than the academic loss of total elimination. Even the pro-Abbott APPLES study acknowledged that the benefits of two-years of PreK are not significantly greater than two years.

Some would say that we cannot cut any PreK since the beneficiaries are mostly low-income and minority, and therefore any cuts should be off the table, but the whole of New Jersey's operations disproportionately (and correctly) benefit low-income people, including minorities. Thus, preserving PreK cuts hurts low-income New Jerseyans in other ways.

For instance, how can anyone claim that the cuts to municipal aid that have occurred in part due to crowding-out by education spending as anything other than a negative for low-income persons and communities?

New Jersey's high-foreclosure and tax-lien rates also disproportionately affect low-income and minority populations, and foreclosure and tax liens are undeniably linked to our extremely high property taxes, so redirecting PreK money into clear-cut tax offsets would help low-income minorities in other ways.For instance, how can anyone claim that the cuts to municipal aid that have occurred in part due to crowding-out by education spending as anything other than a negative for low-income persons and communities?

It's also not PreK versus Other State Obligations. It's PreK versus K-12 aid and PreK versus and Post-Retirement Healthcare. Preserving New Jersey's $800 million PreK expense and hiking it to $900 million takes resources away from other services that also disproportionately benefit New Jersey's low-income residents and communities. It also takes money away from severely underaided school districts.

Further, not all recipients of state-funded PreK are poor. The large majority of PreK students in Hoboken are affluent (which got $14.2 million in PreK money in FY2020), and a majority in Jersey City ($69.3 million) are. As PreK has been expanded to middle-class suburbs under Phil Murphy, even more non-poor students are included.

Don't Cut Other Property Tax Relief Fund Items

An underlying reason that education spending, including aid to high-wealth districts and PreK must be on the table is that the other Property Tax Relief Fund items have been so neglected in the last 20 years.

Of items paid for by the Property Tax Relief Fund, municipal aid, "other local aid," and direct tax rebates as areas that should not be cut except from very high-wealth towns due to the fact that they've been flat-funded since 2001, despite New Jersey gaining 700,000 people since that year.

Don't Cut Public Higher Ed

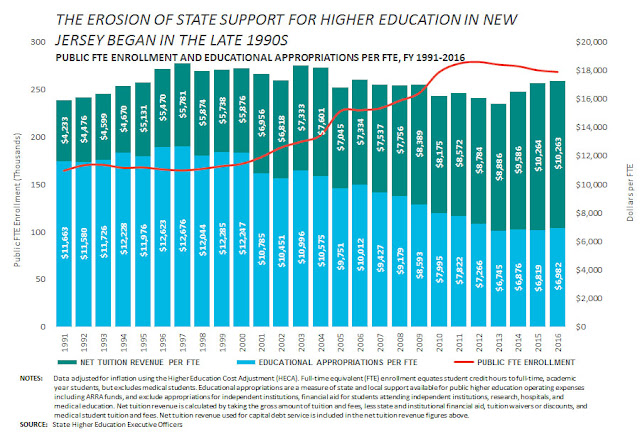

I also think that cutting funding for public higher education would also be a mistake, since New Jersey's higher education funding in dollars per student or dollars per resident is quite low as it is, even lower than Alabama and Mississippi's.

See "New Jersey Underfunds Higher Education"

Don't Cut NJTransit

Self-evident.

Conclusion

New Jersey is in a fiscal catastrophe and must make difficult choices and education should not be spared. The amount in new revenue that New Jersey can likely raise will not be sufficient to bring out budget into balance, let alone reduce debts and build a Rainy Day Fund for the next recession.

Among the cuts should be cuts to the highest-wealth districts that can absorb the lost of state aid, plus PreK, a program that other states do not pay for and which has contributed to our budget disaster.

----

See:

Don't Cut Public Higher Ed

I also think that cutting funding for public higher education would also be a mistake, since New Jersey's higher education funding in dollars per student or dollars per resident is quite low as it is, even lower than Alabama and Mississippi's.

See "New Jersey Underfunds Higher Education"

Don't Cut NJTransit

Self-evident.

Tax Increases

I don't think NJ can survive this crisis solely with cuts and borrowing, so there are taxes New Jersey could increase.

These are the ones that often come up:

I don't think NJ can survive this crisis solely with cuts and borrowing, so there are taxes New Jersey could increase.

These are the ones that often come up:

- Lower the threshold for the 10.75% bracket from $5 million to $1 million.

- Expand the sales tax to services.

- Increase the sales tax to 7%.

- Legalize marijuana and tax it.

New Jersey has several progressive organizations whose mission is to argue for these tax increases, so I will say nothing more about them.

I suggest the following rarely-proposed, more politically difficult, items:

I suggest the following rarely-proposed, more politically difficult, items:

- Create a new gasoline tax that can be used for the General Fund.

- Raise the 1.4% bottom bracket to the 2%, as it was originally. An income tax increase would be difficult for some New Jerseyans, but it would pull in tens of millions of dollars from New Yorkers and Delawareans who work in New Jersey and who benefit from our low low-income brackets, but then have to pay income taxes anyway to Delaware and New York's state governments.

(Delaware's income tax starts at 2.2% for >$2,000, then 4.9% for income >$5,000, etc. New York's income tax is 4% for income >$0, etc).

Conclusion

New Jersey is in a fiscal catastrophe and must make difficult choices and education should not be spared. The amount in new revenue that New Jersey can likely raise will not be sufficient to bring out budget into balance, let alone reduce debts and build a Rainy Day Fund for the next recession.

Among the cuts should be cuts to the highest-wealth districts that can absorb the lost of state aid, plus PreK, a program that other states do not pay for and which has contributed to our budget disaster.

----

See:

No comments:

Post a Comment