|

| Note: Jersey City's Local Fair Share is $375 million for 2018-19. |

Jersey City's derelict wharves have given way to gleaming skyscarpers. Jersey City's empty factories have become million-dollar lofts. Jersey City's mayor calls Jersey City "New Jersey's Economic Powerhouse" and realtors and even residents call it "the Gold Coast."

There are several quantitative ways to measure this transformation, but by real estate value alone, since 1998 Jersey City's share of New Jersey's total Equalized Valuation has risen from 1.05% of the state's total to 2.35%. Were Jersey City's $11.6 billion in PILOTed properties included in Equalized Valuation, Jersey City would possess 3.25% of New Jersey's total real estate wealth.

|

| Note, this graphic was updated in Oct 2018 to reflect release of new Equalized Valuations. |

Yet, despite that staggering increase in wealth, Jersey City still receives state aid as if it were the struggling city of the 1980s; getting $410.4 million in K-12 operating aid for 2017-18, an amount that is $151.5 million in excess of the $258.8 million that SFRA's core formulas actually say that Jersey City needs.

Thus, despite a 2018 Equalized Valuation of $28.4 billion, the Jersey City taxpayers only pay $116 million in school taxes, or 20% of the Jersey City Public Schools' budget. Despite having New Jersey's largest tax base, Jersey City only has the 16th largest tax levy, behind poorer and/or smaller towns like Newark, Cherry Hill, Clifton, and West Orange.

As public school families leave Jersey City, they often move to Jersey City's neighbors, contributing to enrollment increases and budget problems in most of the non-gentrified towns of Hudson County.

----------

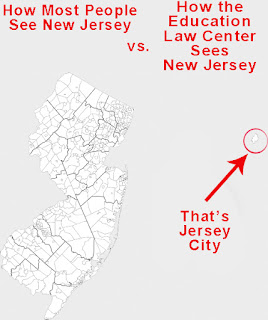

The Education Law Center's case against redistributing Jersey City's Adjustment Aid isn't an argument so much as a redefinition of the words "overfunded" and "overaided" to mean "above Adequacy." The Education Law Center denies the legitimacy of the common usage of the term, which means that a district receives more state money than SFRA's core formulas say it needs.

Here's the core of the Farrie/Education Law Center argument/redefinition:

JCPS receives more state aid for its adequacy budget than the formula would provide because of its allocation of transitional Adjustment Aid under the SFRA. However, this does not mean that the district is “overfunded,” “overaided,” or spending in “excess” of what students need for a thorough and efficient education. In fact, Adjustment Aid does not fully cover the district’s $253 million local levy gap.

Adjustment Aid in Jersey City does not fund spending in excess of the level required under the SFRA for a thorough and efficient education for all district students. Even with Adjustment Aid, the district is spending $100 million below its adequacy target. A reduction in Adjustment Aid would have a severe impact on the district, further eroding the resources that are required to adequately educate all students to the state’s academic standards. For example, using average district compensation levels ($99,158 annual salary plus benefits), the total loss of $151 million in adjustment aid would require the district to cut over 1,500 positions, or one-half of all certificated staff. [my emphasis]

Essentially the Education Law Center claims a monopoly on the right to define the words "overfunded" "overaided." Instead of allowing those words to refer to state aid only (hence my preferred "overaided"), they say they must refer to spending relative to Adequacy.

In the Education Law Center's logic, since Jersey City's schools are only spending $17,149 per student and its full Adequacy budget calls for spending of $20,321 per student, therefore the Jersey City Public Schools cannot be "overfunded" or "overaided."

QED.

(note, Jersey City actually spent $23,466 per pupil in 2014-15, but SFRA's definition of spending excludes several significant revenue sources and spending categories, hence Jersey City's "spending as defined" is only $17,149.)

The Erasure of the Rest of New Jersey

There are many aggravating things about the Education Law Center's defense of Jersey City's aid hoarding, mostly that it sees the Jersey City Public Schools in isolation, ignores the budgetary needs of other school districts, ignores New Jersey's chronic budget crisis, and denies that the motivation to redistribute Jersey City's Adjustment Aid is to GIVE IT TO OTHER DISTRICTS WHO ARE UNDERAIDED AND FARTHER BELOW ADEQUACY THAN JERSEY CITY.

The Education Law center worries about cuts to Adjustment Aid, but it does not worry about what harm will be caused to non-Jersey City students whose schools remain badly to severely underaided (and below Adequacy) due to the state's failure to redistribute Adjustment Aid.

The Education Law Center's argument is only logical if you erase from your consciousness the children of Bayonne, Clifton, Plainfield, New Brunswick, Freehold Boro, Kingsway, Atlantic City, and other underaided districts. It only works if you assume a profound selfishness on the part of Jersey City's taxpayers not to make up for Adjustment Aid losses with local taxdollars.

To show how acute need is outside of Jersey City, just look at Hudson County alone, since there are eight districts in Hudson County who were underaided, higher taxing and farther below Adequacy than Jersey City and who would benefit from the redistribution of Adjustment Aid from Jersey City and other overaided districts.

Indeed, Jersey City is $3,172 per student below Adequacy, which is the 49th biggest deficit in New Jersey, but most of Jersey City's neighbors are significantly worse off and five Hudson County school districts are in New Jersey's bottom ten of below-Adequacy spending.

Guttenberg and East Newark are, in fact, $8,152 per student and $8,011 per student below Adequacy, respectively, making them the two most under Adequacy districts in New Jersey.

West New York is $6,757 per student below Adequacy, the 6th worst in New Jersey and worst-off of any Abbott. Bayonne is $6,483 per student below Adequacy, the 7th worst. Union City is $5,936 per student below Adequacy, the 10th worst.

Nearby is Fairview Boro, in southern Bergen County, is the fifth most under Adequacy district, with a deficit $7,167 per student.

With the exception of West New York, all of the exceptionally under-Adequacy districts of Hudson County are hurt more by insufficient state aid than they are by insufficient local tax effort. New Jersey underaids Guttenberg $3 for every $1 Guttenberg taxes below Local Fair Share. New Jersey underaids East Newark by $11 for every $2 East Newark taxes below Local Fair Share. New Jersey underaids Bayonne $7 for every $2 Bayonne does not tax itself. For Union City underaiding is more of a factor than undertaxing, though not as dramatically as for Guttenberg, East Newark, and Bayonne.

Fairview taxes at 100% of Local Fair Share, so its $7,167 per student sub-Adequacy spending is entirely the state's fault.

| The JCBOE doesn't want to close its Adequacy Gap |

Jersey City's BOE Does Not Want to Raise Taxes Above the Tax Cap

The Education Law Center repeatedly presents an image of a Jersey City Board of Education that yearns to close its spending gap against Adequacy but is prevented by the tax cap.

"Jersey City has increased local revenue every year since 2008, but the state’s 2% annual property tax cap limits JCPS’s ability to make more progress towards closing the large local levy gap." [my emphasis]

And:

"In other words, Jersey City is increasingly reliant on Adjustment Aid because it is unable to increase the local levy to keep pace with its growing adequacy budget and its increasing obligation to fund its budget through local revenues. " [my emphasis]And:

"Contrary to much speculation, JCPS has largely been living up to its obligation under the SFRA to increase local revenue for schools, but it is constrained by the state’s property tax cap. Year after year, the SFRA requires Jersey City to support a greater portion of its budget, and yet at the same time it will not allow the district to raise more local revenue."

The Education Law Center states that Jersey City's taxes remain low due to the tax cap, but the Jersey City Board of Education has not even consistently raised taxes at 2.0%. In 2013-14 the Jersey City BOE only raised taxes by 1.78% and in 2014-15 the Jersey City BOE only raised taxes by 1.5%.

These are not the actions of a Board of Education that is determined to reach its Adequacy budget with local taxes.

|

| http://www.jcboe.org/boe2015/images/pdf/depts/bueinesstech/budget/Proposed_Budget-2016-041715-FINAL1.pdf |

The 2% Tax Cap is not an Insurmountable Barrier to Raising Taxes above 2%

A Board of Education already has the power to ask its voters to raise the tax levy. It is problematic that the higher levy, if approved, would not go into effect into the middle of the next school year, but nevertheless, the power to hold a referendum exists and is costless to a school district. The Jersey City Board of Education has yet to show a desire to do so.

So this claim by Danielle Farrie/the Education Law Center, "increases in local revenue from

|

| The voting booth already gives a school district the power to exceed the tax cap and state aid reformers have hinted at changing the tax cap to make exceeding 2% even easier. |

Jersey City Can Afford to Raise Taxes More Easily Than Almost Any Other Town in NJ

Jersey City has the state's strongest real estate market, gaining 38.4% in Equalized Valuation from 2010-2016 and continuing since then.

So the refusal to raise taxes by more than 2.0% can best be explained by a lack of any desire to do so.

The Jersey City BOE would gladly spend $20,321 per student - or whatever New Jersey says it should spend - if the state were paying. But once Jersey City taxpayers themselves would have to pay, the Jersey City BOE begins to see the decreasing utility of spending above $18,000 per student. I'm sure the Jersey City BOE wants the best for Jersey City children, but in their hearts, the Jersey City BOE members do not agree with the Abbottist doctrine that spending needs to be $20,000 per student to provide a "thorough and efficient education."

This reluctance to employ the allowances within the existing tax cap or go to a referendum exists despite Jersey City's school tax rate has fallen by a third since 2013-14 alone.

Sometimes towns with strong real estate markets see their tax rates fall due to the appreciation of the existing housing stock, while individual tax bills increase, but in Jersey City tax rates are falling due to appreciation and new construction, thereby actually reducing the average homeowner's tax bill itself relative to inflation.

that was lower than what it paid in 1989-90. The average New Jersey district already had high taxes in 2009 and is so smashed by stagnant property values and already high taxes, that even an increase of 24% is a much larger sacrifice than Jersey City.

Jersey City sees a constant stream of new developments and escalating housing prices of the existing housing stock.

One development, 99 Hudson Street, will be New Jersey's tallest building, and will alone will create a palpable reduction in the average Jersey City taxpayer's property taxes.

| Conservatively estimated, 99 Hudson Street alone will offset Jersey City's muni+school taxes by 2.5%. |

Given the rapid pace of redevelopment in Jersey City and the expiration of PILOT agreements, even if Jersey City lost $30 million in Adjustment Aid per year and made up for those losses with local taxes, the tax rate increase would not be proportionate and individuals' taxes would not increase so dramatically. In fact, for 2018-19 Jersey City's Local Fair Share grew to $399 million from $370 million.

For Jersey City to lose $151 million in state aid and make up for all those losses with local revenue it would be equivalent to a 130% increase in school taxes. I admit that that would be a hardship for some people, but there are solutions for at least senior citizens in the form of NJ's property tax freeze and reverse-mortgages. Jersey City residents would still be better off in taxes than people in most other towns, whose school taxes are often higher and real estate appreciation less (or negative.)

Undoubtedly, while paying higher school taxes might be very difficult for some Jersey Cityans, my greater sympathy will always be with people who have to pay higher taxes on depreciating houses, not appreciating ones. (The median NJ town's Equalized Valuation has lagged inflation for years.)

Also, the Education Law Center has no right to worry now about taxes rising so fast, since in the early 1990s it supported a state aid plan that would have taken all state aid - include pension payments - away from a quarter of New Jersey's school districts. Among the school districts slated to lose most or almost all of their state aid were working class and middle-class districts like Belleville, Hackensack, and West Orange. (see the NYT article "Jim Florio's Dream is One Town's Nightmare")

Hints of Changing the Tax Cap for Aid-Losing Towns

A more significant omission from Danielle Farrie and the Education Law Center is not acknowledging that Steve Sweeney's state aid reform plan has always had a provision in it to change the tax cap anyway.

For instance, the Senate 2016 resolution to create a school funding commission contained this language to have the committee evaluate the tax cap.

In September 2017 when the Senate passed the concurrent resolution identical language about the tax cap was included.

- (2) the tax levy growth limitation as established and calculated pursuant to section 3 of P.L.2007, c.62 (C.18A:7F-38) and its impact on the ability of school districts to adequately fund operating expenses;

Changing the tax cap for aid-losing districts also came up in the Senate state aid hearings in 2017, so the idea has already been discussed.

The Corzine-era 4.0% tax cap allowed a school district to increase the local tax levy if it lost state aid. So reviving this provision would not be revolutionary.

Nonetheless, I concur with the Education Law Center that it might be necessary to require local tax increases for Jersey City and not leave it to the discretion of Jersey City's anti-tax Board of Education.

PILOT Exploitation

Another facet that makes Jersey City's state aid level especially objectionable has a long and aggressive history of using PILOT arrangements to increase municipal revenue, cut Hudson County out, and continue to leave statewide taxpayers with the bill for the school system.

The way this exploitation works is that in a Payment In Lieu Of Taxes arrangement the municipality gets 95% of the PILOT fees and the county gets 5%. (it used to be 100% municipal). Thus, it is possible to structure a deal where a developer pays less in taxes than under normal taxation, but a municipality gets more. Because PILOTed properties do not count toward a town's Equalized Valuation, they are "invisible" to the formula for Local Fair Share, legally equivalent to a non-profit owned property, like a cemetery. (see "The Problems of PILOTs")

In 2017 Jersey City's PILOTed properties were worth $11.6 billion, or a third of the total tax base. If that $11.6 billion in property were part of Jersey CIty's Equalized Valuation, Jersey City's Local Fair Share would be $76 million higher than its $351 million for 2017-18.

I assume that all Jersey City politicians understand how PILOTed properties hurt taxpayers in the rest of Hudson County and sustain an artificially low calculation of Local Fair Share, but most of them don't say anything about it in public.

There are exceptions though. For instance, Jersey City councilwoman Candice Osborne recently defended PILOTization because it

|

| [Sic] He meant "[receive] less in state aid for our schools." |

"When it comes to the funding for schools. I have gone though the numbers multiple times and I've said this many times...The math to me makes sense for both the people getting the abatement as well as traditional taxpayers - because of the state aid." (see 2:49:30)

Another instance of Jersey City politicians admitting that they grant PILOTs because of county taxation and school aid skews was in 2016, when Jersey City's former mayor (and convicted felon) Jerry McCann defended PILOTization not as a necessary development tool, but precisely because the use of PILOTs allows Jersey City to pay less in county taxes and [get] more state aid.

There is No Budget Pathway to Full Funding without Redistribution

Worse than the Education Law Center's defense of Jersey City's Adjustment Aid is that its repeated assertion that the deficit is only $1 billion per year and not the ever-growing $2 billion (against Uncapped Aid) it was 2017-18.

Unlike politicians and journalists who use that $1 billion number because they are ignorant of how SFRA works and wouldn't know where to find Uncapped Aid, the Education Law Center does understand how SFRA works and does know how to get Uncapped Aid from the Department of Education. Prior to the development of the state aid reform movement, the Education Law Center used to release deficits against Uncapped Aid. (example 1, example 2, example 3)

The use of that simple, round number, "$1 billion," is itself a concealed argument, since it is imaginable for New Jersey to increase K-12 aid by $1 billion over several years, and therefore there is no need to redistribute state aid.

However, if the Education Law Center admitted that the deficit was really an ever-growing $2 billion the possibility of full funding without redistribution would look impossible, and the state's ability to expand PreK would also be called into question.

The reason redistribution is necessary is because New Jersey's economy does not deliver the growth it delivered in the 20th century.

In the late 1990s, New Jersey's income tax increased by 10% a year. From FY2013 to FY2017, New Jersey's income tax only increased by 15% over five years, from $12.1 billion to $13.96 billion. FY2018 saw an unanticipated 7.5% surge due to changes in the federal tax code and capital gains that is likely not repeatable.

For FY2019 income tax revenue will increase, but mostly due to a (proposed) rate increase that is certainly not repeatable.

Worse, the massive unfunded liability for the Teachers Pension And Annuity Fund and post-retirement medical for teachers claims the bulk of new income taxes.

For FY2016 TPAF payments increased by $387 million and post-retirement medical increased by $45.5 million. For FY2017 TPAF payments increased by $324 million and post-retirement medical increased by $48.1 million. For FY2018 TPAF payments increased by $411 million and post-retirement medical increased by $69.6 million.

|

| Source for 2010 http://www.state.nj.us/treasury/omb/publications/10bib/BIB.pdf Source for 2019 http://www.state.nj.us/treasury/omb/publications/19bib/BIB.pdf |

For FY2017 Phil Murphy has proposed a $757 million income tax increase, but even that plus natural revenue growth only leaves $283 million left over for new K-12 opex aid. Debt and indirect aid are still taking the bulk of new education-related spending.

For FY2019 TPAF payments from income taxes will increase by $392.5 million, with a few hundred million more from lottery profits, and post-retirement medical will increase by $51.8 million.

Equality is a Goal in and Of Itself

For 2018-19 Jersey City is slated to receive $175 million more than SFRA's core formulas say it needs, or $5,716 per student, the 8th largest state aid surplus in New Jersey. In percentage terms, Jersey City will receive 174.6% and is on a trajectory to receive 200% of its recommended state aid for 2020-21.

Equality is a Goal in and Of Itself

For 2018-19 Jersey City is slated to receive $175 million more than SFRA's core formulas say it needs, or $5,716 per student, the 8th largest state aid surplus in New Jersey. In percentage terms, Jersey City will receive 174.6% and is on a trajectory to receive 200% of its recommended state aid for 2020-21.

Meanwhile, the median district is underaided by $419 per student and receives 85.4% of its Uncapped Aid.

To me, having equal aid, according to need, is a goal in and of itself.

If justice is equal treatment under law, and a formerly poor district like Jersey City is allowed to get 200% of its recommended aid, while 75 districts get not even 50% of their recommended aid, than New Jersey's distribution of state aid is savagely unjust.

See Also:

Why is the ELC so Supportive of Adjustment Aid?

The Education Law Center gets over a third of its budget, something above, $550,000 per year - from the NJEA and the NJEA, by virtue of being a teachers union has a bias in favor of higher education spending and an indifference to spending the state's money at its maximum efficiency. Furthermore, the NJEA's largest local is the Jersey City Education Association. (the Newark teachers are represented by the AFT). So the Education Law Center's largest funder has a direct financial interest in sustaining Jersey City's Adjustment Aid.

I have to point out that the Education Law Center is not a disinterested organization.

-----------------------

See Also:

- 2017 Changes in Equalized Valuation: the Urban Core Grows

- Jersey City's Tax Abatements Hurt Jersey City Too

- The Two Faces of Steve Fulop

- Bullshit, Lies, and Hypocrisy from Steve Fulop

- Steve Fulop, Flippant and Thankless Again

- Why Jersey City's New unPILOTed Skyscraper Helps Taxpayers, Not Public School Kids

- Jersey City Declares Own City Hall Blighted

- Jersey City Should Not be an Abbott

- In Five Years, Jersey City Will Not Be Eligible for Equalization Aid

Why is the ELC so Supportive of Adjustment Aid?

The Education Law Center gets over a third of its budget, something above, $550,000 per year - from the NJEA and the NJEA, by virtue of being a teachers union has a bias in favor of higher education spending and an indifference to spending the state's money at its maximum efficiency. Furthermore, the NJEA's largest local is the Jersey City Education Association. (the Newark teachers are represented by the AFT). So the Education Law Center's largest funder has a direct financial interest in sustaining Jersey City's Adjustment Aid.

No comments:

Post a Comment