This post was accurate at the time I wrote it. NJ won Berg v Christie and the suspension of COLAs has stood.

Will the New Jersey Supreme Court gut pension reform?

If you haven't followed Berg v Christie, it's the court case over the constitutionality of suspending COLA benefits. The NJ Supreme Court will hear arguments this fall, with a decision coming in 2016.

The suspension of COLA benefits was the central component on the savings side of 2011's "Chapter 78" pension reform law, along with increasing employee contributions for health care. At the time, suspending COLAs was projected to save New Jersey $80 billion over 30 years, thereby composing half of the savings from pension reform.

Unfortunately, New Jersey is bankrupt even without having to pay COLA benefits. The state pension funds are only 38% funded, the worst in the United States. In absolute terms, New Jersey's debt is usually estimated at $85 billion, although some measures put New Jersey's debt at twice that. New Jersey's debt per person is $52,300, also the worst in the United States. In terms of debt to Gross State Product, New Jersey's debt is the second worst, after Hawaii's.

New Jersey's bond rating is the second worst in the US, after Illinois', and the pension funds will start going broke in 2021, when the judiciary fund (JRS) will zero-out. The state portion of PERS will be depleted in 2024 and TPAF, the teachers fund and the biggest of all, will go broke in 2027. After a fund zeros-out, New Jersey will have no investment income to sustain pension payouts and will have to rely on contributions from active workers, localities, and regular operating revenue to meet pension obligations. As of now, if the state used regular operating revenue to pay pensions it

would cost at least $4 billion a year. $4 billion is almost equal to the $4.3 billion we spend on state operations, meaning that budgeting our way out of this crisis is impossible.

New Jersey's debts might be payable if the economy were robust, but New Jersey's economy is barely growing. In 2014 New Jersey's growth rate was 0.4% compared to a national average of 1.9%. This means that the state's economy cannot sustain the tax increases that will be necessary to pay the full pensions, let alone pensions with COLAs.

Lest anyone simply think the economic lethargy would end if we had a Democratic governor, New Jersey's economy has been a national laggard for the last 15 years. Since 2000, New Jersey's economy has only grown by 0.8% a year, only half the national average and fifth from the bottom. In those fifteen years, New Jersey's economy only outperformed the national economy twice, in 2008 and 2012.

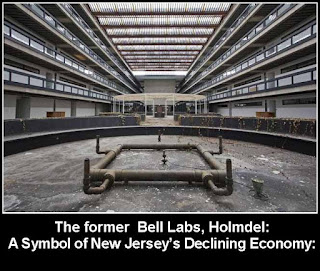

A symbol of this is New Jersey's massive supply of vacant office space. New Jersey has a 14% vacancy rate compared to a national average of 11.5%. Of 860 buildings of 100,000 square feet or more, 45 are 100% vacant. New Jersey's office vacancy rate has exceeded the national average almost continuously since 2003.

New Jersey's foreclosure rate was the highest in the country in 2014, indicating that many New Jersey homeowners are simply running out of money (or taking advantage of foreclosure's slowness in NJ). In the second quarter of 2014, 11.6% of all loans were delinquent by at least 90 days, compared to a national average of only 4.8%. In 2015 New Jersey has remained ranked 1 or 2 in foreclosures alongside Nevada. Every day in New Jersey 400 liens are placed on tax-delinquent properties, the highest rate per capita in the country.

48% of young adults in New Jersey live with their parents, the worst percentage for young adults living independently in the country.

New Jersey's outmigration rate is the worst in the country. IRS figures show that 20,000 New Jerseyans leave per year. Two people leave New Jersey for every person who moves here. According to the United Van Lines' survey, New Jersey has led the nation in outmigration four of the last five years. 42% of those moving said it was for career reasons, 41% said they were retiring.

Business relocation echoes personal relocation. Mercedes-Benz, Sealed-Aid, and Hertz all recently made relocations to low-cost states. According to the New Jersey Chamber of Commerce, 14% of New Jersey business owners want to leave New Jersey, an extraordinary figure considering that not all businesses have potential mobility since their customers are in New Jersey. One business owner who wanted to leave New Jersey cited "State government's far left policies. I am tired of being milked like a cow."

The #1 reason for business departure is taxes, but sometimes businesses relocate to other high-cost, high-tax areas, especially in pharmaceuticals. For instance Hoffman-LaRoche left Nutley/Clifton for the San Francisco Bay area. Sanofi Aventis reduced its Bridgewater presence in favor of Cambridge, Massachusetts. Bristol-Meyers Squibb also moved from New Jersey to Cambridge. Other New Jersey pharmaceuticals companies like Johnson & Johnson, Novartis, and Pfizer have passed up opportunities to open new centers in New Jersey in favor of Massachusetts.

Update: Massachusetts has a flat personal income tax at 5.1%, so any blanket statement that Massachusetts has taxes which are comparable to NJ's (like I made) should be qualified. It was wrong of me to say Massachusetts was a high-tax state.

Although there are bright spots in the state's economy, like a steady relocation of businesses from New York (like JP Morgan's recent relocation of 2,100 jobs to Jersey City), but overall the economy is struggling and New Jersey's quarterly tax revenues have not recovered from the Great Recession.

Given how anemic New Jersey's economy is, you might think that public employees and retirees might cut the state some slack with COLA payments, since public employees are taxpayers too and surely have neighbors, friends, and family members who are losing ground. You might think that public employee unions would be sensitive about bankrupting New Jersey since a bankrupt New Jersey will lay off public employees and if NJ pays COLAs to current retirees future retirees may get nothing.

YEAH RIGHT!

Despite the state's budgetary nightmare, economic malaise, and the fact that public employee pensions are wildly out of sync with the private sector, the public employee unions, including the NJEA, have never accepted the suspension of COLA benefits.

A group of retired lawyers, soon joined by several unions including the NJEA, sued as soon as Chapter 78 was passed to restore COLA benefits. The retiree lawsuit over COLA benefits has been consolidated as "Berg v Christie."

The lead plaintiff is Charles Ouslander, a former prosecutor who retired at age 48 with a $67,183 pension. Ouslander argues that suspending COLA payments is a breach of contract and unconstitutional.

Ouslander doesn't give a shit about the consequences of restoring COLAs.

By this logic, Ouslander would believe that getting cancer at age 40 is a good thing because it "lights a fire" about estate planning.

How do "deplete the fund that much sooner" and "bankrupt the system" mean anything fundamentally different? Also, wouldn't a "sense of urgency" mean large tax increases and spending cuts?

In his legal brief Ouslander uses perverted, self-centered morality to argue that suspending benefits is unfair, saying the suspension violated "rudimentary principles of fairness, i.e., equity."

Fairness for whom? Equity for whom? Almost no one in the private sector has a base pension like Charles Ouslander has and COLAs were always been rare to non-existent even in the heyday of private sector pensions.

Do Ouslander and the NJEA think that the pension funds will be made whole solely with tax increases? If so he is ignorant of an asymmetry between the two political parties: the Republicans respond to deficits solely by cutting spending, but Democrats respond to deficits by cutting spending AND raising taxes. No matter what party governs New Jersey when restored COLAs begin to undermine the state's fiscal situation, the state will cut spending and state aid, causing thousands of public employees to lose their jobs and many vulnerable New Jerseyans to lose state services. Ouslander's locution about a COLA restoration providing a "sense of urgency as to how they're going to fix the funding problem" is a euphemism for how a COLA restoration would wreck state services and possibly induce a struggling economy into recession.

Also, there is a difference between contracts between public sector workers and other workers since there is no other employer/employee relationship where the employee has as much influence over the employer as in the public sector since public sector workers get to "elect their own boss."

Whitman's act making pension benefits "non-forfeitable" was signed in 1997, an election year. Donald DiFrancesco's act to increase pensions was made in 2001, another election year. Charles Ouslander is demanding that children pay excessive compensation agreed to under under contracts made before they could vote and often for services performed before they were born. Is this "fairness" and "equity"?

Ouslander, however, does concede that the state can cut "post-retirement medical benefits." Would Ouslander rather retirees lose their health care so that COLAs can be restored? Apparently yes.

Ouslander is just a lawyer-pensioner and no one should have any expectation that he would consider the broader implications of COLA restoration, but Ouslander is joined by the NJEA. The NJEA's sees the COLA suspension and overall Pension Crisis in black and white terms.

Again, Wendell Steinhauer of the NJEA:

Steinhauer loves the word "severe," but just wait until the "severe blow" dealt by restoring COLAs decimates state aid, school budgets, and New Jersey's young teachers. Many young teachers will become fired teachers, not retired teachers, if COLAs are restored.

The New Jersey attorney general defends COLA suspension, but own brief foreshadows budgetary doom since it echoes the Burgos case and agrees that base pensions are nonforfeitable.

New Jersey's bond rating is the second worst in the US, after Illinois', and the pension funds will start going broke in 2021, when the judiciary fund (JRS) will zero-out. The state portion of PERS will be depleted in 2024 and TPAF, the teachers fund and the biggest of all, will go broke in 2027. After a fund zeros-out, New Jersey will have no investment income to sustain pension payouts and will have to rely on contributions from active workers, localities, and regular operating revenue to meet pension obligations. As of now, if the state used regular operating revenue to pay pensions it

|

| Click on image for higher resolution. |

New Jersey's debts might be payable if the economy were robust, but New Jersey's economy is barely growing. In 2014 New Jersey's growth rate was 0.4% compared to a national average of 1.9%. This means that the state's economy cannot sustain the tax increases that will be necessary to pay the full pensions, let alone pensions with COLAs.

Lest anyone simply think the economic lethargy would end if we had a Democratic governor, New Jersey's economy has been a national laggard for the last 15 years. Since 2000, New Jersey's economy has only grown by 0.8% a year, only half the national average and fifth from the bottom. In those fifteen years, New Jersey's economy only outperformed the national economy twice, in 2008 and 2012.

A symbol of this is New Jersey's massive supply of vacant office space. New Jersey has a 14% vacancy rate compared to a national average of 11.5%. Of 860 buildings of 100,000 square feet or more, 45 are 100% vacant. New Jersey's office vacancy rate has exceeded the national average almost continuously since 2003.

New Jersey's foreclosure rate was the highest in the country in 2014, indicating that many New Jersey homeowners are simply running out of money (or taking advantage of foreclosure's slowness in NJ). In the second quarter of 2014, 11.6% of all loans were delinquent by at least 90 days, compared to a national average of only 4.8%. In 2015 New Jersey has remained ranked 1 or 2 in foreclosures alongside Nevada. Every day in New Jersey 400 liens are placed on tax-delinquent properties, the highest rate per capita in the country.

48% of young adults in New Jersey live with their parents, the worst percentage for young adults living independently in the country.

New Jersey's outmigration rate is the worst in the country. IRS figures show that 20,000 New Jerseyans leave per year. Two people leave New Jersey for every person who moves here. According to the United Van Lines' survey, New Jersey has led the nation in outmigration four of the last five years. 42% of those moving said it was for career reasons, 41% said they were retiring.

Business relocation echoes personal relocation. Mercedes-Benz, Sealed-Aid, and Hertz all recently made relocations to low-cost states. According to the New Jersey Chamber of Commerce, 14% of New Jersey business owners want to leave New Jersey, an extraordinary figure considering that not all businesses have potential mobility since their customers are in New Jersey. One business owner who wanted to leave New Jersey cited "State government's far left policies. I am tired of being milked like a cow."

The #1 reason for business departure is taxes, but sometimes businesses relocate to other high-cost, high-tax areas, especially in pharmaceuticals. For instance Hoffman-LaRoche left Nutley/Clifton for the San Francisco Bay area. Sanofi Aventis reduced its Bridgewater presence in favor of Cambridge, Massachusetts. Bristol-Meyers Squibb also moved from New Jersey to Cambridge. Other New Jersey pharmaceuticals companies like Johnson & Johnson, Novartis, and Pfizer have passed up opportunities to open new centers in New Jersey in favor of Massachusetts.

Update: Massachusetts has a flat personal income tax at 5.1%, so any blanket statement that Massachusetts has taxes which are comparable to NJ's (like I made) should be qualified. It was wrong of me to say Massachusetts was a high-tax state.

Although there are bright spots in the state's economy, like a steady relocation of businesses from New York (like JP Morgan's recent relocation of 2,100 jobs to Jersey City), but overall the economy is struggling and New Jersey's quarterly tax revenues have not recovered from the Great Recession.

|

| http://www.pewtrusts.org/en/multimedia/data-visualizations/2014/fiscal-50#ind0 |

Given how anemic New Jersey's economy is, you might think that public employees and retirees might cut the state some slack with COLA payments, since public employees are taxpayers too and surely have neighbors, friends, and family members who are losing ground. You might think that public employee unions would be sensitive about bankrupting New Jersey since a bankrupt New Jersey will lay off public employees and if NJ pays COLAs to current retirees future retirees may get nothing.

YEAH RIGHT!

Despite the state's budgetary nightmare, economic malaise, and the fact that public employee pensions are wildly out of sync with the private sector, the public employee unions, including the NJEA, have never accepted the suspension of COLA benefits.

A group of retired lawyers, soon joined by several unions including the NJEA, sued as soon as Chapter 78 was passed to restore COLA benefits. The retiree lawsuit over COLA benefits has been consolidated as "Berg v Christie."

The lead plaintiff is Charles Ouslander, a former prosecutor who retired at age 48 with a $67,183 pension. Ouslander argues that suspending COLA payments is a breach of contract and unconstitutional.

Ouslander doesn't give a shit about the consequences of restoring COLAs.

"I don't think that if COLAs are reinstated it will bankrupt the system. I do think it it will deplete the fund that much sooner, and frankly if that provides a sense of urgency as to how they're going to fix the funding problem, then so be it. This should light a fire under everyone." [my emphasis]

By this logic, Ouslander would believe that getting cancer at age 40 is a good thing because it "lights a fire" about estate planning.

How do "deplete the fund that much sooner" and "bankrupt the system" mean anything fundamentally different? Also, wouldn't a "sense of urgency" mean large tax increases and spending cuts?

In his legal brief Ouslander uses perverted, self-centered morality to argue that suspending benefits is unfair, saying the suspension violated "rudimentary principles of fairness, i.e., equity."

Fairness for whom? Equity for whom? Almost no one in the private sector has a base pension like Charles Ouslander has and COLAs were always been rare to non-existent even in the heyday of private sector pensions.

Do Ouslander and the NJEA think that the pension funds will be made whole solely with tax increases? If so he is ignorant of an asymmetry between the two political parties: the Republicans respond to deficits solely by cutting spending, but Democrats respond to deficits by cutting spending AND raising taxes. No matter what party governs New Jersey when restored COLAs begin to undermine the state's fiscal situation, the state will cut spending and state aid, causing thousands of public employees to lose their jobs and many vulnerable New Jerseyans to lose state services. Ouslander's locution about a COLA restoration providing a "sense of urgency as to how they're going to fix the funding problem" is a euphemism for how a COLA restoration would wreck state services and possibly induce a struggling economy into recession.

Also, there is a difference between contracts between public sector workers and other workers since there is no other employer/employee relationship where the employee has as much influence over the employer as in the public sector since public sector workers get to "elect their own boss."

Ouslander, however, does concede that the state can cut "post-retirement medical benefits." Would Ouslander rather retirees lose their health care so that COLAs can be restored? Apparently yes.

Ouslander is just a lawyer-pensioner and no one should have any expectation that he would consider the broader implications of COLA restoration, but Ouslander is joined by the NJEA. The NJEA's sees the COLA suspension and overall Pension Crisis in black and white terms.

Elimination of the COLA has dealt a severe blow to the retirement plans of current and future retirees, since all pensions will be frozen at their current level. That means retirees’ purchasing power will be eroded each year by the rise in the cost of living index.

Again, Wendell Steinhauer of the NJEA:

“[A ruling against COLA suspension] is a significant ruling for thousands of currently retired teachers, school employees, and other public employees, who have already been severely harmed, as will all future retirees,” said Steinhauer. “The court has told them they have every right to believe that cost-of-living adjustments will be a part of their pension.”

Steinhauer loves the word "severe," but just wait until the "severe blow" dealt by restoring COLAs decimates state aid, school budgets, and New Jersey's young teachers. Many young teachers will become fired teachers, not retired teachers, if COLAs are restored.

The New Jersey attorney general defends COLA suspension, but own brief foreshadows budgetary doom since it echoes the Burgos case and agrees that base pensions are nonforfeitable.

No one disputes that the retirees in these consolidated cases have a non-forfeitable right to their base pensions. The State reiterates that it is not walking away from this obligation and will continue to pay these benefits when due.

Although the attorney-general is just echoing what the New Jersey Supreme Court decided in Burgos, this stance of full repayment is going to create a budgetary doomsday since even base pensions are unpayable. How can the state cover all of its pension payments in the future when it is unable to make a fifth of the actuarial contribution now?

Some people say that New Jersey's governors have been "kicking the can down the road" with pensions, but this is a bad metaphor because a person is capable of picking up a can whereas New Jersey's pension debt is more like a huge tanker whose weight is beyond human strength to lift.

School Aid Will Be Slashed

Closing the pension deficit will require tax increases and service cuts on everyone and every sector of the population. However, my major concern is state aid and here the effects will be devastating. Direct operating aid to school districts is a quarter of New Jersey's budget, so there is no way the state could avoid cuts to education once it begins to try to pay down its pension debt.

Even four years after the recession officially ended, state school aid has not recovered from the cuts of 2010 and 2011 for most districts. For 2015-16 Pre-K and K-12 aid increased by less than $8 million statewide, or 0.1%, but payments into TPAF increased by $387 million, to $802.4 million. Payments for retiree health care increased by $45.5 million, to $1.1 billion. SFRA is now dead, since the Democrats now propose to put all new state revenue into pensions.

School funding is already being reduced in New Jersey in per pupil terms and adjusted for inflation, but the next few years will mean cuts in absolute dollars and the state desperately attempts to pay pension expenses. In other words, New Jersey is going to sacrifice its young for the luxury of its public sector retirees.

----

See Also: "GE Leaves Connecticut and What it Means for NJ"

Some people say that New Jersey's governors have been "kicking the can down the road" with pensions, but this is a bad metaphor because a person is capable of picking up a can whereas New Jersey's pension debt is more like a huge tanker whose weight is beyond human strength to lift.

|

| Click on image for higher resolution. |

Closing the pension deficit will require tax increases and service cuts on everyone and every sector of the population. However, my major concern is state aid and here the effects will be devastating. Direct operating aid to school districts is a quarter of New Jersey's budget, so there is no way the state could avoid cuts to education once it begins to try to pay down its pension debt.

Even four years after the recession officially ended, state school aid has not recovered from the cuts of 2010 and 2011 for most districts. For 2015-16 Pre-K and K-12 aid increased by less than $8 million statewide, or 0.1%, but payments into TPAF increased by $387 million, to $802.4 million. Payments for retiree health care increased by $45.5 million, to $1.1 billion. SFRA is now dead, since the Democrats now propose to put all new state revenue into pensions.

School funding is already being reduced in New Jersey in per pupil terms and adjusted for inflation, but the next few years will mean cuts in absolute dollars and the state desperately attempts to pay pension expenses. In other words, New Jersey is going to sacrifice its young for the luxury of its public sector retirees.

----

See Also: "GE Leaves Connecticut and What it Means for NJ"

NJ teachers' pension has seven to eight years left before it hits $0, by my calculations. Every teachers in the state will be affected inside of 10 years. Thanks for this.

ReplyDeletehttp://millennialmoola.com/2016/01/18/new-jersey-teachers-pension-fund/

Thank you for commenting. I read your blog post about the approaching zero-out date for TPAF and posted the link on my Facebook page.

DeleteWe are heading into uncharted waters. The spending cuts and tax increases necessary to sustain the pension system will create a statewide recession.

If you're interested in another pension piece I've written, check out this one about Abbott's contribution to the pension crisis.

http://njeducationaid.blogspot.com/2015/08/the-role-of-abbott-funding-in-njs.html