New Jersey is only one month away from the inauguration of Phil Murphy as governor.

Murphy has never held elective office before and he typically avoided talking about the details of state aid during most of the campaign.

Most of Murphy's opinions on the details of SFRA are unknown. Murphy has said he supports "tweaks" to SFRA, but never explained what that means.

However, the stances of people in Murphy's circle, like Sheila Oliver, as well as constituencies within the Democratic Party, are known.

My predictions are based on what Democratic constituencies and Sheila Oliver have said.

Prediction 1: $200-$300 million in Adjustment Aid will be redistributed.

Basis: Phil Murphy said this at a town hall in Maplewood, NJ and again in a televised forum with Tom Moran. It is budgetarily necessary as well.- Sub-conjecture: There will be some complex mechanism of cutting Adjustment Aid. The districts to lose Adjustment Aid will be ones who are above Adequacy and/or severely under Local Fair Share.

- Basis for Belief: The Education Law Center, which is NJEA funded, only (with extreme reluctance) accepts the loss of Adjustment Aid to above Adequacy districts. Politically it will be necessary to cut Jersey City's state aid, since it taxes at one-third of Local Fair Share, but is below Adequacy.

The Education Law Center only wants districts that are below Adequacy to receive additional state aid "State aid increases must be directed to under adequacy districts" but this is such an extreme stance and contrary to what the legislature will want that I don't see Murphy completely denying over-Adequacy districts.

On the other hand, I would not be surprised if under-Adequacy districts get larger percentage state aid increases, which is what SFRA already calls for. Underaided districts that are nonetheless above Adequacy due to their own high taxes, like Cherry Hill and West Orange, may not receive very much new aid.

Prediction 2: The Distribution PILOT Revenue Will be Changed So that the Money is Apportioned in the Same Way Regular Taxes Are:

Basis: This is something Steve Sweeney wants to see happen, it is something many Republicans (like Mike Doherty) want to see happen, and there isn't anyone visibly opposing this change. Even Steve Fulop of Jersey City is willing to let the Jersey City public schools have 10% of PILOT revenue (instead of 25% of regular taxes)NJ's Urban Mayors Association met in November 2017 and endorsed this.

At present, 95% of PILOT revenue is given to the municipality and 5% goes to the county. The local public schools get 0%.

Prediction 3: There will be an Attempt to Reduce Local Fair Share for Districts with High Municipal Taxes:

Basis: It makes fiscal sense, it would satisfy the powerful urban constituency within the Democratic Party, and it an Education Law Center demand.EG, here is the Education Law Center's demand "Lawmakers must consider providing relief for school districts facing municipal overburden. These districts have high tax rates, but low rates of local school funding due to the high costs of other municipal obligations."

I agree that some urban districts have municipal taxes that are too high to allow them to meet their Local Fair Shares. New Jersey's average municipal tax rate is 0.694, but Newark's muni rate is 1.642, Trenton's is

3.329, Paterson's is 2.578, Elizabeth's is 2.206. East Orange's muni rate is 3.353, which is one of the highest in New Jersey.

It isn't a surprise then that these districts have school taxes that are so far below Local Fair Share. Newark's tax levy is $45 million below LFS, Trenton's tax levy is $16 million below LFS, Paterson's is $51 million below LFS, Elizabeth's is $36 million below LFS, East Orange's is $20 million below LFS. |

| A town like East Orange cannot pay its full Local Fair Share. |

IMO, factoring in municipal tax rate into the calculation of Local Fair Share would create an incentive to have high muni tax rates. A fairer solution would be to condition Local Fair Share on a place having a low-income, since that is outside the control of politicians.

Prediction 4: The state will increase its reimbursement of districts for their charter students.

Basis: Sheila Oliver does not like the principle of "money following the child" and neither does the NJEA.In August 2017 at a forum with Randi Weingarten of the AFT Oliver said:

Oliver reaffirmed her support for [traditional] public schools.

“The expansion and growth of charter schools has hurt our public schools,” she said. “We will make sure that our public schools will be front and center on our agenda.”

Oliver said that although she embraces all kinds of schools, funds should not be diverted away from public education.

“We can’t take funds out of district budgets to support them," she said.

If "we can't take funds out of district budgets to support" charters, then charters ought not to exist or districts should be double-funded for charter students.

Oliver has also said "What I am vehemently opposed to is using the money that goes to our public school system to support charters."

The NJEA has been a little more vague though, but it has demanded some change.

“NJEA has consistently supported the proposal by Assembly Speaker Vincent Prieto to gather the appropriate stakeholders to develop a plan to transition back to the current funding formula. In addition, we have called for that group to study the funding mechanism for charter schools, as the current mechanism is causing drastic program cuts in the districts from which charters draw their students.And:

New Jersey should follow a similarly thoughtful and deliberative process for reviewing the current aid formula and recommending reasonable adjustments. That should include an honest look at the adverse financial impact that charter schools have on host district schools and ways to alleviate that harm.

Even the Christie administration has sent extra state aid to districts with growing charter school populations through a unilaterally-created aid stream called "Host District Stabilization Aid," a $27,653,005 expense for 2017-18.

If funds aren't leaving district budgets for charters, then the students have to be kept in districts or the state has to reimburse districts for their charter transfers.

It's also possible that we will see the Department of Education give money directly to charter schools rather than route that money through local school districts. This might relieve some tension between traditional public schools and charters, but it would be a gimmick in terms of any real budgetary assistance since now school districts would have less money to begin with.

Prediction 5: SFRA will move away from the Census-weighting for Special Education Students in the Calculation of Equalization Aid.

Basis for Belief: It's superficially common sense. Even some politicians already want to do it.It's a benign demand by the NJEA:

Blistan also highlighted the plan’s commitment to providing relief to districts that have been harmed by the current approach to special education funding. 'Districts should be not be punished for providing students with the special education resources they need. This approach will bring fairness to districts while continuing to meet the needs of students,' said Blistan, who is also a special education resource center teacher in Washington Township.At present, NJ assumes that every district has 14.69% of its students classified, when everyone knows that classification rate would vary, like all populations vary.

The Department of Education opposed using Census weighting during the Corzine years and Christie years for seemingly sincere reasons, but that may change under Murphy.

Unfortunately, changing the calculation of Adequacy Budgets in Equalization Aid is meaningless as long as the overall distribution is out-of-whack and the state cannot come up with the additional money to fund it.

So this is like renovating the kitchen in a house that is falling into a sinkhole anyway.

Prediction 6: There will be a Loosening of the Tax Cap

Basis: Steve Sweeney's state aid reform commission proposed some amendment to the cap, presumably to allow aid-losing districts to tap their tax bases.The NJSBA supports loosening the cap to allow automatic tax authority to districts with high Out of District tuition costs.

Prediction 7: The State will Expand PreK Disproportionately

Basis: It's something the Democrats all say they want to do and there are well-funded lobbies in place to support PreK expansion, with support from VIPs like Jim Florio and Tom Kean. From 2011-2016 basically all Democrats in the legislature were more interested in PreK than K-12.

|

| In a Zero-Sum Budget Enrivonrment, PreK Expansion Comes at the Expense of Everything Else |

Although Steve Sweeney is more sensitive to New Jersey's tax stress and indebtedness than most other Democrats, PreK expansion is something he strongly supports nonetheless.

Children who attend preschool see greater achievement than their peers and are less likely to drop out. Pre-K is vital for kids to reach their maximum potential, and we are committed to continuing to increase funding for pre-K.— Steve Sweeney (@NJSenatePres) December 11, 2017

I say the PreK increases will be "disproportionate" because the increases will be much larger percentage-wise for PreK than K-12 education. NJ's PreK funding was going to be $655 million for FY2018, but the legislative Democrats got it a $25 million increase, or 3.8%. The legislature's (net) last-minute increase for K-12 aid and Extraordinary Aid was only $125 million, a 1.6% increase.

The Wild Cards

1. The Republican tax plan.

If the SALT deduction is capped at $10,000 per taxpayer and the Mortgage Interest Deduction is capped at $500,000, real estate values in middle-class and affluent suburbs will decline by perhaps as much as 10%.

If real estate values fall, then it would reduce those towns' Local Fair Shares and SFRA would, in theory, send them more Equalization Aid.

NJ already has a severe outmigration problem and its suburbs are already in decline, but the capping of the SALT deduction would likely accelerate those trends.

See: "They're Staying Away in Droves."

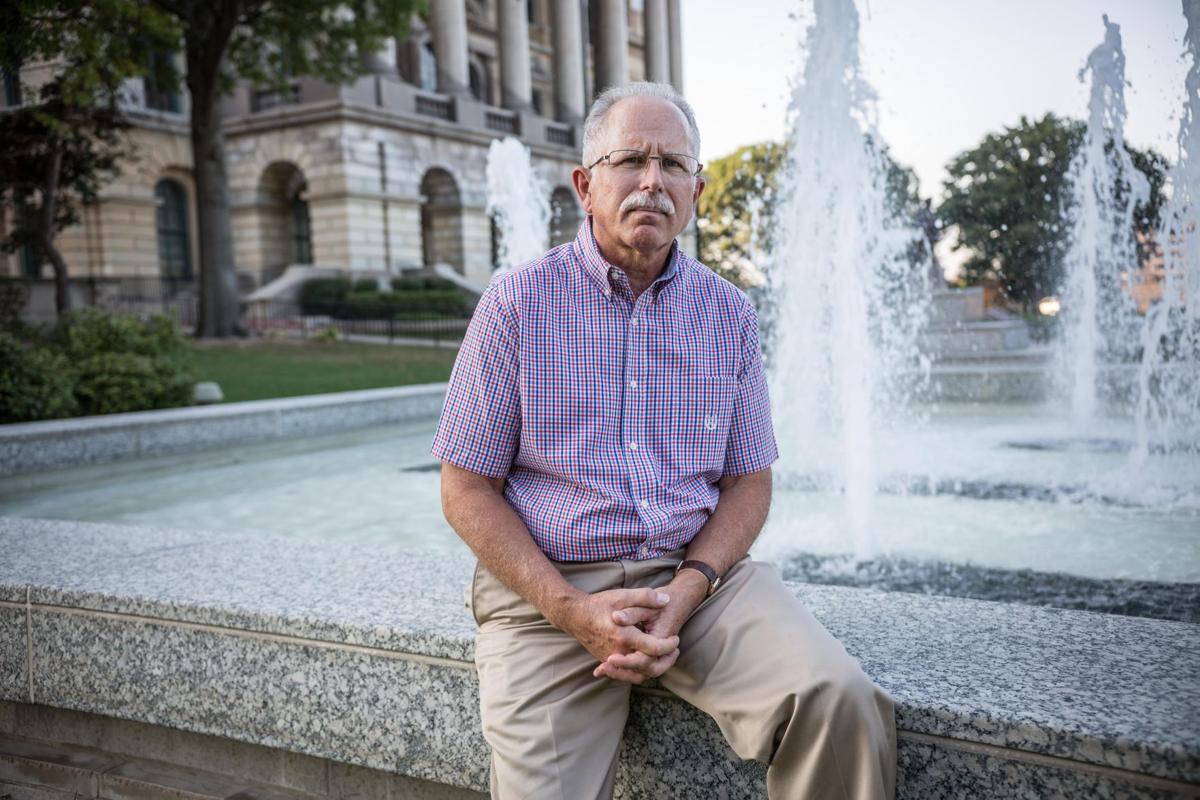

2. The Janus decision

|

| Mark Janus, Illinois Child Care Specialist & Petitioner in Janus v AFSCME |

This means that NJ's public sector will become right-to-work and the 20-30% of teachers and other staff who are discontented with the NJEA can stop paying dues. At a 30% dropoff, that would mean a loss of $40 million out of the NJEA's $140 million budget. (see this for NEA affiliate financial resources)

Since NJEA dues will now be voluntary, the NJEA will have to invest more of its remaining money into membership retention and keep dues lower so that more members do not quit. At present NJEA state-dues are $897 per full-time teacher, plus a few hundred dollars more for the national organization, county organization, and local organization.

The NJEA will still be very powerful even if 30% of members leave, but it will not be colossus it is now and the Democrats may have more latitude to side with taxpayers and not the NJEA and other unions.