If you are a glutton for pain, the following is just how insane NJ property taxes actually are.

|

| Source: http://www.thefiscaltimes.com/2015/08/14/10-Worst-States-Property-Taxes |

|

| Source: https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/ (These data are out of date.) |

Why are our taxes so high?

It's the (School) Spending!

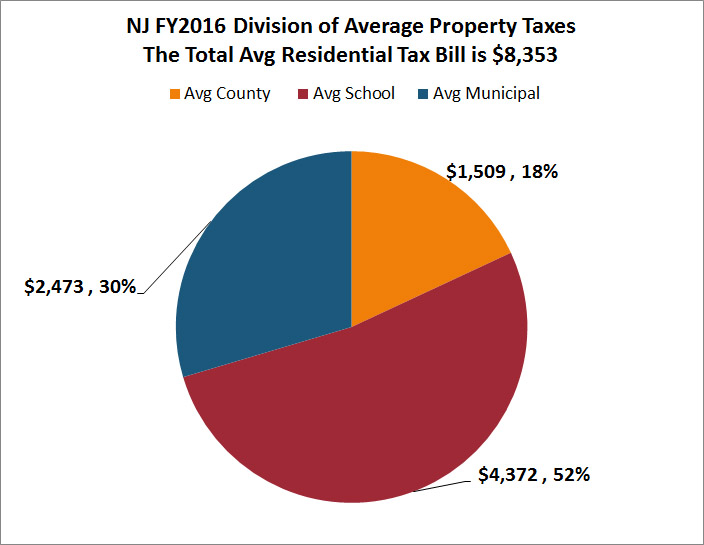

NJ's municipal and county spending are high too, but education taxes are greater than municipal and county government combined, so when it comes to NJ's tax levels, school spending cannot be ignored.

|

| These data are more recent than the state-by-state comparisons used above, hence the higher median property tax bill. |

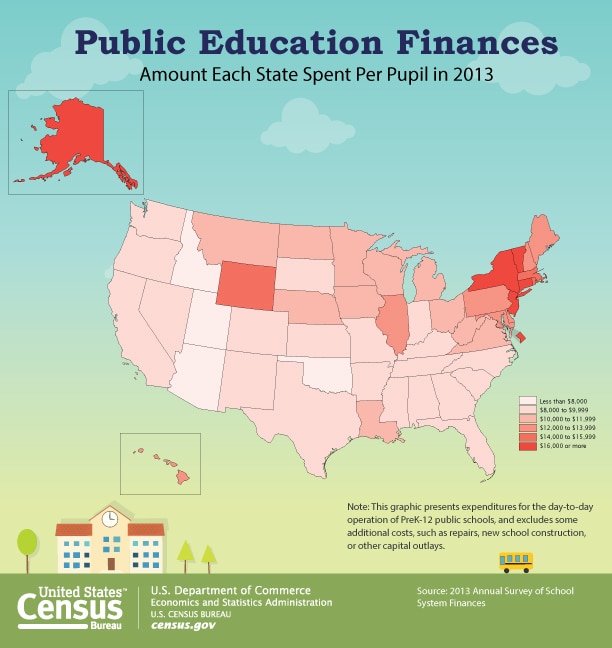

What's rarely definitively discussed in the same context of NJ's excessive taxes is that our education spending is among the country's highest, with only New York State and Alaska outspending us.

Highest Spending States, 2013-14

- New York, $20,610 per student

- Alaska, $18,416 per student

- New Jersey, $17,907 per student

- Connecticut, $17,745 per student

- Vermont, $16,988 per student

- Wyoming, $15,797 per student

- Massachusetts, $15,087 per student

- Rhode Island, $14,767 per student

- New Hampshire, $14,335 per student

- Maryland, $14,003 per student

- Pennsylvania, $13,961 per student

Alaska has oil revenue and New York State gets $6 billion per year in income taxes paid by commuters who work in New York State but live elsewhere, usually New Jersey. New Jersey has no equivalent outside source of revenue.

Alaska, Vermont, Wyoming, Rhode Island, and New Hampshire are all small states that receive much larger amounts of federal education aid per student than New Jersey due to the Small-State Minimum in federal aid formulas.

If New Jersey spent as much on K-12 education per pupil as

other high-wealth states, our taxes would be substantially lower.

- If New Jersey spent as much as Connecticut per student we would $221,839,398 less.

- If New Jersey spent as much as Massachusetts per student we would spend $3,861,648,780 less.

- If New Jersey spent as much as Maryland per student we would spend $5,346,055,616 less.

- If New Jersey spent as much as Pennsylvania per student we would spend $5,403,569,534 less.

(Since NJ had 1,369,379 public school students in 2013, I just multiplied the difference in per pupil spending by 1,369,379.)

It's simple but it's ignored:

New Jersey's Taxes are High Because We Spend A Lot.

Mostly on Schools.

Some accounts that recognize that NJ's taxes are high because our spending is high attribute the spending to the seemingly large number of school districts and municipalities in New Jersey, implying that if it weren't for so many districts, Boards of Education, and superintendents our spending and taxes would be normal.

For instance, this NJSpotlight piece titled "Why Property Taxes are So High" by Collean O'Dea blamed the multiplicity of school districts and said that the balance of local funding/state funding for schools was the problem:

Why are taxes so high?

New Jersey relies heavily on the property tax to fund local governments and schools. The tax pays for municipal services -- police, roads and the like. It pays for local and, sometimes, regional public schools. And it pays for county government -- roads, parks, elections and more. Depending on the municipality, there may also be open space, library or fire service taxes.

Last year, local governments levied more than $27 billion in local property taxes. The bill is so high, in part, because New Jersey is a high-cost state.

The state has 565 separate municipalities and even more school districts, nearly all of them led by their own administrators and support staff – who are often doing similar jobs in very close proximity. Officials say state mandates add to municipal costs, as well.

At the same time, exclusive of federal aid, the amount of assistance the state gave to municipalities to defray their expenses represented just 15 percent of total spending,. What’s more, only about one-third of school spending is covered by state aid.The New Jersey Policy Perspective recently said that NJ's municipal fragmentation caused NJ's high taxes.

There are many explanations for New Jersey’s historically high property taxes such as its population density, the excessive number of municipalities and school districts and its traditions of local control.Although I agree that there is some explanatory power in NJ's municipal fragmentation, this frequently-made argument that New Jersey's multiplicity of governmental units causes us to have high taxes is demolished in this Rutgers University Report "Size May Not be the Issue."

First, on a per capita basis, New Jersey is just average for governmental units.

Asking the question about having too many governments from a different perspective may yield an entirely different conclusion. How many “general governments” does New Jersey have on a per capita basis? The answer is: surprisingly few. In fact, New Jersey ranks 34th in the number of general governments per capita. When all “special districts” (fire, water, sewer, and so on) are also considered,New Jersey ranks 36th of the 50 states.Second, on the NJ municipal level at least, there is no correlation between the size of a locality and its per resident spending. On the municipal level, the lowest spending towns are actually ones with 3,601- 5,150 residents.

|

| Source: http://assets.njspotlight.com/assets/14/1116/2244, page 25 Note: Jersey Shore resort communities are excluded. |

Most of NJ's largest towns are low-income cities where high spending is to be expected, but if you only look at more middle-class suburbs, it's clear that size isn't leading to economies of scale.

New Jersey's average equalized all-in tax rate for 2016 is 2.333, but

- Woodbridge's tax rate is 2.685.

- Edison's is 2.193.

- Clifton's is 2.984.

- Lakewood's is 2.109.

- Hamilton's is 2.643.

- Cherry Hill's tax rate is 3.384.

- Brick, whose schools are overaided and where school spending is below-average, is 2.022.

Yet Toms River is the exception the proves the rule of school spending being central to our high taxes, since Toms River only spends $15,587 per student (counting pensions + FICA), which is about $3,500 per student below NJ's average. Toms River's school taxes are only 76% of Local Fair Share.

Nor is it true that NJ's educiiton spending is merely proportion to our income. NJ's education spending as a percentage of GDP was 4.76% in 2014-15, the second highest in the US.

General Administrative Spending in NJ is 2% of Spending

The theory is that NJ's (seemingly) large number of school districts leading to high taxes is that having a small number of districts leads to inefficient central office administration.

Insofar as New Jersey might have more administrators than states with fewer and larger districts, this theory fails to account for very much of NJ's exceptional tax burden since "General Administration" is only 2% in NJ of district spending.

The US government actually keeps track of administrative spending and the additional spending in New Jersey in the Administration category is not that high.

NJ's administrative spending per student was $367 for general administration in 2013-14. The national average for general administration was $210.

So NJ is only $157 per student above the national average. Yet our taxes are more than $5,000 per household above the national average and literally double the national average in terms of tax rate.

If you compare New Jersey's average district spending to national numbers, it's obvious that New Jersey school districts spend more on every category, including the categories that are independent of district size, like "Instructional Salaries" and "Instructional Benefits," ie, "teachers."

|

| Source: http://www.governing.com/gov-data/education-data/state-education-spending-per-pupil-data.html |

Given how low Maryland's administrative spending is ($125 per student), I think there is some truth to the "too many districts, too many administrators" theory, but it is a minor cause of NJ's tax burden.

Not every explanatory article about NJ's obscene property taxes is as bad as that NJSpotlight piece or the New Jersey Policy Perspective's claim.

This piece from the Asbury Park Press, titled "Why are our taxes so high?," has a lot of invaluable information and gets the cause of the property tax crisis partly right, but even it misses the centrality of education spending in NJ's outsize tax burden:

It's no secret that New Jersey is a high-tax state. But few stop to think about the precise reasons why, other than the vague and altogether accurate notion that public employee salaries and benefits are too generous, and that there are too many government workers collecting them. Or that there are two many towns and school districts. Or that the high cost of living here explains why government is so costly....

On the revenue side, the problem lies less with layers of government and excessive numbers of government workers providing services than with the generous salaries and benefits of those who are on the public payroll. Average state worker salaries: highest in the nation. Average teacher salaries: third highest. Public employee health benefit costs: second highest in the nation.

Yes, the cost of living in New Jersey is high. That is necessarily reflected in public employee salaries and benefits. But New Jersey, which ranks first or second in so many tax and spending categories, has the fourth-highest cost of living in the U.S., behind New York, Hawaii and Alaska. Other states with far lower tax burdens have similarly high costs of living.

Although it's worth pointing out where there exists inefficiency and superfluousness in municipal and county spending (like police officers making $200,000), the fact is that over half of New Jersey's property tax levy - $14.5 billion out of $27.7 billion - is for schools, so inefficiency and superflousness in schools is really what drives New Jersey's extraordinary property taxes.

The Income Tax Reallocation Distraction

Another theory I often see that avoids discussion of spending is that NJ's property taxes are so high because income taxes are too low. This notion then becomes the premise for an argument for reallocating taxation, where income taxes would rise and offset property taxes.

Indeed, there are some seemingly cogent arguments for this.

The property tax in New Jersey brings in twice as much revenue as the income tax, so mathematically, reallocation would lower property taxes in the short term. While New Jersey's top bracket, 8.97% on income above $1 million, is the fifth highest in the US for 2017, on low-income earners, NJ rates are low and on middle-income earners NJ rates are only average.

(CA, OR, MN, and IA now have higher top brackets than NJ. Maine was going to have a higher to have a higher bracket through "Question 2," but that was repealed by the legislature and Maine's top bracket is lower than NJ's.)

The problem with this approach is that it isn't a net help for New Jerseyans if they exchange the country's highest property taxes for the country's highest income taxes. If just half of the $27.7 billion in property taxes were shifted to income taxes, New Jersey's income tax levy would literally double (in FY2016 NJ's income tax brought in $13.8 billion).

If all-in taxes were to drop for middle-income and lower-income New Jerseyans, more money would have to come from the wealthy.

This is an idea I support, but raising the $1,000,000 bracket from 8.97% to 10.75% would only bring in $615 million. Raising taxes on incomes above $500,000 per year to 10.25% would bring in $155 million.

Combining the two upper-income tax increases would bring in $770 million, which is only 2.7% of NJ's $27.7 billion property tax bill.

Could New Jersey increase taxes exceed 10.75% for $1 million+ incomes in order to produce real property tax relief? In theory yes, but if the top rate were increased by only 50%, NJ's top bracket would exceed California's 13.3%. If NJ's top rate were increased by only 10%, we would have the country's third highest top rate.

More importantly, our top rate would easily exceed New York State's 8.82%, Connecticut's 6.99%, and Pennsylvania's 3.07%. The combined New York State+New York City top bracket is 12.4%, also within reach if NJ attempted a massive property tax/income tax reallocation.

I don't feel sorry for the rich, but the departure of only a small percentage of ultra-high-income individuals is a permanent fiscal risk for New Jersey since the ultra-rich pay so much in NJ income taxes:

Ok, point taken, but the New Jersey Policy Perspective does not attempt to evaluate the counterfactual; ie, what New Jersey's population of millionaires would be if our taxes were more moderate.

Also, although NJ's number of high-income filers may constantly increase, New Jersey's top-bracket is barely higher than New York State's. If the NJ top-bracket were to become substantially higher than New York State's, the constant growth of the millionaire population may slow down or reverse.

Finally, there are two practical problems with relying on income taxes:

School district/municipal consolidation and shifting more taxation to income taxes are good things on their own merits, but these approaches neglect the real cause of NJ's tax crisis, which is our extraordinarily high spending, particularly on education.

Over the years, NJ has repeatedly tried to supplant property taxes with income tax-derived state aid , but most state aid has always gone to poor towns & districts - leaving the non-poor without much state support. Indeed, the state's attempt to give income tax money to middle-class and affluent districts was ruled unconstitutional by the NJ Supreme Court in 1990 in Abbott II as "counterequalizing."

Not all explanations for why NJ has such high taxes are as bad as the ones that kick off my blog post.

The Income Tax Reallocation Distraction

Another theory I often see that avoids discussion of spending is that NJ's property taxes are so high because income taxes are too low. This notion then becomes the premise for an argument for reallocating taxation, where income taxes would rise and offset property taxes.

Indeed, there are some seemingly cogent arguments for this.

The property tax in New Jersey brings in twice as much revenue as the income tax, so mathematically, reallocation would lower property taxes in the short term. While New Jersey's top bracket, 8.97% on income above $1 million, is the fifth highest in the US for 2017, on low-income earners, NJ rates are low and on middle-income earners NJ rates are only average.

(CA, OR, MN, and IA now have higher top brackets than NJ. Maine was going to have a higher to have a higher bracket through "Question 2," but that was repealed by the legislature and Maine's top bracket is lower than NJ's.)

The problem with this approach is that it isn't a net help for New Jerseyans if they exchange the country's highest property taxes for the country's highest income taxes. If just half of the $27.7 billion in property taxes were shifted to income taxes, New Jersey's income tax levy would literally double (in FY2016 NJ's income tax brought in $13.8 billion).

If all-in taxes were to drop for middle-income and lower-income New Jerseyans, more money would have to come from the wealthy.

This is an idea I support, but raising the $1,000,000 bracket from 8.97% to 10.75% would only bring in $615 million. Raising taxes on incomes above $500,000 per year to 10.25% would bring in $155 million.

Combining the two upper-income tax increases would bring in $770 million, which is only 2.7% of NJ's $27.7 billion property tax bill.

Could New Jersey increase taxes exceed 10.75% for $1 million+ incomes in order to produce real property tax relief? In theory yes, but if the top rate were increased by only 50%, NJ's top bracket would exceed California's 13.3%. If NJ's top rate were increased by only 10%, we would have the country's third highest top rate.

More importantly, our top rate would easily exceed New York State's 8.82%, Connecticut's 6.99%, and Pennsylvania's 3.07%. The combined New York State+New York City top bracket is 12.4%, also within reach if NJ attempted a massive property tax/income tax reallocation.

I don't feel sorry for the rich, but the departure of only a small percentage of ultra-high-income individuals is a permanent fiscal risk for New Jersey since the ultra-rich pay so much in NJ income taxes:

The New Jersey Policy Perspective often points out that despite NJ's income taxes already being very high, the number of high-income filers in New Jersey constantly increases, so, they argue, NJ should not base policy on fears of outmigration.

One half of one percent of New Jersey taxpayers account for almost a third of income tax revenues, and only 600 filers - many of whom may already have second homes outside of New Jersey - account for about $1.4 billion in income tax payments.

Ok, point taken, but the New Jersey Policy Perspective does not attempt to evaluate the counterfactual; ie, what New Jersey's population of millionaires would be if our taxes were more moderate.

Also, although NJ's number of high-income filers may constantly increase, New Jersey's top-bracket is barely higher than New York State's. If the NJ top-bracket were to become substantially higher than New York State's, the constant growth of the millionaire population may slow down or reverse.

Finally, there are two practical problems with relying on income taxes:

- income tax collections are volatile.

- income taxes can be evaded and avoided more easily than property taxes.

School district/municipal consolidation and shifting more taxation to income taxes are good things on their own merits, but these approaches neglect the real cause of NJ's tax crisis, which is our extraordinarily high spending, particularly on education.

Over the years, NJ has repeatedly tried to supplant property taxes with income tax-derived state aid , but most state aid has always gone to poor towns & districts - leaving the non-poor without much state support. Indeed, the state's attempt to give income tax money to middle-class and affluent districts was ruled unconstitutional by the NJ Supreme Court in 1990 in Abbott II as "counterequalizing."

Not all explanations for why NJ has such high taxes are as bad as the ones that kick off my blog post.

Andrew Sidamon-Eristoff eruditely pins the causation where it belongs here:

This post of mine has clearly targeted spending itself - chiefly for education - as the cause of NJ's extraordinary tax burden, but, IT'S OUR OWN FAULT.

If New Jerseyans really wanted lower taxes, they would vote in anti-tax politicians, but New Jerseyans almost never do this, hence Democratic domination of the legislature.

If the majority of New Jerseyans wanted lower taxes, they would vote for politicians who want that too.

New Jersey is a democracy and at a certain point the voters themselves are accountable.

---

Update, New Jersey's school spending is also the second highest in the United States as a percentage of state GDP:

At the risk of gross oversimplification, the sum and substance is this: Given New Jersey’s relatively high state and local spending (the latest census figures) suggest that New Jersey’s state and local unit direct spending is approximately 11 percent higher than the national average), the limited revenue-generating capacity of our income tax base, the relative lack of federal revenue supporting local spending, and the fact that fiscal redistribution will always be a higher legal if not political priority, it is highly unlikely that New Jersey’s state government will ever have the discretionary fiscal capacity to meet the rising cost of education and local government, let alone offset the related heavy reliance on property taxes, on anything other than a temporary and unsustainable basis.

Why does this matter? The systemic overselling of “property tax relief” distorts the public policy debate. We dissipate too much of our political energy arguing over funding levels for local aid and popular direct-benefit programs that have no real impact on property taxes as such, leaving our long-suffering taxpaying public disillusioned and cynical. After decades of hackneyed bipartisan dogma, perhaps it’s time to focus on the only thing that will actually make a real difference to property taxes over time: controlling the cost of education and local government in New Jersey.

This post of mine has clearly targeted spending itself - chiefly for education - as the cause of NJ's extraordinary tax burden, but, IT'S OUR OWN FAULT.

If New Jerseyans really wanted lower taxes, they would vote in anti-tax politicians, but New Jerseyans almost never do this, hence Democratic domination of the legislature.

If the majority of New Jerseyans wanted lower taxes, they would vote for politicians who want that too.

New Jersey is a democracy and at a certain point the voters themselves are accountable.

---

Update, New Jersey's school spending is also the second highest in the United States as a percentage of state GDP:

|

| Source: Education Law Center/Rutgers Graduate School of Education https://drive.google.com/file/d/0BxtYmwryVI00VDhjRGlDOUh3VE0/view |

There is a local reform movement, that I hope more NJ natives get behind ASAP! Major root problem is suburbanization in both these states-short term gain and long term pain baked in the cake. Anyone good at math can see the tax base is too small in each burb to pay for the costs. Do check out Charles Marohn (of strong towns )on the ponzi scheme that is suburbanization.

ReplyDeleteBoth states are aging and residents will be marooned once they lose their keys because public transport is so poor. And oh how are those "savings"! Do NJ natives know they need to set aside at LEAST $240,000 for healthcare NOT covered by Medicare!

Do not expect Uncle Sam to help out! Uncle Sam has been as profligate and is overly reliant on incompetent Saudi Arabia-the petrodollar linchpin holding up the USD! And do check out how KSA is sinking as it too has been profligate!

The future is not bright as already majority of kids in public schools in the COUNTRY are poor and getting bad 3d world quality education! Inequitable education's rotten fruit is coming home to roost! Even "good" schools provide inadequate education as I found out when a cousin could not do Math at MIT despite being an "honors" student in an NJ school-and NJ has after all 2d best ed system in the country! Scary what others must be like! She lost her confidence and did not seek a graduate degree!

No wonder more than 1/2 of inventions are now made by foreign born inventors. But soon they will not want to come to a country with such poor prospects because it has been profligate and unwilling to invest on its own!

NJ is most suburbanized state in the country. Illinois has the most # of local units! Local governance structural problems are hurting their bottom line;but there's unwillingness to reform the system.

ReplyDeleteAre you aware how outmoded the US local governance system is? It has only been kept afloat by debt-and some changes at the margins (like annexation permitted in the southern states). But annexation is only short term gain and long term pain because of the suburban style development pattern baked in the cake!

Check out the lunacy in Texas:

http://www.houstonpress.com/news/how-a-few-rent-a-voters-in-a-vacant-lot-lead-to-millions-in-bonds-for-taxpayers-8223400

How a Few Rent-A-Voters in a Vacant Lot Lead to Millions in Bonds for Taxpayers

Its ed system stinks because like all southern states does not want to invest in human capital investment! At least one cannot accuse NE states of that flaw! Lee Kwan Yew's example reveals how poor the leadership quality in southern states has been over the years! It He took his island state from low wages to high wages in 1 generation! Oh and guess what Singapore topped 2015 PISA and TIMSS at ALL grade levels in ALL subjects in a multi-ethnic city-state a report found was also the MOST religiously diverse in the WORLD!!! Its students spend less hours doing math i school and were #!;while US students spend more hours doing math in school and sank further! That is bad news as mATH is a foundational subject for several sciences. Tests found that US students did worse at every socio-economic level in math! So something very WRONG about math instruction!!! Now I am not surprised my cousin who studied in a NJ school could not do MIT -level math.

In the age of automation and AI, who needs to pay even low wage US workers?

Recently a report announced that 47% of jobs may disappear in two decades! If you think these will all be for those low wage workers, you are deluding yourself. I was recently on a conference call where I was told they want to maintain "lean" management and rely more on "systems"-that is automation and AI! Americans better train themselves so they do not rely on an employer to make a living!